Section One

Section One

Section One

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

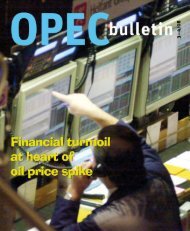

to this, there is the dominance of the US-dollar as the global reserve currency and<br />

the still preeminent role of the US financial system. A failure of the US economy<br />

would have a major global impact.<br />

After the economic crisis of 2008 and 2009, the recovery in US consumer consumption<br />

was greatly supported by government-led stimulus. However, the recovery<br />

has recently decelerated considerably after the fiscal stimulus ended and after<br />

the major ‘extraordinary’ monetary supply measures came to an end. Moreover, the<br />

troubling US labour market situation shows few signs of improving. It is obvious<br />

that government-financed consumption cannot continue indefinitely and that the<br />

underlying economy needs to improve in order to stand on its own feet, but there<br />

is no clear answer as to whether the US economy is actually in a position to do so.<br />

However, it currently seems unlikely that this important motor of global growth<br />

will accelerate away at any time soon.<br />

The third major issue is the recent slow-down in developing countries, particularly<br />

the deceleration in China and India. While the global stimulus and the measures<br />

undertaken by these countries themselves have had a highly positive effect on their<br />

growth rates, these economies remain largely dependent on either capital inflows<br />

from, or exports to, developed countries. It is evident too that they have been<br />

relatively successful in building-up domestic markets and stimulating greater local<br />

demand, but they are still too weak to absorb all the capacity established in recent<br />

years. Developing countries have also recently observed significant increases in inflation<br />

that have forced them to initiate provisions to avoid their economies overheating.<br />

This has had a dampening effect on their growth rates, and it is expected<br />

that it will continue to do so. However, these countries can be expected to be a<br />

major factor supporting future global economic growth.<br />

In summary, it is evident that sovereign intervention, in terms of stimulus packages<br />

and monetary policy, has been the main driving force behind the recovery<br />

since the financial crisis began. And this remains true today. Thus, the recovery<br />

cannot be deemed to be self-sustaining at this point in time. It is perhaps important<br />

to ask a follow up to this: is it at least sustaining? In the main, this is expected<br />

to depend on the ability of governments to continue their various support<br />

measures for as long as it takes to solve the economic issues. This can be expected<br />

to take a number of years and therefore the current best assumed outcome is a<br />

below average global growth scenario, similar to the situation at the end of 2011,<br />

as reflected in the Reference Case medium-term assumptions in Table 1.1. If<br />

the economic situation worsens post-2011, however, then this may need to be<br />

further reassessed. Although this appears unlikely at present, it cannot be ruled<br />

out entirely.<br />

35<br />

Chapter<br />

1