Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

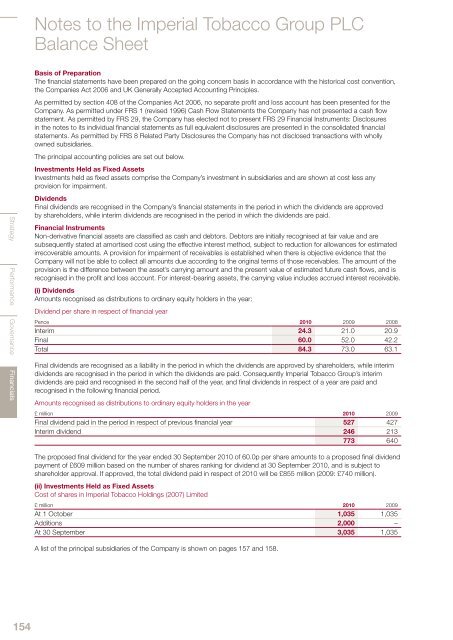

Notes to the <strong>Imperial</strong> <strong>Tobacco</strong> <strong>Group</strong> PLCBalance SheetStrategy Performance Governance FinancialsBasis of PreparationThe financial statements have been prepared on the going concern basis in accordance with the historical cost convention,the Companies Act 2006 and UK Generally Accepted Accounting Principles.As permitted by section 408 of the Companies Act 2006, no separate profit and loss account has been presented for theCompany. As permitted under FRS 1 (revised 1996) Cash Flow Statements the Company has not presented a cash flowstatement. As permitted by FRS 29, the Company has elected not to present FRS 29 Financial Instruments: Disclosuresin the notes to its individual financial statements as full equivalent disclosures are presented in the consolidated financialstatements. As permitted by FRS 8 Related Party Disclosures the Company has not disclosed transactions with whollyowned subsidiaries.The principal accounting policies are set out below.Investments Held as Fixed AssetsInvestments held as fixed assets comprise the Company’s investment in subsidiaries and are shown at cost less anyprovision for impairment.DividendsFinal dividends are recognised in the Company’s financial statements in the period in which the dividends are approvedby shareholders, while interim dividends are recognised in the period in which the dividends are paid.Financial InstrumentsNon-derivative financial assets are classified as cash and debtors. Debtors are initially recognised at fair value and aresubsequently stated at amortised cost using the effective interest method, subject to reduction for allowances for estimatedirrecoverable amounts. A provision for impairment of receivables is established when there is objective evidence that theCompany will not be able to collect all amounts due according to the original terms of those receivables. The amount of theprovision is the difference between the asset’s carrying amount and the present value of estimated future cash flows, and isrecognised in the profit and loss account. For interest-bearing assets, the carrying value includes accrued interest receivable.(i) DividendsAmounts recognised as distributions to ordinary equity holders in the year:Dividend per share in respect of financial yearPence <strong>2010</strong> 2009 2008Interim 24.3 21.0 20.9Final 60.0 52.0 42.2Total 84.3 73.0 63.1Final dividends are recognised as a liability in the period in which the dividends are approved by shareholders, while interimdividends are recognised in the period in which the dividends are paid. Consequently <strong>Imperial</strong> <strong>Tobacco</strong> <strong>Group</strong>’s interimdividends are paid and recognised in the second half of the year, and final dividends in respect of a year are paid andrecognised in the following financial period.Amounts recognised as distributions to ordinary equity holders in the year£ million <strong>2010</strong> 2009Final dividend paid in the period in respect of previous financial year 527 427Interim dividend 246 213773 640The proposed final dividend for the year ended 30 September <strong>2010</strong> of 60.0p per share amounts to a proposed final dividendpayment of £609 million based on the number of shares ranking for dividend at 30 September <strong>2010</strong>, and is subject toshareholder approval. If approved, the total dividend paid in respect of <strong>2010</strong> will be £855 million (2009: £740 million).(ii) Investments Held as Fixed AssetsCost of shares in <strong>Imperial</strong> <strong>Tobacco</strong> Holdings (2007) Limited£ million <strong>2010</strong> 2009At 1 October 1,035 1,035Additions 2,000 –At 30 September 3,035 1,035A list of the principal subsidiaries of the Company is shown on pages 157 and 158.154