The Global Economic Impact of Private Equity Report 2008 - World ...

The Global Economic Impact of Private Equity Report 2008 - World ...

The Global Economic Impact of Private Equity Report 2008 - World ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

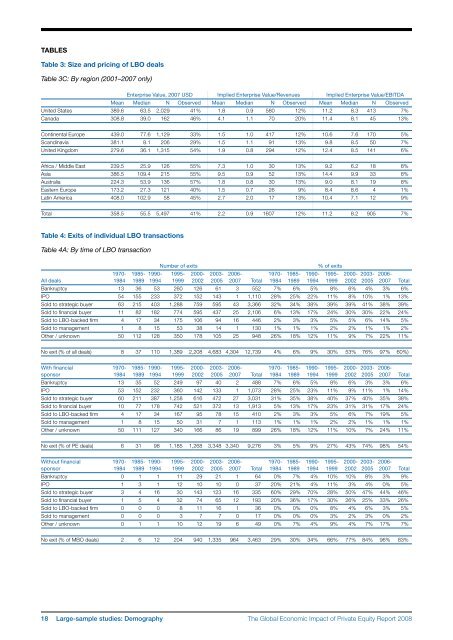

TablesTable 3: Size and pricing <strong>of</strong> LBO dealsTable 3C: By region (2001–2007 only)Enterprise Value, 2007 USD Implied Enterprise Value/Revenues Implied Enterprise Value/EBITDAMean Median N Observed Mean Median N Observed Mean Median N ObservedUnited States 389.6 63.5 2,029 41% 1.8 0.9 580 12% 11.2 8.3 413 7%Canada 308.8 39.0 162 46% 4.1 1.1 70 20% 11.4 8.1 45 13%Continental Europe 439.0 77.6 1,129 33% 1.5 1.0 417 12% 10.6 7.6 170 5%Scandinavia 381.1 8.1 206 29% 1.5 1.1 91 13% 9.8 8.5 50 7%United Kingdom 279.6 36.1 1,315 54% 1.9 0.8 294 12% 12.4 8.5 141 6%Africa / Middle East 239.5 25.9 126 55% 7.3 1.0 30 13% 9.2 6.2 18 8%Asia 386.5 109.4 215 55% 9.5 0.9 52 13% 14.4 9.9 33 8%Australia 224.3 53.9 136 57% 1.8 0.8 30 13% 9.0 8.1 19 8%Eastern Europe 173.2 27.3 121 40% 1.5 0.7 26 9% 8.4 8.6 4 1%Latin America 408.0 102.9 58 45% 2.7 2.0 17 13% 10.4 7.1 12 9%Total 358.5 55.5 5,497 41% 2.2 0.9 1607 12% 11.2 8.2 905 7%Table 4: Exits <strong>of</strong> individual LBO transactionsTable 4A: By time <strong>of</strong> LBO transactionNumber <strong>of</strong> exits% <strong>of</strong> exits1970- 1985- 1990- 1995- 2000- 2003- 2006- 1970- 1985- 1990- 1995- 2000- 2003- 2006-All deals 1984 1989 1994 1999 2002 2005 2007 Total 1984 1989 1994 1999 2002 2005 2007 TotalBankruptcy 13 36 53 260 126 61 3 552 7% 6% 5% 8% 6% 4% 3% 6%IPO 54 155 233 372 152 143 1 1,110 28% 25% 22% 11% 8% 10% 1% 13%Sold to strategic buyer 63 215 403 1,288 759 595 43 3,366 32% 34% 38% 39% 39% 41% 38% 39%Sold to financial buyer 11 82 182 774 595 437 25 2,106 6% 13% 17% 24% 30% 30% 22% 24%Sold to LBO-backed firm 4 17 34 175 106 94 16 446 2% 3% 3% 5% 5% 6% 14% 5%Sold to management 1 8 15 53 38 14 1 130 1% 1% 1% 2% 2% 1% 1% 2%Other / unknown 50 112 128 350 178 105 25 948 26% 18% 12% 11% 9% 7% 22% 11%No exit (% <strong>of</strong> all deals) 8 37 110 1,389 2,208 4,683 4,304 12,739 4% 6% 9% 30% 53% 76% 97% 60%)With financial 1970- 1985- 1990- 1995- 2000- 2003- 2006- 1970- 1985- 1990- 1995- 2000- 2003- 2006-sponsor 1984 1989 1994 1999 2002 2005 2007 Total 1984 1989 1994 1999 2002 2005 2007 TotalBankruptcy 13 35 52 249 97 40 2 488 7% 6% 5% 8% 6% 3% 3% 6%IPO 53 152 232 360 142 133 1 1,073 28% 25% 23% 11% 9% 11% 1% 14%Sold to strategic buyer 60 211 387 1,258 616 472 27 3,031 31% 35% 38% 40% 37% 40% 35% 38%Sold to financial buyer 10 77 178 742 521 372 13 1,913 5% 13% 17% 23% 31% 31% 17% 24%Sold to LBO-backed firm 4 17 34 167 95 78 15 410 2% 3% 3% 5% 6% 7% 19% 5%Sold to management 1 8 15 50 31 7 1 113 1% 1% 1% 2% 2% 1% 1% 1%Other / unknown 50 111 127 340 166 86 19 899 26% 18% 12% 11% 10% 7% 24% 11%No exit (% <strong>of</strong> PE deals) 6 31 98 1,185 1,268 3,348 3,340 9,276 3% 5% 9% 27% 43% 74% 98% 54%Without financial 1970- 1985- 1990- 1995- 2000- 2003- 2006- 1970- 1985- 1990- 1995- 2000- 2003- 2006-sponsor 1984 1989 1994 1999 2002 2005 2007 Total 1984 1989 1994 1999 2002 2005 2007 TotalBankruptcy 0 1 1 11 29 21 1 64 0% 7% 4% 10% 10% 8% 3% 9%IPO 1 3 1 12 10 10 0 37 20% 21% 4% 11% 3% 4% 0% 5%Sold to strategic buyer 3 4 16 30 143 123 16 335 60% 29% 70% 28% 50% 47% 44% 46%Sold to financial buyer 1 5 4 32 74 65 12 193 20% 36% 17% 30% 26% 25% 33% 26%Sold to LBO-backed firm 0 0 0 8 11 16 1 36 0% 0% 0% 8% 4% 6% 3% 5%Sold to management 0 0 0 3 7 7 0 17 0% 0% 0% 3% 2% 3% 0% 2%Other / unknown 0 1 1 10 12 19 6 49 0% 7% 4% 9% 4% 7% 17% 7%No exit (% <strong>of</strong> MBO deals) 2 6 12 204 940 1,335 964 3,463 29% 30% 34% 66% 77% 84% 96% 83%18 Large-sample studies: Demography<strong>The</strong> <strong>Global</strong> <strong>Economic</strong> <strong>Impact</strong> <strong>of</strong> <strong>Private</strong> <strong>Equity</strong> <strong>Report</strong> <strong>2008</strong>