Vorarlberger Landes- und Hypothekenbank Aktiengesellschaft

Vorarlberger Landes- und Hypothekenbank Aktiengesellschaft

Vorarlberger Landes- und Hypothekenbank Aktiengesellschaft

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

75<br />

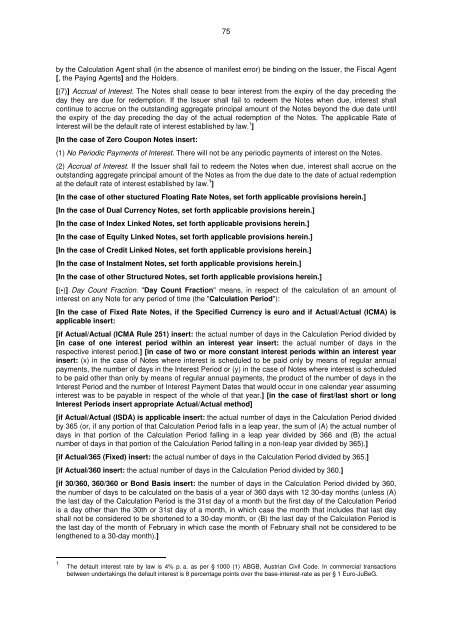

by the Calculation Agent shall (in the absence of manifest error) be binding on the Issuer, the Fiscal Agent<br />

[, the Paying Agents] and the Holders.<br />

[(7)] Accrual of Interest. The Notes shall cease to bear interest from the expiry of the day preceding the<br />

day they are due for redemption. If the Issuer shall fail to redeem the Notes when due, interest shall<br />

continue to accrue on the outstanding aggregate principal amount of the Notes beyond the due date until<br />

the expiry of the day preceding the day of the actual redemption of the Notes. The applicable Rate of<br />

Interest will be the default rate of interest established by law. 1 ]<br />

[In the case of Zero Coupon Notes insert:<br />

(1) No Periodic Payments of Interest. There will not be any periodic payments of interest on the Notes.<br />

(2) Accrual of Interest. If the Issuer shall fail to redeem the Notes when due, interest shall accrue on the<br />

outstanding aggregate principal amount of the Notes as from the due date to the date of actual redemption<br />

at the default rate of interest established by law. 1 ]<br />

[In the case of other stuctured Floating Rate Notes, set forth applicable provisions herein.]<br />

[In the case of Dual Currency Notes, set forth applicable provisions herein.]<br />

[In the case of Index Linked Notes, set forth applicable provisions herein.]<br />

[In the case of Equity Linked Notes, set forth applicable provisions herein.]<br />

[In the case of Credit Linked Notes, set forth applicable provisions herein.]<br />

[In the case of Instalment Notes, set forth applicable provisions herein.]<br />

[In the case of other Structured Notes, set forth applicable provisions herein.]<br />

[(•)] Day Count Fraction. "Day Count Fraction" means, in respect of the calculation of an amount of<br />

interest on any Note for any period of time (the "Calculation Period"):<br />

[In the case of Fixed Rate Notes, if the Specified Currency is euro and if Actual/Actual (ICMA) is<br />

applicable insert:<br />

[if Actual/Actual (ICMA Rule 251) insert: the actual number of days in the Calculation Period divided by<br />

[in case of one interest period within an interest year insert: the actual number of days in the<br />

respective interest period.] [in case of two or more constant interest periods within an interest year<br />

insert: (x) in the case of Notes where interest is scheduled to be paid only by means of regular annual<br />

payments, the number of days in the Interest Period or (y) in the case of Notes where interest is scheduled<br />

to be paid other than only by means of regular annual payments, the product of the number of days in the<br />

Interest Period and the number of Interest Payment Dates that would occur in one calendar year assuming<br />

interest was to be payable in respect of the whole of that year.] [in the case of first/last short or long<br />

Interest Periods insert appropriate Actual/Actual method]<br />

[if Actual/Actual (ISDA) is applicable insert: the actual number of days in the Calculation Period divided<br />

by 365 (or, if any portion of that Calculation Period falls in a leap year, the sum of (A) the actual number of<br />

days in that portion of the Calculation Period falling in a leap year divided by 366 and (B) the actual<br />

number of days in that portion of the Calculation Period falling in a non-leap year divided by 365).]<br />

[if Actual/365 (Fixed) insert: the actual number of days in the Calculation Period divided by 365.]<br />

[if Actual/360 insert: the actual number of days in the Calculation Period divided by 360.]<br />

[if 30/360, 360/360 or Bond Basis insert: the number of days in the Calculation Period divided by 360,<br />

the number of days to be calculated on the basis of a year of 360 days with 12 30-day months (unless (A)<br />

the last day of the Calculation Period is the 31st day of a month but the first day of the Calculation Period<br />

is a day other than the 30th or 31st day of a month, in which case the month that includes that last day<br />

shall not be considered to be shortened to a 30-day month, or (B) the last day of the Calculation Period is<br />

the last day of the month of February in which case the month of February shall not be considered to be<br />

lengthened to a 30-day month).]<br />

1 The default interest rate by law is 4% p. a. as per § 1000 (1) ABGB, Austrian Civil Code. In commercial transactions<br />

between <strong>und</strong>ertakings the default interest is 8 percentage points over the base-interest-rate as per § 1 Euro-JuBeG.