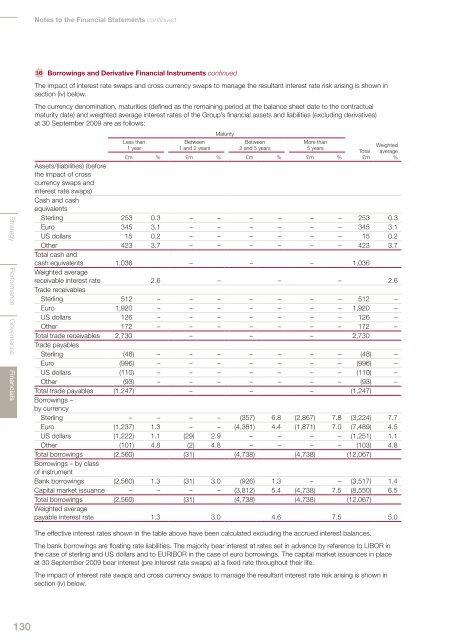

Notes to the Financial Statements continued16 Borrowings and Derivative Financial Instruments continuedStrategy Performance Governance FinancialsThe impact of interest rate swaps and cross currency swaps to manage the resultant interest rate risk arising is shown insection (iv) below.The currency denomination, maturities (defined as the remaining period at the balance sheet date to the contractualmaturity date) and weighted average interest rates of the <strong>Group</strong>’s financial assets and liabilities (excluding derivatives)at 30 September 2009 are as follows:Less than1 yearBetween1 and 2 yearsMaturityBetween2 and 5 yearsMore than5 yearsTotal£mWeightedaverage%£m % £m % £m % £m %Assets/(liabilities) (beforethe impact of crosscurrency swaps andinterest rate swaps)Cash and cashequivalentsSterling 253 0.3 – – – – – – 253 0.3Euro 345 3.1 – – – – – – 345 3.1US dollars 15 0.2 – – – – – – 15 0.2Other 423 3.7 – – – – – – 423 3.7Total cash andcash equivalents 1,036 – – – 1,036Weighted averagereceivable interest rate 2.6 – – – 2.6Trade receivablesSterling 512 – – – – – – – 512 –Euro 1,920 – – – – – – – 1,920 –US dollars 126 – – – – – – – 126 –Other 172 – – – – – – – 172 –Total trade receivables 2,730 – – – 2,730Trade payablesSterling (48) – – – – – – – (48) –Euro (996) – – – – – – – (996) –US dollars (110) – – – – – – – (110) –Other (93) – – – – – – – (93) –Total trade payables (1,247) – – – (1,247)Borrowings –by currencySterling – – – – (357) 6.8 (2,867) 7.8 (3,224) 7.7Euro (1,237) 1.3 – – (4,381) 4.4 (1,871) 7.0 (7,489) 4.5US dollars (1,222) 1.1 (29) 2.9 – – – – (1,251) 1.1Other (101) 4.8 (2) 4.8 – – – – (103) 4.8Total borrowings (2,560) (31) (4,738) (4,738) (12,067)Borrowings – by classof instrumentBank borrowings (2,560) 1.3 (31) 3.0 (926) 1.3 – – (3,517) 1.4Capital market issuance – – – – (3,812) 5.4 (4,738) 7.5 (8,550) 6.5Total borrowings (2,560) (31) (4,738) (4,738) (12,067)Weighted averagepayable interest rate 1.3 3.0 4.6 7.5 5.0The effective interest rates shown in the table above have been calculated excluding the accrued interest balances.The bank borrowings are floating rate liabilities. The majority bear interest at rates set in advance by reference to LIBOR inthe case of sterling and US dollars and to EURIBOR in the case of euro borrowings. The capital market issuances in placeat 30 September 2009 bear interest (pre interest rate swaps) at a fixed rate throughout their life.The impact of interest rate swaps and cross currency swaps to manage the resultant interest rate risk arising is shown insection (iv) below.130

