- Page 1 and 2:

The Mobile Internet Report Key Them

- Page 3 and 4:

What You are Reading - The Mobile I

- Page 5 and 6:

Key Mobile Internet Themes 1) Wealt

- Page 7 and 8:

…Key Mobile Internet Themes… 3)

- Page 9 and 10:

…Key Mobile Internet Themes 6) Ma

- Page 11 and 12:

Key Theme #1 11

- Page 13 and 14:

Key Theme #1 - Wealth Creation / De

- Page 15 and 16:

Wealth Creation / Destruction Is Ma

- Page 17 and 18:

Winners of Each New Cycle Often Cre

- Page 19 and 20:

NCR Won Big in Mainframe Era, DEC W

- Page 21 and 22:

Compaq + Microsoft Won Big in PC Er

- Page 23 and 24:

Net, New Computing Cycles Create /

- Page 25 and 26:

New Computing Cycle Characteristics

- Page 27 and 28:

12,000,000 Mobile Internet Traffic

- Page 29 and 30:

Pace of company change related to m

- Page 31 and 32:

Rapid Pace of Corporate M&A Related

- Page 33 and 34:

Technology Companies Created > Weal

- Page 35 and 36:

Top Internet-Related Tech Wealth Cr

- Page 37 and 38:

We Know What Happened Over Past 15

- Page 39 and 40:

Mobile Internet Likely to Follow Ti

- Page 41 and 42:

2009 Global Top 30 TMT Companies by

- Page 43 and 44:

Key Theme #2 43

- Page 45 and 46:

Key Theme #2 - Mobile Ramping Faste

- Page 47 and 48:

Apple iPhone + iTouch = Fastest new

- Page 49 and 50:

Mobile Internet Outpaces Desktop In

- Page 51 and 52:

Tech Cycles Tend to Last Ten Years

- Page 53 and 54:

User-Interface Revolutions (Overlai

- Page 55 and 56:

Broad base of IP-based mobile usage

- Page 57 and 58:

Wireless Network Primer GPS - Glob

- Page 59 and 60:

Increasingly, Mobile Phone Usage is

- Page 61 and 62:

Mobile Devices + Infrastructure Ena

- Page 63 and 64:

Cloud-Based Content / App Services

- Page 65 and 66:

Machine to Machine (M2M) Takes on N

- Page 67 and 68:

Rapid growth in number / type of mo

- Page 69 and 70:

GPS proliferation (and related loca

- Page 71 and 72:

GPS = 421MM Chipsets Sold in 2008E

- Page 73 and 74:

WIRED Magazine - “Inside the GPS

- Page 75 and 76:

3G proliferation is a big deal. 75

- Page 77 and 78:

3G = Key to Enabling Internet Usage

- Page 79 and 80:

3G Penetration Inflection Points Va

- Page 81 and 82:

3G Growth Still Concentrated in Dev

- Page 83 and 84:

USA Likely to Remain Most Dynamic 3

- Page 85 and 86:

Wi-Fi proliferation is a big deal.

- Page 87 and 88:

Wi-Fi’s High Speed + Wide Availab

- Page 89 and 90:

100,000 Wi-Fi Households (USA) = 20

- Page 91 and 92:

Bluetooth proliferation is a big de

- Page 93 and 94:

Bluetooth = 1.3B Chipsets Sold in 2

- Page 95 and 96:

What Is a ‘Smartphone’ We defi

- Page 97 and 98:

Smartphone of 2009 = As Powerful as

- Page 99 and 100:

Mobile Internet - Leveraging the Ev

- Page 101 and 102:

Notebook PC + Smartphone Shipments

- Page 103 and 104:

Impressive / Rapid Growing Smartpho

- Page 105 and 106:

Consumer Internet-Enabled Devices -

- Page 107 and 108:

Significant Growth in 3G + Smartpho

- Page 109 and 110:

Unified Communication (UC) Voice (~

- Page 111 and 112:

If VoIP Leader Skype Were a Carrier

- Page 113 and 114:

