Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

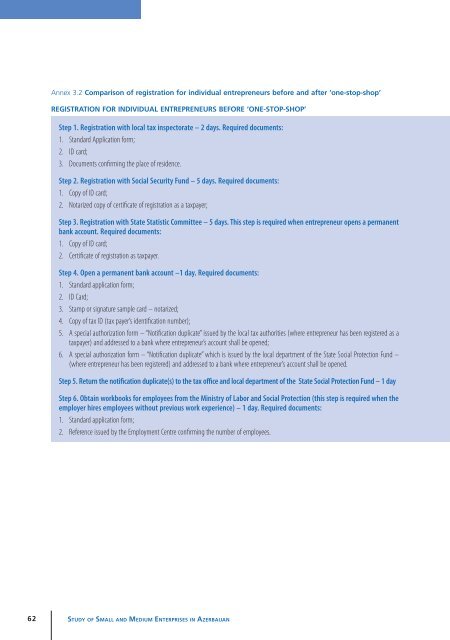

Annex 3.2 Comparison <strong>of</strong> registration for <strong>in</strong>dividual entrepreneurs before <strong>and</strong> after ‘one-stop-shop’<br />

Registration for <strong>in</strong>dividual entrepreneurs before ’one-stop-shop’<br />

Step 1. Registration with local tax <strong>in</strong>spectorate – 2 days. Required documents:<br />

1. St<strong>and</strong>ard Application form;<br />

2. ID card;<br />

3. Documents confirm<strong>in</strong>g the place <strong>of</strong> residence.<br />

Step 2. Registration with Social Security Fund – 5 days. Required documents:<br />

1. Copy <strong>of</strong> ID card;<br />

2. Notarized copy <strong>of</strong> certificate <strong>of</strong> registration as a taxpayer;<br />

Step 3. Registration with State Statistic Committee – 5 days. This step is required when entrepreneur opens a permanent<br />

bank account. Required documents:<br />

1. Copy <strong>of</strong> ID card;<br />

2. Certificate <strong>of</strong> registration as taxpayer.<br />

Step 4. Open a permanent bank account –1 day. Required documents:<br />

1. St<strong>and</strong>ard application form;<br />

2. ID Card;<br />

3. Stamp or signature sample card – notarized;<br />

4. Copy <strong>of</strong> tax ID (tax payer’s identification number);<br />

5. A special authorization form – “Notification duplicate” issued by the local tax authorities (where entrepreneur has been registered as a<br />

taxpayer) <strong>and</strong> addressed to a bank where entrepreneur’s account shall be opened;<br />

6. A special authorization form – “Notification duplicate” which is issued by the local department <strong>of</strong> the State Social Protection Fund –<br />

(where entrepreneur has been registered) <strong>and</strong> addressed to a bank where entrepreneur’s account shall be opened.<br />

Step 5. Return the notification duplicate(s) to the tax <strong>of</strong>fice <strong>and</strong> local department <strong>of</strong> the State Social Protection Fund – 1 day<br />

Step 6. Obta<strong>in</strong> workbooks for employees from the M<strong>in</strong>istry <strong>of</strong> Labor <strong>and</strong> Social Protection (this step is required when the<br />

employer hires employees without previous work experience) – 1 day. Required documents:<br />

1. St<strong>and</strong>ard application form;<br />

2. Reference issued by the Employment Centre confirm<strong>in</strong>g the number <strong>of</strong> employees.<br />

62<br />

St u d y o f Sma l l a n d Me d i u m Ent e r p r i s es <strong>in</strong> Az e r b a i j a n