Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the local tax <strong>in</strong>spectorate for registration (see Chart 3.6). The one-stop-shop has also<br />

<strong>in</strong>troduced the possibility for open<strong>in</strong>g a bank account by the tax <strong>of</strong>fice onl<strong>in</strong>e, <strong>and</strong><br />

therefore removed the requirement <strong>of</strong> obta<strong>in</strong><strong>in</strong>g <strong>and</strong> return<strong>in</strong>g the notification form to<br />

the tax <strong>of</strong>fice by the bank or entrepreneur 13 . However, as was stressed <strong>in</strong> the previous<br />

section, s<strong>in</strong>ce onl<strong>in</strong>e bank<strong>in</strong>g is applicable only to a limited number <strong>of</strong> banks, <strong>in</strong> most<br />

cases entrepreneurs still have to obta<strong>in</strong> the notification duplicate from the tax <strong>of</strong>fice,<br />

present it <strong>in</strong> person to the bank, <strong>and</strong> then return it back to the tax authorities.<br />

Chart 3.6<br />

Registration work<br />

flow for <strong>in</strong>dividual<br />

entrepreneurs<br />

Consolidated<br />

application<br />

form<br />

Registration<br />

process work<br />

flow performed<br />

at the regional<br />

<strong>of</strong>fice<br />

M<strong>in</strong>istry <strong>of</strong> Taxes<br />

AVIS<br />

System<br />

SSC<br />

SSPF<br />

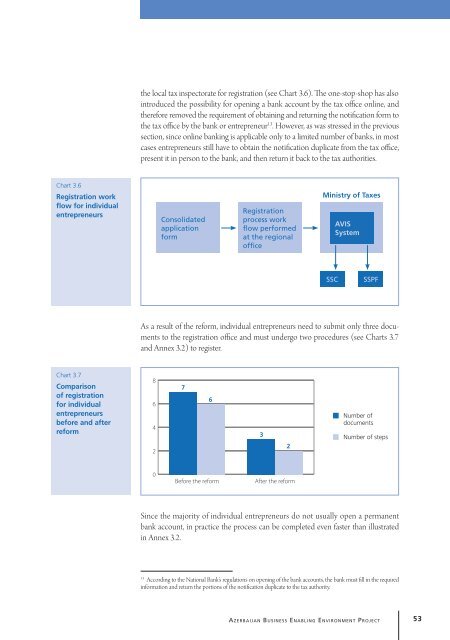

As a result <strong>of</strong> the reform, <strong>in</strong>dividual entrepreneurs need to submit only three documents<br />

to the registration <strong>of</strong>fice <strong>and</strong> must undergo two procedures (see Charts 3.7<br />

<strong>and</strong> Annex 3.2) to register.<br />

Chart 3.7<br />

Comparison<br />

<strong>of</strong> registration<br />

for <strong>in</strong>dividual<br />

entrepreneurs<br />

before <strong>and</strong> after<br />

reform<br />

8<br />

6<br />

4<br />

2<br />

7<br />

6<br />

3<br />

2<br />

Number <strong>of</strong><br />

documents<br />

Number <strong>of</strong> steps<br />

0<br />

Before the reform<br />

After the reform<br />

S<strong>in</strong>ce the majority <strong>of</strong> <strong>in</strong>dividual entrepreneurs do not usually open a permanent<br />

bank account, <strong>in</strong> practice the process can be completed even faster than illustrated<br />

<strong>in</strong> Annex 3.2.<br />

13<br />

Accord<strong>in</strong>g to the National Bank’s regulations on open<strong>in</strong>g <strong>of</strong> the bank accounts, the bank must fill <strong>in</strong> the required<br />

<strong>in</strong>formation <strong>and</strong> return the portions <strong>of</strong> the notification duplicate to the tax authority.<br />

Aze r b a i j a n Bu s i n e s s En a b l i n g En v i r o n m e n t Pr o j e c t 53