Section One

Section One

Section One

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

138<br />

Figure 4.1<br />

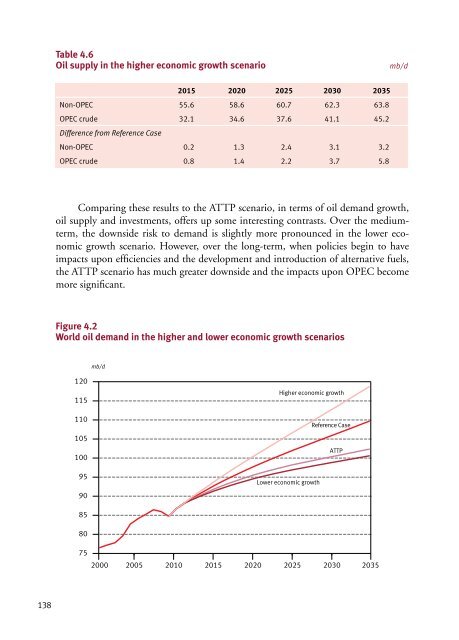

Table 4.6<br />

Oil supply in the higher economic growth scenario mb/d<br />

mb/d<br />

2015 2020 2025 2030 2035<br />

Non-OPEC 110<br />

55.6 58.6 60.7 62.3 63.8<br />

OPEC crude<br />

105<br />

Difference from Reference Case<br />

32.1 34.6 37.6 Reference Case 41.1 45.2<br />

Non-OPEC 100<br />

0.2 1.3 2.4 3.1 3.2<br />

OPEC crude<br />

95<br />

0.8 1.4 2.2 ATTP 3.7 5.8<br />

90<br />

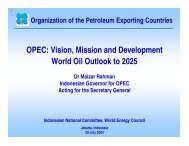

Comparing these results to the ATTP scenario, in terms of oil demand growth,<br />

oil supply 85 and investments, offers up some interesting contrasts. Over the mediumterm,<br />

the downside risk to demand is slightly more pronounced in the lower eco-<br />

nomic 80growth<br />

scenario. However, over the long-term, when policies begin to have<br />

impacts upon efficiencies and the development and introduction of alternative fuels,<br />

the ATTP 75 scenario has much greater downside and the impacts upon OPEC become<br />

more significant.<br />

2000 2005 2010 2015 2020 2025 2030 2035<br />

Figure 4.2<br />

World oil demand in the higher and lower economic Figure 4.3 growth scenarios<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

mb/d<br />

Higher economic growth<br />

Lower economic growth<br />

Reference Case<br />

75<br />

2000 2005 2010 2015 2020 2025 2030 2035<br />

ATTP<br />

Figure 4.5<br />

mb/d<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

46<br />

44<br />

42<br />

40<br />

38<br />

36<br />

34<br />

32<br />

30<br />

28<br />

26<br />

24<br />

0<br />

mb/d<br />

200