Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

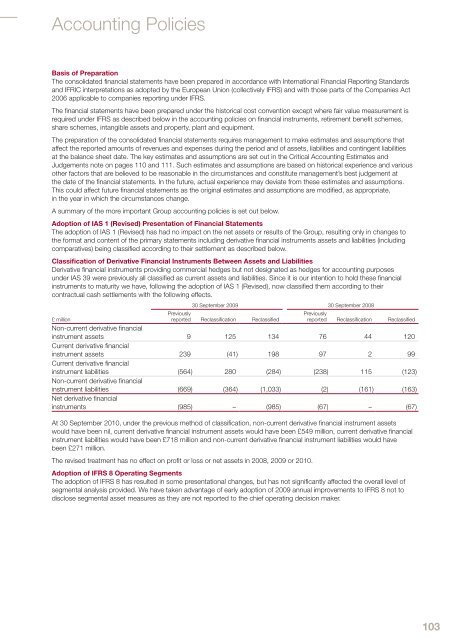

Accounting PoliciesBasis of PreparationThe consolidated financial statements have been prepared in accordance with International Financial Reporting Standardsand IFRIC interpretations as adopted by the European Union (collectively IFRS) and with those parts of the Companies Act2006 applicable to companies <strong>report</strong>ing under IFRS.The financial statements have been prepared under the historical cost convention except where fair value measurement isrequired under IFRS as described below in the accounting policies on financial instruments, retirement benefit schemes,share schemes, intangible assets and property, plant and equipment.The preparation of the consolidated financial statements requires management to make estimates and assumptions thataffect the <strong>report</strong>ed amounts of revenues and expenses during the period and of assets, liabilities and contingent liabilitiesat the balance sheet date. The key estimates and assumptions are set out in the Critical Accounting Estimates andJudgements note on pages 110 and 111. Such estimates and assumptions are based on historical experience and variousother factors that are believed to be reasonable in the circumstances and constitute management’s best judgement atthe date of the financial statements. In the future, actual experience may deviate from these estimates and assumptions.This could affect future financial statements as the original estimates and assumptions are modified, as appropriate,in the year in which the circumstances change.A summary of the more important <strong>Group</strong> accounting policies is set out below.Adoption of IAS 1 (Revised) Presentation of Financial StatementsThe adoption of IAS 1 (Revised) has had no impact on the net assets or results of the <strong>Group</strong>, resulting only in changes tothe format and content of the primary statements including derivative financial instruments assets and liabilities (includingcomparatives) being classified according to their settlement as described below.Classification of Derivative Financial Instruments Between Assets and LiabilitiesDerivative financial instruments providing commercial hedges but not designated as hedges for accounting purposesunder IAS 39 were previously all classified as current assets and liabilities. Since it is our intention to hold these financialinstruments to maturity we have, following the adoption of IAS 1 (Revised), now classified them according to theircontractual cash settlements with the following effects.30 September 2009 30 September 2008Previously<strong>report</strong>ed Reclassification ReclassifiedPreviously<strong>report</strong>ed Reclassification Reclassified£ millionNon-current derivative financialinstrument assets 9 125 134 76 44 120Current derivative financialinstrument assets 239 (41) 198 97 2 99Current derivative financialinstrument liabilities (564) 280 (284) (238) 115 (123)Non-current derivative financialinstrument liabilities (669) (364) (1,033) (2) (161) (163)Net derivative financialinstruments (985) – (985) (67) – (67)At 30 September <strong>2010</strong>, under the previous method of classification, non-current derivative financial instrument assetswould have been nil, current derivative financial instrument assets would have been £549 million, current derivative financialinstrument liabilities would have been £718 million and non-current derivative financial instrument liabilities would havebeen £271 million.The revised treatment has no effect on profit or loss or net assets in 2008, 2009 or <strong>2010</strong>.Adoption of IFRS 8 Operating SegmentsThe adoption of IFRS 8 has resulted in some presentational changes, but has not significantly affected the overall level ofsegmental analysis provided. We have taken advantage of early adoption of 2009 annual improvements to IFRS 8 not todisclose segmental asset measures as they are not <strong>report</strong>ed to the chief operating decision maker.103