Vorarlberger Landes- und Hypothekenbank Aktiengesellschaft

Vorarlberger Landes- und Hypothekenbank Aktiengesellschaft

Vorarlberger Landes- und Hypothekenbank Aktiengesellschaft

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

37<br />

Risk Factors<br />

Risk Factors regarding Hypo <strong>Landes</strong>bank Vorarlberg<br />

The following is a disclosure of risk factors that may affect the Issuer's ability to fulfill its<br />

obligations <strong>und</strong>er the Notes. Prospective investors should consider these risk factors before<br />

deciding to purchase Notes issued <strong>und</strong>er the Programme.<br />

Prospective investors should consider all information provided in this Prospectus and consult<br />

with their own professional advisers if they consider it necessary. In addition, investors should be<br />

aware that the risks described may combine and thus intensify one another.<br />

The risk related to <strong>Vorarlberger</strong> <strong>Landes</strong>- <strong>und</strong> <strong>Hypothekenbank</strong> <strong>Aktiengesellschaft</strong>'s ability to fulfill its<br />

obligations as Issuer is described by reference to the ratings assigned to <strong>Vorarlberger</strong> <strong>Landes</strong>- <strong>und</strong><br />

<strong>Hypothekenbank</strong> <strong>Aktiengesellschaft</strong> 1 . The rating for a specific issue of Notes may vary and will be set out<br />

in the respective Final Terms.<br />

<strong>Vorarlberger</strong> <strong>Landes</strong>- <strong>und</strong> <strong>Hypothekenbank</strong> <strong>Aktiengesellschaft</strong> is rated by Moody's Investors Service Inc.<br />

("Moody's" or the "Rating Agency"). As of the date of publication of the Prospectus, the ratings assigned<br />

to <strong>Vorarlberger</strong> <strong>Landes</strong>- <strong>und</strong> <strong>Hypothekenbank</strong> <strong>Aktiengesellschaft</strong> by the Rating Agency are as follows:<br />

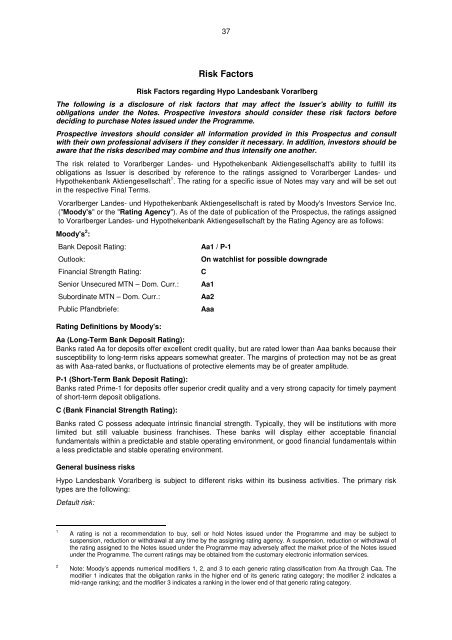

Moody's 2 :<br />

Bank Deposit Rating: Aa1 / P-1<br />

Outlook: On watchlist for possible downgrade<br />

Financial Strength Rating: C<br />

Senior Unsecured MTN – Dom. Curr.: Aa1<br />

Subordinate MTN – Dom. Curr.: Aa2<br />

Public Pfandbriefe: Aaa<br />

Rating Definitions by Moody's:<br />

Aa (Long-Term Bank Deposit Rating):<br />

Banks rated Aa for deposits offer excellent credit quality, but are rated lower than Aaa banks because their<br />

susceptibility to long-term risks appears somewhat greater. The margins of protection may not be as great<br />

as with Aaa-rated banks, or fluctuations of protective elements may be of greater amplitude.<br />

P-1 (Short-Term Bank Deposit Rating):<br />

Banks rated Prime-1 for deposits offer superior credit quality and a very strong capacity for timely payment<br />

of short-term deposit obligations.<br />

C (Bank Financial Strength Rating):<br />

Banks rated C possess adequate intrinsic financial strength. Typically, they will be institutions with more<br />

limited but still valuable business franchises. These banks will display either acceptable financial<br />

f<strong>und</strong>amentals within a predictable and stable operating environment, or good financial f<strong>und</strong>amentals within<br />

a less predictable and stable operating environment.<br />

General business risks<br />

Hypo <strong>Landes</strong>bank Vorarlberg is subject to different risks within its business activities. The primary risk<br />

types are the following:<br />

Default risk:<br />

1 A rating is not a recommendation to buy, sell or hold Notes issued <strong>und</strong>er the Programme and may be subject to<br />

suspension, reduction or withdrawal at any time by the assigning rating agency. A suspension, reduction or withdrawal of<br />

the rating assigned to the Notes issued <strong>und</strong>er the Programme may adversely affect the market price of the Notes issued<br />

<strong>und</strong>er the Programme. The current ratings may be obtained from the customary electronic information services.<br />

2 Note: Moody’s appends numerical modifiers 1, 2, and 3 to each generic rating classification from Aa through Caa. The<br />

modifier 1 indicates that the obligation ranks in the higher end of its generic rating category; the modifier 2 indicates a<br />

mid-range ranking; and the modifier 3 indicates a ranking in the lower end of that generic rating category.