Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Case study <strong>of</strong> a Baku-based glass <strong>and</strong> w<strong>in</strong>dow manufactur<strong>in</strong>g bus<strong>in</strong>ess obta<strong>in</strong>ed<br />

through an <strong>in</strong>-depth <strong>in</strong>terview held <strong>in</strong> July 2008.<br />

Loan grant<strong>in</strong>g process is regulated by the <strong>in</strong>ternal regulations <strong>of</strong> commercial banks<br />

<strong>and</strong> relevant legal requirements <strong>of</strong> the National Bank.<br />

There are a number <strong>of</strong> reasons why the banks impose such rigid conditions on lend<strong>in</strong>g:<br />

8.2.2 The majority <strong>of</strong> banks cannot attract long-term low-cost<br />

resources for subsequent SME ref<strong>in</strong>anc<strong>in</strong>g<br />

Banks <strong>in</strong> <strong>Azerbaijan</strong> are operat<strong>in</strong>g <strong>in</strong> complex f<strong>in</strong>ancial market conditions <strong>and</strong> need<br />

to <strong>of</strong>fer high returns <strong>in</strong> order to attract deposits from <strong>in</strong>dividuals <strong>and</strong> legal entities<br />

(see Table 8.2).<br />

Table 8.2 Conditions (terms & <strong>in</strong>terest rates) for deposits by commercial banks <strong>in</strong> <strong>Azerbaijan</strong><br />

(data from the NBA Annual Report 2007)<br />

Average <strong>in</strong>terest<br />

rates %<br />

Legal entities<br />

Individual<br />

persons<br />

Up to 1 mo.<br />

1-3 mo.<br />

3-6 mo.<br />

6-9 mo.<br />

9-12 mo.<br />

12-60 mo.<br />

Interest rate for deposit <strong>in</strong> local<br />

currency, %<br />

Interest rate for deposit <strong>in</strong> dollars<br />

or euros, %<br />

11.4 9.7 12.5 7.3 8.6 9.5 9.9 12.1 12.8<br />

12.2 7.7 12.5 7.1 6.9 9.5 11.2 12.2 13.3<br />

Tak<strong>in</strong>g <strong>in</strong>to account the bank’s marg<strong>in</strong>, this rate is reflected <strong>in</strong> the <strong>in</strong>terest rates <strong>of</strong> the<br />

credits <strong>of</strong>fered.<br />

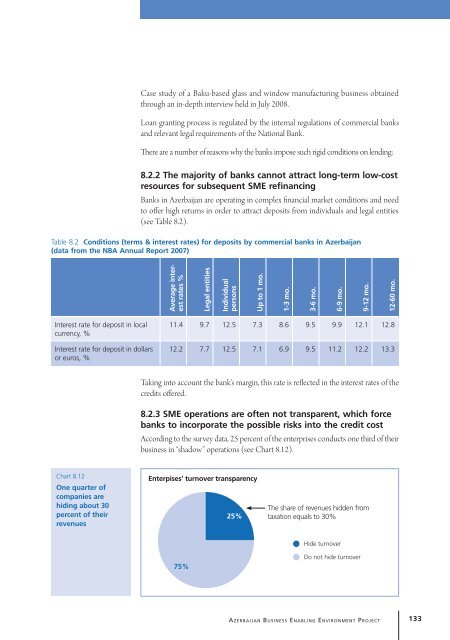

8.2.3 SME operations are <strong>of</strong>ten not transparent, which force<br />

banks to <strong>in</strong>corporate the possible risks <strong>in</strong>to the credit cost<br />

Accord<strong>in</strong>g to the survey data, 25 percent <strong>of</strong> the enterprises conducts one third <strong>of</strong> their<br />

bus<strong>in</strong>ess <strong>in</strong> “shadow” operations (see Chart 8.12).<br />

Chart 8.12<br />

One quarter <strong>of</strong><br />

companies are<br />

hid<strong>in</strong>g about 30<br />

percent <strong>of</strong> their<br />

revenues<br />

Enterpises’ turnover transparency<br />

25%<br />

The share <strong>of</strong> revenues hidden from<br />

taxation equals to 30%<br />

75%<br />

Hide turnover<br />

Do not hide turnover<br />

Aze r b a i j a n Bu s i n e s s En a b l i n g En v i r o n m e n t Pr o j e c t 133