VoIP = Material Impact on Tradition

- Page 115 and 116:

Google Voice Putting User in Contro

- Page 117 and 118:

Social Networking - Global Phenomen

- Page 119 and 120:

Facebook = Garnering Rising Share o

- Page 121 and 122:

Powerful Devices (like iPhone) + Ne

- Page 123 and 124:

Video = High Usage + High Bandwidth

- Page 125 and 126:

Mobile Ramping Faster than Desktop

- Page 127 and 128:

Key Theme #3 1) Wealth Creation / D

- Page 129 and 130:

Apple Leading in Mobile Innovation

- Page 131 and 132:

Apple’s Impressive Share Likely M

- Page 133 and 134:

iTunes App Store = Shot Heard ‘Ro

- Page 135 and 136:

iTunes App Store = The Killer Mobil

- Page 137 and 138:

Mobile App Definition A mobile appl

- Page 139 and 140:

Users / Developers / Apple = Likely

- Page 141 and 142:

Apple iPhone / iTouch = 2B+ App Dow

- Page 143 and 144:

Most Downloaded Free iPhone Apps -

- Page 145 and 146:

iPhone Apps for Nearly Everyone - L

- Page 147 and 148:

Mobile Developer Mind Share / Focus

- Page 149 and 150:

Powerful mobile device usage trends

- Page 151 and 152:

iPhone / Android Gaining Mobile Int

- Page 153 and 154:

Mobile Internet Operating System Co

- Page 155 and 156:

Handset Device Price / Volume Pyram

- Page 157 and 158:

High-End Quickly Becomes Low-End -

- Page 159 and 160:

iPhone 3G BOM = 33% Lower than iPho

- Page 161 and 162:

Apple iTunes App Revenue = Could Su

- Page 163 and 164:

Apple leads race for handset profit

- Page 165 and 166:

Apple + RIM = 13% Share of Handset

- Page 167 and 168:

Apple / RIM - Smartphone Leaders Co

- Page 169 and 170:

PC Platform Leaders (Microsoft + In

- Page 171 and 172:

Apple iPhone Base Case + Upside Cas

- Page 173 and 174:

Scenarios for Apple iPhone Market S

- Page 175 and 176:

The Apple Tablet Potential Should N

- Page 177 and 178:

Apple - Potential Long-Term Challen

- Page 179 and 180:

Google Android’s Open + Low Cost

- Page 181 and 182:

Apple may believe its platform mana

- Page 183 and 184:

In Technology, Products with Most /

- Page 185 and 186:

Multitudes of Android Phones - Tens

- Page 187 and 188:

Android’s Conundrum Open-Source S

- Page 189 and 190:

Next Generation Android Smartphones

- Page 191 and 192:

Apple’s Potential Long-Term Chall

- Page 193 and 194:

Native Apps Benefits Challenges For

- Page 195 and 196:

Native Apps Should Always Have Perf

- Page 197 and 198:

Apple = Likely Well Positioned to N

- Page 199 and 200:

Do Incumbents Have Apple-Like Poten

- Page 201 and 202:

Smartphones Not Relevant in Emergin

- Page 203 and 204:

Retail Sales (Not Carrier Sales) -

- Page 205 and 206:

Apple’s Success Has Been Proven i

- Page 207 and 208:

Buddhist Phone White-Box “Shanzha

- Page 209 and 210:

Don’t Expect Apple to Stand Still

- Page 211 and 212:

Carrier Exclusivity Limits Apple’

- Page 213 and 214:

iPhone Price Cut to $99 Would Elimi

- Page 215 and 216:

Ending Carrier Exclusivity = Could

- Page 217 and 218:

Battery Technology Constraining iPh

- Page 219 and 220:

Implications of New Horizontal Busi

- Page 221 and 222:

Apple’s Vertical Handset Model =

- Page 223 and 224:

Apple iPhone + iTouch = On Track to

- Page 225 and 226:

Apple iTouch - Key Companion to iPh

- Page 227 and 228:

RIM’s Vertical Handset Model = Pr

- Page 229 and 230:

