Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

Study of Small and Medium Enterprises in Azerbaijan - IFC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

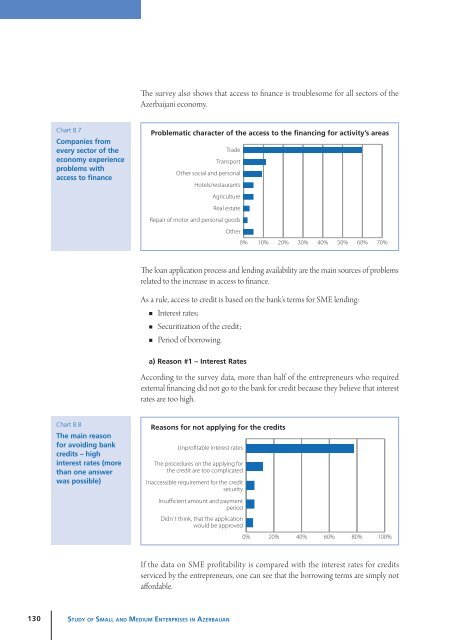

The survey also shows that access to f<strong>in</strong>ance is troublesome for all sectors <strong>of</strong> the<br />

<strong>Azerbaijan</strong>i economy.<br />

Chart 8.7<br />

Companies from<br />

every sector <strong>of</strong> the<br />

economy experience<br />

problems with<br />

access to f<strong>in</strong>ance<br />

Problematic character <strong>of</strong> the access to the f<strong>in</strong>anc<strong>in</strong>g for activity’s areas<br />

Trade<br />

Transport<br />

Other social <strong>and</strong> personal<br />

Hotels/restaurants<br />

Agriculture<br />

Real estate<br />

Repair <strong>of</strong> motor <strong>and</strong> personal goods<br />

Other<br />

0% 10% 20% 30% 40% 50% 60% 70%<br />

The loan application process <strong>and</strong> lend<strong>in</strong>g availability are the ma<strong>in</strong> sources <strong>of</strong> problems<br />

related to the <strong>in</strong>crease <strong>in</strong> access to f<strong>in</strong>ance.<br />

As a rule, access to credit is based on the bank’s terms for SME lend<strong>in</strong>g:<br />

• Interest rates;<br />

• Securitization <strong>of</strong> the credit;<br />

• Period <strong>of</strong> borrow<strong>in</strong>g.<br />

a) Reason #1 – Interest Rates<br />

Accord<strong>in</strong>g to the survey data, more than half <strong>of</strong> the entrepreneurs who required<br />

external f<strong>in</strong>anc<strong>in</strong>g did not go to the bank for credit because they believe that <strong>in</strong>terest<br />

rates are too high.<br />

Chart 8.8<br />

The ma<strong>in</strong> reason<br />

for avoid<strong>in</strong>g bank<br />

credits – high<br />

<strong>in</strong>terest rates (more<br />

than one answer<br />

was possible)<br />

Reasons for not apply<strong>in</strong>g for the credits<br />

Unpr<strong>of</strong>itable <strong>in</strong>terest rates<br />

The procedures on the apply<strong>in</strong>g for<br />

the credit are too complicated<br />

Inaccessible requirement for the credit<br />

security<br />

Insufficient amount <strong>and</strong> payment<br />

period<br />

Didn`t th<strong>in</strong>k, that the application<br />

would be approved<br />

0% 20% 40% 60% 80% 100%<br />

If the data on SME pr<strong>of</strong>itability is compared with the <strong>in</strong>terest rates for credits<br />

serviced by the entrepreneurs, one can see that the borrow<strong>in</strong>g terms are simply not<br />

affordable.<br />

130<br />

St u d y o f Sma l l a n d Me d i u m Ent e r p r i s es <strong>in</strong> Az e r b a i j a n