Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

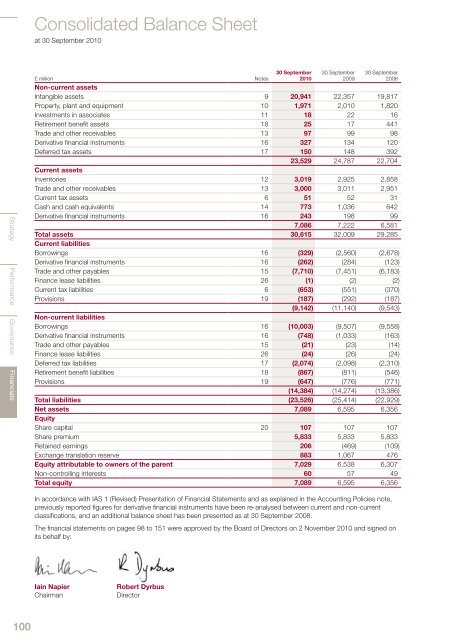

Consolidated Balance Sheetat 30 September <strong>2010</strong>Strategy Performance Governance Financials30 September<strong>2010</strong>30 September200930 September2008£ million NotesNon-current assetsIntangible assets 9 20,941 22,357 19,817Property, plant and equipment 10 1,971 2,010 1,820Investments in associates 11 18 22 16Retirement benefit assets 18 25 17 441Trade and other receivables 13 97 99 98Derivative financial instruments 16 327 134 120Deferred tax assets 17 150 148 39223,529 24,787 22,704Current assetsInventories 12 3,019 2,925 2,858Trade and other receivables 13 3,000 3,011 2,951Current tax assets 6 51 52 31Cash and cash equivalents 14 773 1,036 642Derivative financial instruments 16 243 198 997,086 7,222 6,581Total assets 30,615 32,009 29,285Current liabilitiesBorrowings 16 (329) (2,560) (2,678)Derivative financial instruments 16 (262) (284) (123)Trade and other payables 15 (7,710) (7,451) (6,183)Finance lease liabilities 26 (1) (2) (2)Current tax liabilities 6 (653) (551) (370)Provisions 19 (187) (292) (187)(9,142) (11,140) (9,543)Non-current liabilitiesBorrowings 16 (10,003) (9,507) (9,558)Derivative financial instruments 16 (748) (1,033) (163)Trade and other payables 15 (21) (23) (14)Finance lease liabilities 26 (24) (26) (24)Deferred tax liabilities 17 (2,074) (2,098) (2,310)Retirement benefit liabilities 18 (867) (811) (546)Provisions 19 (647) (776) (771)(14,384) (14,274) (13,386)Total liabilities (23,526) (25,414) (22,929)Net assets 7,089 6,595 6,356EquityShare capital 20 107 107 107Share premium 5,833 5,833 5,833Retained earnings 206 (469) (109)Exchange translation reserve 883 1,067 476Equity attributable to owners of the parent 7,029 6,538 6,307Non-controlling interests 60 57 49Total equity 7,089 6,595 6,356In accordance with IAS 1 (Revised) Presentation of Financial Statements and as explained in the Accounting Policies note,previously <strong>report</strong>ed figures for derivative financial instruments have been re-analysed between current and non-currentclassifications, and an additional balance sheet has been presented as at 30 September 2008.The financial statements on pages 98 to 151 were approved by the Board of Directors on 2 November <strong>2010</strong> and signed onits behalf by:Iain NapierChairmanRobert DyrbusDirector100