Threats from RIM’s Vertical Integ

- Page 231 and 232:

Horizontal Handset Model Finally Em

- Page 233 and 234:

Opportunities / Benefits from Horiz

- Page 235 and 236:

Key Theme #4 235

- Page 237 and 238:

Key Theme #4 - Game-Changing Commun

- Page 239 and 240:

Facebook and Apple iPhone / iTouch

- Page 241 and 242:

Facebook + Apple iPhone / iTouch =

- Page 243 and 244:

Social Networks - Underpinning of I

- Page 245 and 246:

Social Networking Driving Consumer

- Page 247 and 248:

Social Networks - Gaining Material

- Page 249 and 250:

Facebook Platform - A Hub for Commu

- Page 251 and 252:

Facebook - Next Generation Portal f

- Page 253 and 254:

Facebook - Largest Share Gainer of

- Page 255 and 256:

Facebook / Twitter Replacing Tradit

- Page 257 and 258:

Communication on Twitter Not Only C

- Page 259 and 260:

Facebook Users = Heavy Content Crea

- Page 261 and 262:

Top 10 Facebook Applications - Game

- Page 263 and 264:

Facebook = A Platform for Advertise

- Page 265 and 266:

Facebook - Opportunity for Advertis

- Page 267 and 268:

Facebook - Advertiser / Vendor Succ

- Page 269 and 270:

Social Networks in General = Platfo

- Page 271 and 272:

LinkedIn - Social Network for Profe

- Page 273 and 274:

Like Twitter and Facebook, Foursqua

- Page 275 and 276:

Advertising Follows Eyeballs - Glob

- Page 277 and 278:

Facebook - Vibrant Developer / Appl

- Page 279 and 280:

Developer / Application Success on

- Page 281 and 282:

China Serves as Proxy & Leads World

- Page 283 and 284:

Tencent Business Model Overview - H

- Page 285 and 286:

Mobile = Future of Social Networks

- Page 287 and 288:

Mobile Social Networking in Japan ~

- Page 289 and 290:

Facebook Symbiotic with Mobile - Sh

- Page 291 and 292:

Carriers’ ‘Walled Gardens’ =

- Page 293 and 294:

Apple Unshackled Developers + Consu

- Page 295 and 296:

Mobile Commerce = Accelerator for O

- Page 297 and 298:

15 Years for Online to Reach 4% of

- Page 299 and 300:

Mobile Revolutionizing Commerce - W

- Page 301 and 302:

Deep Discounts - Invitation-Only Ti

- Page 303 and 304:

Traditional Retailers Using Pings t

- Page 305 and 306:

Key Theme #5 305

- Page 307 and 308:

Key Theme #5 Growth / Monetization

- Page 309 and 310:

Japan has led world by 5-10 years i

- Page 311 and 312:

ROW’s Mobile Internet Revenue Mix

- Page 313 and 314:

Mobile Revenue (ex. Data Access) pe

- Page 315 and 316:

3G Penetration - …Developed / Eme

- Page 317 and 318:

Why Has Japan Led the World in Mobi

- Page 319 and 320:

Rich Content / Apps / Services - Ja

- Page 321 and 322:

Powerful / Internet-Enabled Handset

- Page 323 and 324:

Japan Mobile Online Commerce / Paid

- Page 325 and 326:

Japan Mobile Online Commerce / Paid

- Page 327 and 328:

Japan as Proxy for Technology’s R

- Page 329 and 330:

Japan mobile monetization models pr

- Page 331 and 332:

Japan’s Mobile Online Commerce /

- Page 333 and 334:

Mobile Online Commerce - Promising

- Page 335 and 336:

Japan - Physical Products Gaining S

- Page 337 and 338:

ROW Also Making Inroads into Mobile

- Page 339 and 340:

ROW - Branded Mobile Apps Could Dri

- Page 341 and 342:

Digital Content (Music / Video / Ap

- Page 343 and 344:

Digital Content - Mobile Games / Mu

- Page 345 and 346:

