Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7. Bus<strong>in</strong>ess Taxation<br />

The Tax Code <strong>of</strong> the Republic <strong>of</strong> <strong>Azerbaijan</strong>, the first attempt at the codification<br />

<strong>of</strong> <strong>Azerbaijan</strong>i tax legislation, came <strong>in</strong>to effect on January 1, 2001 <strong>and</strong> resulted<br />

<strong>in</strong> substantial improvement <strong>of</strong> the <strong>Azerbaijan</strong>i taxation system. In an attempt to<br />

improve the taxation system further, the Tax Code has been amended 19 times s<strong>in</strong>ce its<br />

adoption. Notwithst<strong>and</strong><strong>in</strong>g these amendments, a closer study <strong>of</strong> the tax system coupled<br />

with the survey results reveals that the <strong>Azerbaijan</strong>i tax system, <strong>in</strong>clud<strong>in</strong>g tax legislation<br />

<strong>and</strong> tax adm<strong>in</strong>istration, is still <strong>in</strong>efficient <strong>and</strong> impedes the development <strong>of</strong> <strong>Azerbaijan</strong>’s<br />

private sector.<br />

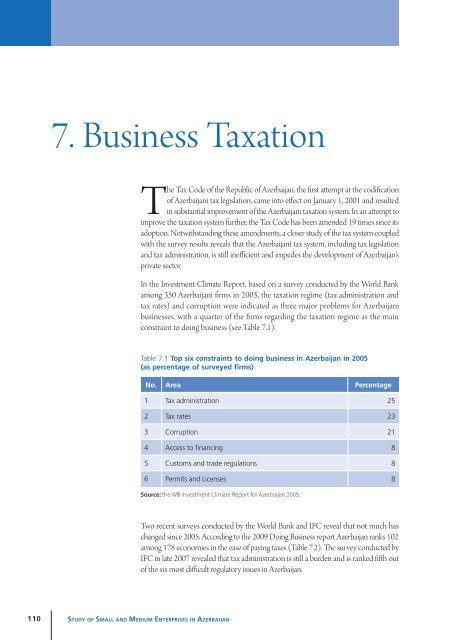

In the Investment Climate Report, based on a survey conducted by the World Bank<br />

among 350 <strong>Azerbaijan</strong>i firms <strong>in</strong> 2005, the taxation regime (tax adm<strong>in</strong>istration <strong>and</strong><br />

tax rates) <strong>and</strong> corruption were <strong>in</strong>dicated as three major problems for <strong>Azerbaijan</strong>i<br />

bus<strong>in</strong>esses, with a quarter <strong>of</strong> the firms regard<strong>in</strong>g the taxation regime as the ma<strong>in</strong><br />

constra<strong>in</strong>t to do<strong>in</strong>g bus<strong>in</strong>ess (see Table 7.1).<br />

Table 7.1 Top six constra<strong>in</strong>ts to do<strong>in</strong>g bus<strong>in</strong>ess <strong>in</strong> <strong>Azerbaijan</strong> <strong>in</strong> 2005<br />

(as percentage <strong>of</strong> surveyed firms)<br />

No. Area Percentage<br />

1 Tax adm<strong>in</strong>istration 25<br />

2 Tax rates 23<br />

3 Corruption 21<br />

4 Access to f<strong>in</strong>anc<strong>in</strong>g 8<br />

5 Customs <strong>and</strong> trade regulations 8<br />

6 Permits <strong>and</strong> Licenses 8<br />

Source: the WB Investment Climate Report for <strong>Azerbaijan</strong> 2005.<br />

Two recent surveys conducted by the World Bank <strong>and</strong> <strong>IFC</strong> reveal that not much has<br />

changed s<strong>in</strong>ce 2005. Accord<strong>in</strong>g to the 2009 Do<strong>in</strong>g Bus<strong>in</strong>ess report <strong>Azerbaijan</strong> ranks 102<br />

among 178 economies <strong>in</strong> the ease <strong>of</strong> pay<strong>in</strong>g taxes (Table 7.2). The survey conducted by<br />

<strong>IFC</strong> <strong>in</strong> late 2007 revealed that tax adm<strong>in</strong>istration is still a burden <strong>and</strong> is ranked fifth out<br />

<strong>of</strong> the six most difficult regulatory issues <strong>in</strong> <strong>Azerbaijan</strong>.<br />

110<br />

St u d y o f Sma l l a n d Me d i u m Ent e r p r i s es <strong>in</strong> Az e r b a i j a n