Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The <strong>IFC</strong> survey reveals that one <strong>in</strong> five entrepreneurs <strong>in</strong> <strong>Azerbaijan</strong> conceals about 30<br />

percent <strong>of</strong> its <strong>in</strong>come from the taxation <strong>and</strong> one <strong>in</strong> three entrepreneurs spend 20 percent<br />

<strong>of</strong> his or her pr<strong>of</strong>it on un<strong>of</strong>ficial payments, thus <strong>in</strong>creas<strong>in</strong>g corruption. The impact <strong>of</strong><br />

corruption on SMEs is usually more negative <strong>and</strong> conspicuous than on large-scale<br />

enterprises, as such enterprises normally are <strong>in</strong> a more vulnerable position. Also, the<br />

effect <strong>of</strong> corruption on SMEs is felt more, as <strong>in</strong> most countries the SMEs’ contribution<br />

to the economy, especially on employment, is greater than that <strong>of</strong> large enterprises.<br />

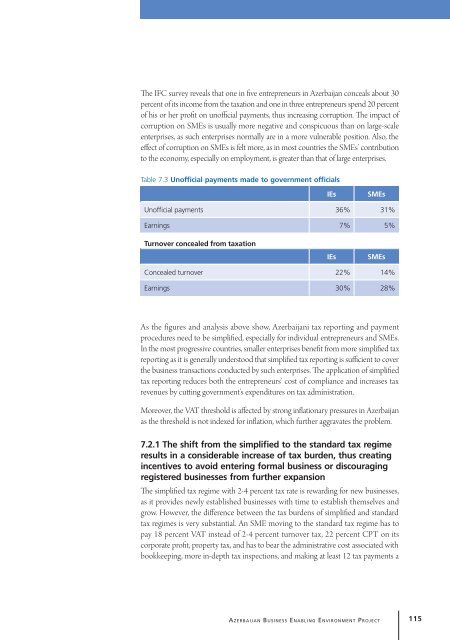

Table 7.3 Un<strong>of</strong>ficial payments made to government <strong>of</strong>ficials<br />

IEs<br />

SMEs<br />

Un<strong>of</strong>ficial payments 36% 31%<br />

Earn<strong>in</strong>gs 7% 5%<br />

Turnover concealed from taxation<br />

IEs<br />

SMEs<br />

Concealed turnover 22% 14%<br />

Earn<strong>in</strong>gs 30% 28%<br />

As the figures <strong>and</strong> analysis above show, <strong>Azerbaijan</strong>i tax report<strong>in</strong>g <strong>and</strong> payment<br />

procedures need to be simplified, especially for <strong>in</strong>dividual entrepreneurs <strong>and</strong> SMEs.<br />

In the most progressive countries, smaller enterprises benefit from more simplified tax<br />

report<strong>in</strong>g as it is generally understood that simplified tax report<strong>in</strong>g is sufficient to cover<br />

the bus<strong>in</strong>ess transactions conducted by such enterprises. The application <strong>of</strong> simplified<br />

tax report<strong>in</strong>g reduces both the entrepreneurs’ cost <strong>of</strong> compliance <strong>and</strong> <strong>in</strong>creases tax<br />

revenues by cutt<strong>in</strong>g government’s expenditures on tax adm<strong>in</strong>istration.<br />

Moreover, the VAT threshold is affected by strong <strong>in</strong>flationary pressures <strong>in</strong> <strong>Azerbaijan</strong><br />

as the threshold is not <strong>in</strong>dexed for <strong>in</strong>flation, which further aggravates the problem.<br />

7.2.1 The shift from the simplified to the st<strong>and</strong>ard tax regime<br />

results <strong>in</strong> a considerable <strong>in</strong>crease <strong>of</strong> tax burden, thus creat<strong>in</strong>g<br />

<strong>in</strong>centives to avoid enter<strong>in</strong>g formal bus<strong>in</strong>ess or discourag<strong>in</strong>g<br />

registered bus<strong>in</strong>esses from further expansion<br />

The simplified tax regime with 2-4 percent tax rate is reward<strong>in</strong>g for new bus<strong>in</strong>esses,<br />

as it provides newly established bus<strong>in</strong>esses with time to establish themselves <strong>and</strong><br />

grow. However, the difference between the tax burdens <strong>of</strong> simplified <strong>and</strong> st<strong>and</strong>ard<br />

tax regimes is very substantial. An SME mov<strong>in</strong>g to the st<strong>and</strong>ard tax regime has to<br />

pay 18 percent VAT <strong>in</strong>stead <strong>of</strong> 2-4 percent turnover tax, 22 percent CPT on its<br />

corporate pr<strong>of</strong>it, property tax, <strong>and</strong> has to bear the adm<strong>in</strong>istrative cost associated with<br />

bookkeep<strong>in</strong>g, more <strong>in</strong>-depth tax <strong>in</strong>spections, <strong>and</strong> mak<strong>in</strong>g at least 12 tax payments a<br />

Aze r b a i j a n Bu s i n e s s En a b l i n g En v i r o n m e n t Pr o j e c t 115