Tencent Business Model Overview - H

- Page 347 and 348:

Japan - Virtual / Digital Goods on

- Page 349 and 350:

China Serves as Proxy & Leads World

- Page 351 and 352:

Developer / Application Success on

- Page 353 and 354:

Japan Mobile Paid Services 5 Years

- Page 355 and 356:

Rakuten Travel - Mobile Gross Hotel

- Page 357 and 358:

Mobile Advertising - Personalizatio

- Page 359 and 360:

Japan - Mobile Advertising - 24% CA

- Page 361 and 362:

Upside to Mobile Search Advertising

- Page 363 and 364:

Heavy Search / Display Advertising

- Page 365 and 366:

Interactive Video Advertising Revol

- Page 367 and 368:

Desktop Internet Monetization Evolu

- Page 369 and 370:

…While Premium Content Revenue (U

- Page 371 and 372:

At Margin, Advertising + Online Com

- Page 373 and 374:

Users Often Pay for Content as Long

- Page 375 and 376:

View of Paid vs. Ad-Supported Conte

- Page 377 and 378:

Media Time Spent vs. Ad Spend Out o

- Page 379 and 380:

History Proves That Ads Follow Eyeb

- Page 381 and 382:

Global Mobile Advertising Scenario

- Page 383 and 384:

Global Mobile Online Commerce / Pai

- Page 385 and 386:

Global Mobile Internet Ecosystem -

- Page 387 and 388:

Global Mobile Internet Ecosystem Re

- Page 389 and 390:

Mobile Internet Revenue Mix Shiftin

- Page 391 and 392:

Google - Internet Search Innovation

- Page 393 and 394:

Amazon.com - Online Shopping Experi

- Page 395 and 396:

Some companies can benefit from tec

- Page 397 and 398:

How Mobile Internet Revenue May Evo

- Page 399 and 400:

Key Theme #6 1) Wealth Creation / D

- Page 401 and 402:

Key Theme #6 - Massive Data Growth

- Page 403 and 404:

The Carriers’ Capex Conundrum…

- Page 405 and 406:

Massive Data Growth Driving Carrier

- Page 407 and 408:

Global Mobile Data Trends Imply Ong

- Page 409 and 410:

Global Mobile Data Users - 29% CAGR

- Page 411 and 412:

Global Mobile Data Users - 55% CAGR

- Page 413 and 414:

Company- and Product-level Mobile D

- Page 415 and 416:

AT&T = 50x Mobile Data Traffic Incr

- Page 417 and 418:

Data = Increasingly Dominating Netw

- Page 419 and 420:

European Market Supporting Data and

- Page 421 and 422:

Smartphone Data Usage Will Rise wit

- Page 423 and 424:

Near Term, Mobile Internet Usage Su

- Page 425 and 426:

European Mobile Network Utilization

- Page 427 and 428:

As Data Usage Becomes More Importan

- Page 429 and 430:

Aggregate Mobile Data Network Suppl

- Page 431 and 432:

Network Congestion in High Density

- Page 433 and 434:

Total Network Capacity on a Cell Si

- Page 435 and 436:

However, As Smartphone Penetration

- Page 437 and 438:

Overview of a Mobile Data Network T

- Page 439 and 440:

Wireless Capacity - Where Does It L

- Page 441 and 442:

Network Improvement Timeline Step A

- Page 443 and 444:

Short-Term Network Improvements - H

- Page 445 and 446:

Short-term Network Improvements - W

- Page 447 and 448:

Wireless Backhaul Capacity Expected

- Page 449 and 450:

Mobile Internet Implications for Wi

- Page 451 and 452:

Wi-Fi Moves from Carrier Foe to Fri

- Page 453 and 454:

Wi-Fi Significantly Cheaper for Car

- Page 455 and 456:

Wi-Fi Network Coverage in Home and

- Page 457 and 458:

~7,000 AT&T Wi-Fi Access Points at

- Page 459 and 460:

Wi-Fi Case Study #2 - Boosting Valu

- Page 461 and 462:

