Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Box 7.1 What is the Shadow Economy?<br />

By def<strong>in</strong>ition, the shadow (or <strong>in</strong>formal) economy constitutes activities that are not recorded by the government.<br />

One <strong>of</strong> the ma<strong>in</strong> reasons for the very existence <strong>of</strong> the <strong>in</strong>formal sector is entrepreneurs’ attempt to f<strong>in</strong>d a shelter from government-<strong>in</strong>duced<br />

distortions such as excessive taxes, regulation, <strong>and</strong> bribery. Companies that conceal some <strong>of</strong> their transactions pay lower taxes, thereby shift<strong>in</strong>g<br />

the tax burden onto the taxpayers who operate legally. Such companies operat<strong>in</strong>g with<strong>in</strong> the law, however, do not have to waste resources<br />

to conceal their activities, <strong>and</strong> therefore can develop <strong>and</strong> achieve optimum growth. This premise is supported by the Do<strong>in</strong>g Bus<strong>in</strong>ess (2005)<br />

project, which found that, “on average, <strong>in</strong> the 10 develop<strong>in</strong>g countries sampled, the output <strong>of</strong> shadow enterprises was 40 percent less than that<br />

<strong>of</strong> legal bus<strong>in</strong>esses operat<strong>in</strong>g <strong>in</strong> the same economic sectors.” Therefore, operat<strong>in</strong>g <strong>in</strong> the shadow economy is also harmful for the bus<strong>in</strong>esses<br />

themselves s<strong>in</strong>ce they have limited ability to attract external fund<strong>in</strong>g. Companies that understate their pr<strong>of</strong>it to avoid taxes are also deprived<br />

<strong>of</strong> other opportunities – low f<strong>in</strong>ancial <strong>in</strong>dicators do not permit them to secure bank credit or use the services <strong>of</strong> leas<strong>in</strong>g companies.<br />

Although <strong>in</strong> comparison with the previous year, <strong>Azerbaijan</strong> has made significant<br />

progress <strong>in</strong> reduc<strong>in</strong>g the number <strong>of</strong> tax payments (from 30 to 23), the 2009 Do<strong>in</strong>g<br />

Bus<strong>in</strong>ess report <strong>in</strong>dicates that the number <strong>of</strong> tax payments is still higher than <strong>in</strong><br />

certa<strong>in</strong> neighbor<strong>in</strong>g economies such as Kazakhstan, where bus<strong>in</strong>esses make just 9 tax<br />

payments per year <strong>and</strong> spend 271 hours on tax compliance (Table 7.6). Moreover,<br />

<strong>IFC</strong> survey results <strong>in</strong>dicate that on average <strong>Azerbaijan</strong>i bus<strong>in</strong>esses have to visit<br />

tax authorities for various reasons seven times a year, <strong>and</strong> their employees spend<br />

approximately 3 percent <strong>of</strong> their work<strong>in</strong>g hours on the preparation <strong>of</strong> tax reports.<br />

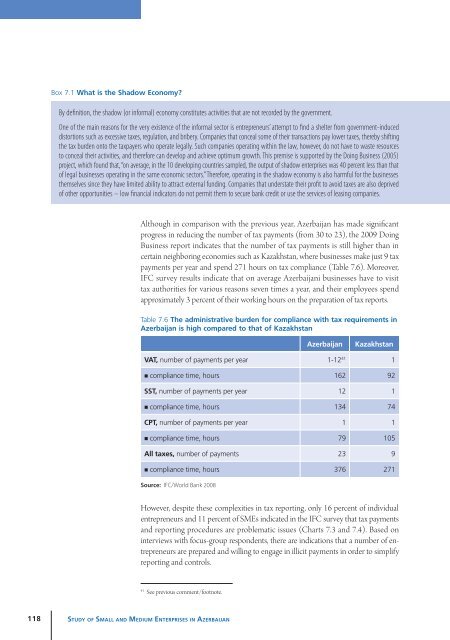

Table 7.6 The adm<strong>in</strong>istrative burden for compliance with tax requirements <strong>in</strong><br />

<strong>Azerbaijan</strong> is high compared to that <strong>of</strong> Kazakhstan<br />

<strong>Azerbaijan</strong><br />

Kazakhstan<br />

VAT, number <strong>of</strong> payments per year 1-12 41 1<br />

• compliance time, hours 162 92<br />

SST, number <strong>of</strong> payments per year 12 1<br />

• compliance time, hours 134 74<br />

CPT, number <strong>of</strong> payments per year 1 1<br />

• compliance time, hours 79 105<br />

All taxes, number <strong>of</strong> payments 23 9<br />

• compliance time, hours 376 271<br />

Source: <strong>IFC</strong>/World Bank 2008<br />

However, despite these complexities <strong>in</strong> tax report<strong>in</strong>g, only 16 percent <strong>of</strong> <strong>in</strong>dividual<br />

entrepreneurs <strong>and</strong> 11 percent <strong>of</strong> SMEs <strong>in</strong>dicated <strong>in</strong> the <strong>IFC</strong> survey that tax payments<br />

<strong>and</strong> report<strong>in</strong>g procedures are problematic issues (Charts 7.3 <strong>and</strong> 7.4). Based on<br />

<strong>in</strong>terviews with focus-group respondents, there are <strong>in</strong>dications that a number <strong>of</strong> entrepreneurs<br />

are prepared <strong>and</strong> will<strong>in</strong>g to engage <strong>in</strong> illicit payments <strong>in</strong> order to simplify<br />

report<strong>in</strong>g <strong>and</strong> controls.<br />

41<br />

See previous comment/footnote.<br />

118<br />

St u d y o f Sma l l a n d Me d i u m Ent e r p r i s es <strong>in</strong> Az e r b a i j a n