Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

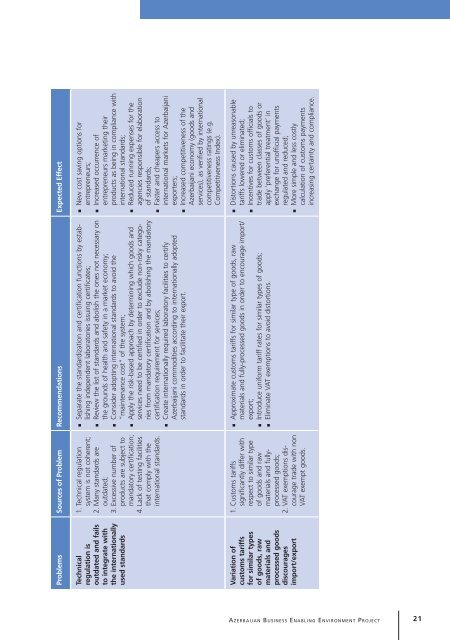

Problems Sources <strong>of</strong> Problem Recommendations Expected Effect<br />

Technical<br />

regulation is<br />

outdated <strong>and</strong> fails<br />

to <strong>in</strong>tegrate with<br />

the <strong>in</strong>ternationally<br />

used st<strong>and</strong>ards<br />

1. Technical regulation<br />

system is not coherent;<br />

2. Many st<strong>and</strong>ards are<br />

outdated;<br />

3. Excessive number <strong>of</strong><br />

products are subject to<br />

m<strong>and</strong>atory certification;<br />

4. Lack <strong>of</strong> test<strong>in</strong>g facilities<br />

that comply with the<br />

<strong>in</strong>ternational st<strong>and</strong>ards.<br />

• Separate the st<strong>and</strong>ardization <strong>and</strong> certification functions by establish<strong>in</strong>g<br />

<strong>in</strong>dependent laboratories issu<strong>in</strong>g certificates;<br />

• Review the list <strong>of</strong> st<strong>and</strong>ards <strong>and</strong> abolish the ones not necessary on<br />

the grounds <strong>of</strong> health <strong>and</strong> safety <strong>in</strong> a market economy;<br />

• Consider adopt<strong>in</strong>g <strong>in</strong>ternational st<strong>and</strong>ards to avoid the<br />

“ma<strong>in</strong>tenance cost” <strong>of</strong> the system;<br />

• Apply the risk-based approach by determ<strong>in</strong><strong>in</strong>g which goods <strong>and</strong><br />

services need to be certified <strong>in</strong> order to exclude non-risky categories<br />

from m<strong>and</strong>atory certification <strong>and</strong> by abolish<strong>in</strong>g the m<strong>and</strong>atory<br />

certification requirement for services;<br />

• Create <strong>in</strong>ternationally required laboratory facilities to certify<br />

<strong>Azerbaijan</strong>i commodities accord<strong>in</strong>g to <strong>in</strong>ternationally adopted<br />

st<strong>and</strong>ards <strong>in</strong> order to facilitate their export.<br />

• New cost sav<strong>in</strong>g options for<br />

entrepreneurs;<br />

• Increased occurrence <strong>of</strong><br />

entrepreneurs market<strong>in</strong>g their<br />

products as be<strong>in</strong>g <strong>in</strong> compliance with<br />

<strong>in</strong>ternational st<strong>and</strong>ards;<br />

• Reduced runn<strong>in</strong>g expenses for the<br />

agencies responsible for elaboration<br />

<strong>of</strong> st<strong>and</strong>ards;<br />

• Faster <strong>and</strong> cheapers access to<br />

<strong>in</strong>ternational markets for <strong>Azerbaijan</strong>i<br />

exporters;<br />

• Increased competitiveness <strong>of</strong> the<br />

<strong>Azerbaijan</strong>i economy (goods <strong>and</strong><br />

services), as verified by <strong>in</strong>ternational<br />

competitiveness rat<strong>in</strong>gs (e.g.<br />

Competitiveness Index).<br />

Variation <strong>of</strong><br />

customs tariffs<br />

for similar types<br />

<strong>of</strong> goods, raw<br />

materials <strong>and</strong><br />

processed goods<br />

discourages<br />

import/export<br />

1. Customs tariffs<br />

significantly differ with<br />

respect to similar type<br />

<strong>of</strong> goods <strong>and</strong> raw<br />

materials <strong>and</strong> fullyprocessed<br />

goods;<br />

2. VAT exemptions discourage<br />

trade with non<br />

VAT exempt goods.<br />

• Approximate customs tariffs for similar type <strong>of</strong> goods, raw<br />

materials <strong>and</strong> fully-processed goods <strong>in</strong> order to encourage import/<br />

export;<br />

• Introduce uniform tariff rates for similar types <strong>of</strong> goods;<br />

• Elim<strong>in</strong>ate VAT exemptions to avoid distortions.<br />

• Distortions caused by unreasonable<br />

tariffs lowered or elim<strong>in</strong>ated;<br />

• Incentives for customs <strong>of</strong>ficials to<br />

trade between classes <strong>of</strong> goods or<br />

apply ‘preferential treatment’ <strong>in</strong><br />

exchange for un<strong>of</strong>ficial payments<br />

regulated <strong>and</strong> reduced;<br />

• More simple <strong>and</strong> less costly<br />

calculation <strong>of</strong> customs payments<br />

<strong>in</strong>creas<strong>in</strong>g certa<strong>in</strong>ty <strong>and</strong> compliance.<br />

Aze r b a i j a n Bu s i n e s s En a b l i n g En v i r o n m e n t Pr o j e c t 21