Bottom Line = Wi-Fi Offload Will Be

- Page 463 and 464:

HSPA + Backhaul Upgrades Should Red

- Page 465 and 466:

Long-term Network Improvements - Ne

- Page 467 and 468:

Good News = Proprietary Network Opt

- Page 469 and 470:

Long-term Network Improvements - Up

- Page 471 and 472:

HSPA / LTE Buildout Roadmap - Succe

- Page 473 and 474:

LTE = 24x Theoretical Bandwidth of

- Page 475 and 476:

39 Operators in 19 Countries Alread

- Page 477 and 478:

LTE Introduction Cost Should Be Low

- Page 479 and 480:

New Lower Spectrum Allocations, Suc

- Page 481 and 482:

Spectral Efficiency ((Bit/S)/Hz), p

- Page 483 and 484:

What effect will long-term network

- Page 485 and 486:

Raw Network Capacity Improvement Ca

- Page 487 and 488:

Underlying Technology Improvements

- Page 489 and 490:

Case Study - 2010E Capex Analysis f

- Page 491 and 492:

AT&T Plans to Increase Capacity in

- Page 493 and 494:

Network Sharing Is Becoming Increas

- Page 495 and 496:

In the USA and W. Europe, Carrier V

- Page 497 and 498:

Premium Voice + SMS Revenue Share L

- Page 499 and 500:

Rapid Consumer / Business Adoption

- Page 501 and 502:

VoIP International Long Distance (I

- Page 503 and 504:

Mobile Texting Revenue Growth Slowi

- Page 505 and 506:

Global Mobile Voice TTM Revenue of

- Page 507 and 508:

Mobile Data Pricing Models in Flux

- Page 509 and 510:

Flat-Rate Pricing = Necessary for U

- Page 511 and 512:

Flat-Rate Wireless Data Plans - Pro

- Page 513 and 514:

Flat-Rate Pricing May Also Encourag

- Page 515 and 516:

Wireline Broadband Tiered Pricing C

- Page 517 and 518:

KDDI Tiered Flat-Rate Pricing Cater

- Page 519 and 520:

Bell Canada Combo Plans Bring Tiere

- Page 521 and 522:

Base Case USA / W. Europe Carrier O

- Page 523 and 524:

Key Scenario Drivers for US Wireles

- Page 525 and 526:

USA Wireless Revenue Base Case Scen

- Page 527 and 528:

Total ARPU Expected to Decline Slig

- Page 529 and 530:

Non-Text Revenue = Key to Data Reve

- Page 531 and 532:

W. Europe* Wireless Service Revenue

- Page 533 and 534:

Implied W. Europe Wireless Carrier

- Page 535 and 536:

Scale, Access to Spectrum and Capit

- Page 537 and 538:

…10 Attributes of Winning Wireles

- Page 539 and 540:

Scale = Key Competitive Advantage f

- Page 541 and 542:

USA Spectrum Holdings - Larger Carr

- Page 543 and 544:

Exclusive Devices (such as iPhone)

- Page 545 and 546:

But Carrying the iPhone Is Mixed Bl

- Page 547 and 548:

Competitive Share Gain Opportunitie

- Page 549 and 550:

Scenario: AT&T Loses iPhone Exclusi

- Page 551 and 552:

Opportunities for Network Equipment

- Page 553 and 554:

Total Wireless Equipment Revenue Ex

- Page 555 and 556:

Network Services Is Now ~$80B Addre

- Page 557 and 558:

Mobile / 3G Subscriber Trends by Co

- Page 559 and 560:

…Mobile / 3G Subscriber Trends by

- Page 561 and 562:

…Mobile / 3G Subscriber Trends by

- Page 563 and 564:

Key Theme #7 563

- Page 565 and 566:

Key Theme #7 - Compelling Opportuni

- Page 567 and 568:

Emerging Markets = Significant Long

- Page 569 and 570:

Emerging Markets = Significant Long

- Page 571 and 572:

At Inflection Point, Long-Term EM O

- Page 573 and 574:

