Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

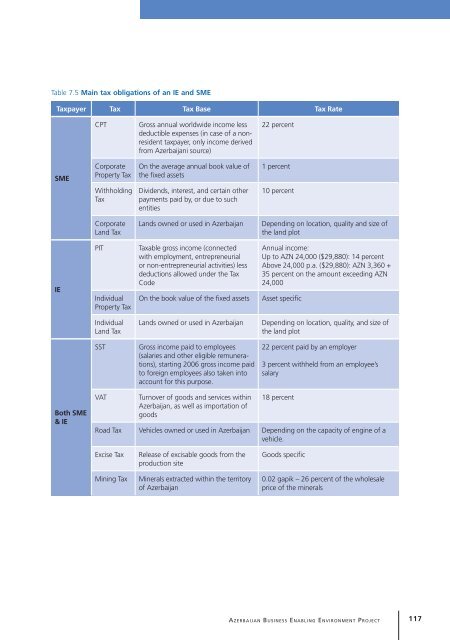

Table 7.5 Ma<strong>in</strong> tax obligations <strong>of</strong> an IE <strong>and</strong> SME<br />

Taxpayer Tax Tax Base Tax Rate<br />

CPT<br />

Gross annual worldwide <strong>in</strong>come less<br />

deductible expenses (<strong>in</strong> case <strong>of</strong> a nonresident<br />

taxpayer, only <strong>in</strong>come derived<br />

from <strong>Azerbaijan</strong>i source)<br />

22 percent<br />

SME<br />

Corporate<br />

Property Tax<br />

On the average annual book value <strong>of</strong><br />

the fixed assets<br />

1 percent<br />

Withhold<strong>in</strong>g<br />

Tax<br />

Dividends, <strong>in</strong>terest, <strong>and</strong> certa<strong>in</strong> other<br />

payments paid by, or due to such<br />

entities<br />

10 percent<br />

Corporate<br />

L<strong>and</strong> Tax<br />

L<strong>and</strong>s owned or used <strong>in</strong> <strong>Azerbaijan</strong><br />

Depend<strong>in</strong>g on location, quality <strong>and</strong> size <strong>of</strong><br />

the l<strong>and</strong> plot<br />

IE<br />

PIT<br />

Individual<br />

Property Tax<br />

Taxable gross <strong>in</strong>come (connected<br />

with employment, entrepreneurial<br />

or non-entrepreneurial activities) less<br />

deductions allowed under the Tax<br />

Code<br />

On the book value <strong>of</strong> the fixed assets<br />

Annual <strong>in</strong>come:<br />

Up to AZN 24,000 ($29,880): 14 percent<br />

Above 24,000 p.a. ($29,880): AZN 3,360 +<br />

35 percent on the amount exceed<strong>in</strong>g AZN<br />

24,000<br />

Asset specific<br />

Individual<br />

L<strong>and</strong> Tax<br />

L<strong>and</strong>s owned or used <strong>in</strong> <strong>Azerbaijan</strong><br />

Depend<strong>in</strong>g on location, quality, <strong>and</strong> size <strong>of</strong><br />

the l<strong>and</strong> plot<br />

SST<br />

Gross <strong>in</strong>come paid to employees<br />

(salaries <strong>and</strong> other eligible remunerations),<br />

start<strong>in</strong>g 2006 gross <strong>in</strong>come paid<br />

to foreign employees also taken <strong>in</strong>to<br />

account for this purpose.<br />

22 percent paid by an employer<br />

3 percent withheld from an employee’s<br />

salary<br />

Both SME<br />

& IE<br />

VAT<br />

Turnover <strong>of</strong> goods <strong>and</strong> services with<strong>in</strong><br />

<strong>Azerbaijan</strong>, as well as importation <strong>of</strong><br />

goods<br />

18 percent<br />

Road Tax Vehicles owned or used <strong>in</strong> <strong>Azerbaijan</strong> Depend<strong>in</strong>g on the capacity <strong>of</strong> eng<strong>in</strong>e <strong>of</strong> a<br />

vehicle.<br />

Excise Tax<br />

M<strong>in</strong><strong>in</strong>g Tax<br />

Release <strong>of</strong> excisable goods from the<br />

production site<br />

M<strong>in</strong>erals extracted with<strong>in</strong> the territory<br />

<strong>of</strong> <strong>Azerbaijan</strong><br />

Goods specific<br />

0.02 gapik – 26 percent <strong>of</strong> the wholesale<br />

price <strong>of</strong> the m<strong>in</strong>erals<br />

Aze r b a i j a n Bu s i n e s s En a b l i n g En v i r o n m e n t Pr o j e c t 117