Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

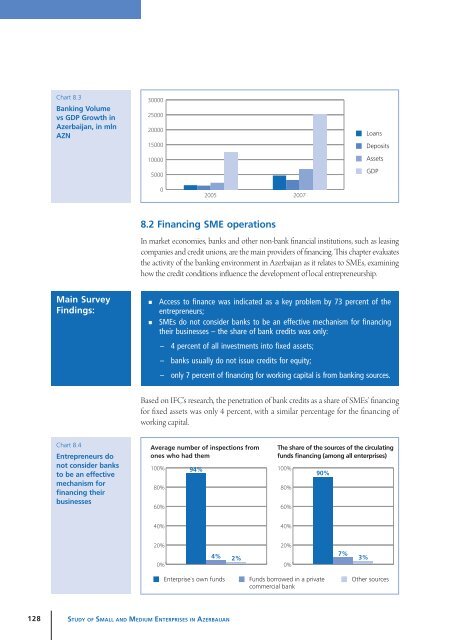

Chart 8.3<br />

Bank<strong>in</strong>g Volume<br />

vs GDP Growth <strong>in</strong><br />

<strong>Azerbaijan</strong>, <strong>in</strong> mln<br />

AZN<br />

30000<br />

25000<br />

20000<br />

15000<br />

10000<br />

5000<br />

Loans<br />

Deposits<br />

Assets<br />

GDP<br />

0<br />

2005<br />

2007<br />

8.2 F<strong>in</strong>anc<strong>in</strong>g SME operations<br />

In market economies, banks <strong>and</strong> other non-bank f<strong>in</strong>ancial <strong>in</strong>stitutions, such as leas<strong>in</strong>g<br />

companies <strong>and</strong> credit unions, are the ma<strong>in</strong> providers <strong>of</strong> f<strong>in</strong>anc<strong>in</strong>g. This chapter evaluates<br />

the activity <strong>of</strong> the bank<strong>in</strong>g environment <strong>in</strong> <strong>Azerbaijan</strong> as it relates to SMEs, exam<strong>in</strong><strong>in</strong>g<br />

how the credit conditions <strong>in</strong>fluence the development <strong>of</strong> local entrepreneurship.<br />

Ma<strong>in</strong> Survey<br />

F<strong>in</strong>d<strong>in</strong>gs:<br />

• Access to f<strong>in</strong>ance was <strong>in</strong>dicated as a key problem by 73 percent <strong>of</strong> the<br />

entrepreneurs;<br />

• SMEs do not consider banks to be an effective mechanism for f<strong>in</strong>anc<strong>in</strong>g<br />

their bus<strong>in</strong>esses – the share <strong>of</strong> bank credits was only:<br />

– 4 percent <strong>of</strong> all <strong>in</strong>vestments <strong>in</strong>to fixed assets;<br />

– banks usually do not issue credits for equity;<br />

– only 7 percent <strong>of</strong> f<strong>in</strong>anc<strong>in</strong>g for work<strong>in</strong>g capital is from bank<strong>in</strong>g sources.<br />

Based on <strong>IFC</strong>’s research, the penetration <strong>of</strong> bank credits as a share <strong>of</strong> SMEs’ f<strong>in</strong>anc<strong>in</strong>g<br />

for fixed assets was only 4 percent, with a similar percentage for the f<strong>in</strong>anc<strong>in</strong>g <strong>of</strong><br />

work<strong>in</strong>g capital.<br />

Chart 8.4<br />

Entrepreneurs do<br />

not consider banks<br />

to be an effective<br />

mechanism for<br />

f<strong>in</strong>anc<strong>in</strong>g their<br />

bus<strong>in</strong>esses<br />

Average number <strong>of</strong> <strong>in</strong>spections from<br />

ones who had them<br />

100% 94%<br />

80%<br />

60%<br />

The share <strong>of</strong> the sources <strong>of</strong> the circulat<strong>in</strong>g<br />

funds f<strong>in</strong>anc<strong>in</strong>g (among all enterprises)<br />

100%<br />

80%<br />

60%<br />

90%<br />

40%<br />

40%<br />

20%<br />

0%<br />

20%<br />

4% 2%<br />

0%<br />

7% 3%<br />

Enterprise`s own funds<br />

Funds borrowed <strong>in</strong> a private<br />

commercial bank<br />

Other sources<br />

128<br />

St u d y o f Sma l l a n d Me d i u m Ent e r p r i s es <strong>in</strong> Az e r b a i j a n