Opportunities Could Be Significant

- Page 575 and 576:

Over Time, Impact of Mobile Interne

- Page 577 and 578:

…Caused in Part by Sub-20% Fixed-

- Page 579 and 580:

3G / Wireless = ‘Only Choice’ f

- Page 581 and 582:

Vibrant Mobile Value-Added Services

- Page 583 and 584:

Emerging Asia VAS Revenue Share Alr

- Page 585 and 586:

Emerging Market Carriers Adapted to

- Page 587 and 588:

Bharti-Airtel = Cost Savings from O

- Page 589 and 590:

Compressing Wireless Data Could Red

- Page 591 and 592:

Emerging Markets - Some Near-Term 3

- Page 593 and 594:

Near-Term 3G Adoption Barriers = Lo

- Page 595 and 596:

Low Post-Paid Ratio + Low GDP per C

- Page 597 and 598:

High Monthly Data Plan Costs = Near

- Page 599 and 600:

Emerging Markets Regional Analysis

- Page 601 and 602:

Regional Analysis / Forecast - Chin

- Page 603 and 604:

Chinese Consumers Are Ready for 3G

- Page 605 and 606:

3G Creates New Battle Ground for Ch

- Page 607 and 608:

iPhone Costs Too High for Majority

- Page 609 and 610:

Key Scenario Drivers for China Wire

- Page 611 and 612:

China Wireless Revenue Base Case Sc

- Page 613 and 614: Data ARPU Growth Expected to Partia

- Page 615 and 616: India - Near-term Barriers to 3G Ad

- Page 617 and 618: India - Upcoming Auction to Bring 3

- Page 619 and 620: Base Case: Winning 3G Spectrum Does

- Page 621 and 622: Capex Required for 3G Network Could

- Page 623 and 624: Other Emerging Asia - Low Fixed-Lin

- Page 625 and 626: Philippines - Mobile Overtook Fixed

- Page 627 and 628: Indonesia - Mobile Could Accelerate

- Page 629 and 630: WiMAX in Emerging Asia - Still in N

- Page 631 and 632: EEMEA - Carriers Leverage Cost-Effe

- Page 633 and 634: Africa - Mobile Broadband Prolifera

- Page 635 and 636: Middle East + Africa Have the Lowes

- Page 637 and 638: Key Scenario Drivers for Russia Wir

- Page 639 and 640: Key Theme #8 639

- Page 641 and 642: Key Theme #8 - Regulators Can Help

- Page 643 and 644: Net Neutrality - Key to Decentraliz

- Page 645 and 646: In the US, FCC Has Issued a “Noti

- Page 647 and 648: Both Sides of Net Neutrality Debate

- Page 649 and 650: What Could Regulators Do to Acceler

- Page 651 and 652: Lower Mobile Data Roaming Fees = En

- Page 653 and 654: “Not in My Back Yard” (NIMBY) P

- Page 655 and 656: 3G Licenses Reshape China’s Compe

- Page 657 and 658: USA Recent Developments - USA F

- Page 659 and 660: Recent Developments - China / India

- Page 661 and 662: Disclosure Section (cont.) Morgan S

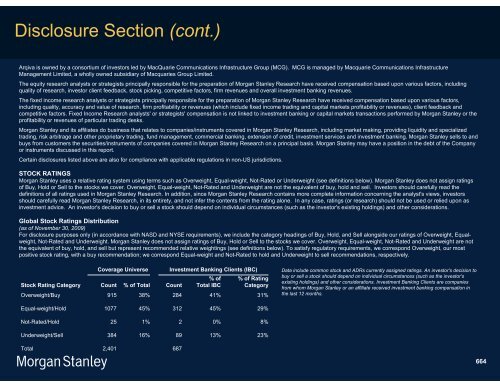

- Page 663: Disclosure Section (cont.) Within t

- Page 667 and 668: Disclosure Section (cont.) Stock Pr

- Page 669 and 670: Disclosure Section (cont.) Importan

- Page 671: Disclosure Section (cont.) MTN does