(iv) Derivative financial instrumentsIAS 39 requires that all derivative financial instruments are recognised in the balance sheet at fair value, with changes in thefair value being recognised in the income statement unless the instrument satisfies the hedge accounting rules under IFRSand the <strong>Group</strong> chooses to designate the derivative financial instrument as a hedge. The <strong>Group</strong> hedges underlying exposuresin an efficient, commercial and structured manner. However, the strict hedging requirements of IAS 39 may lead to somecommercially effective hedge positions not qualifying for hedge accounting. As a result, and as permitted under IAS 39, the<strong>Group</strong> has decided not to apply cash flow or fair value hedge accounting for its derivative financial instruments. However, the<strong>Group</strong> does apply net investment hedging, designating certain borrowings and derivatives as hedges of the net investmentin the <strong>Group</strong>’s foreign operations, as permitted by IAS 39, in order to minimise income statement volatility. See section (vi)below for details. The information contained in sections (ii) and (iii) above shows the underlying borrowing position before theeffect of interest rate swaps and cross currency swaps.The <strong>Group</strong> separates its borrowing activities from its interest rate risk management decisions by issuing debt in the market ormarkets that are most appropriate at the time of raising new finance and using derivative financial instruments, such as crosscurrency swaps and interest rate swaps, to change the debt into the desired currency and into floating interest rates shortlyafter issue.The following tables set out the <strong>Group</strong>’s borrowings and derivative financial instruments at 30 September <strong>2010</strong>, anddemonstrate the <strong>Group</strong>’s use of derivative financial instruments to manage the <strong>Group</strong>’s foreign currency exchange rateand interest rate exposures. The tables present the nominal value of such instruments used to calculate the contractualpayments under such contracts, analysed by maturity date, together with the related weighted average interest ratewhere relevant.Seven of the interest rate swaps have embedded options and assumptions have been made based on market informationand from counterparties’ expectations at 30 September <strong>2010</strong> to determine whether, and if so when, such options are likelyto be exercised in order to determine the probable maturity date. Details of these options and the expected maturity datesare included in the footnotes to the relevant tables. The actual maturity date could be earlier or later depending upon futuremarket conditions and a cancellation would not result in a cash flow other than in respect of interest outstanding at thecancellation date. The effect of the cancellation of any of these interest rate swaps would be to reduce the proportion of the<strong>Group</strong>’s borrowings that were at a fixed rate, increasing the <strong>Group</strong>’s exposure to cash flow interest rate risk. Shortly afterany such cancellation <strong>Group</strong> Treasury would, if deemed necessary as part of the management of interest rate risk, transactfurther interest rate swaps to replace the cancelled swaps. It is currently believed that there is sufficient appetite amongstcounterparties for such transactions.Debt is issued in the market or markets that are most appropriate at the time of raising new finance.Matures in financial year ending in2011 2012 2013 2014 2015 Thereafter TotalGBP equivalent at 30 September <strong>2010</strong> £mCapital market issuance£350m 6.875% notes due 2012 – 350 – – – – 350€1,250m 5.0% notes due 2012 – 1,082 – – – – 1,082€500m 5.125% notes due 2013 – – – 433 – – 433€1,200m 4.375% notes due 2013 – – – 1,038 – – 1,038€750m 7.25% notes due 2014 – – – 649 – – 649€500m 4.0% notes due 2015 – – – – 433 – 433£450m 5.5% notes due 2016 – – – – – 450 450€1,500m 8.375% notes due 2016 – – – – – 1,298 1,298£200m 6.25% notes due 2018 – – – – – 200 200£500m 7.75% notes due 2019 – – – – – 500 500£1,000m 9.0% notes due 2022 – – – – – 1,000 1,000£600m 8.125% notes due 2024 – – – – – 600 600Interest accruals, discounts and fairvalue adjustments – 20 – 59 (24) 183 238Total capital market issuance – 1,452 – 2,179 409 4,231 8,271Bank loans and overdrafts, borrowed atLIBOR (or equivalent) plus a margin at thetime of borrowing 328 1,731 – – – – 2,059Interest accruals 1 1 – – – – 2Total bank borrowings 329 1,732 – – – – 2,061Total borrowings 329 3,184 – 2,179 409 4,231 10,332Derivative financial instruments are then transacted to change the debt issued into the desired currency and into floatinginterest rates, per the following table:131

- Page 1 and 2:

Imperial Tobacco Group PLCAnnual Re

- Page 3 and 4:

…to deliver sustainableshareholde

- Page 5 and 6:

Operational HighlightsDelivering Su

- Page 7 and 8:

and product portfolio to evolving c

- Page 9 and 10:

In this section9 Strategic Review10

- Page 11 and 12:

Our StrategyWe are focused on deliv

- Page 13 and 14:

Total Tobacco5 % Our Powerful Brand

- Page 15 and 16:

Our global strategic cigarette bran

- Page 17 and 18:

Our global team is fully aligned be

- Page 19 and 20:

Satisfying consumers and aligning o

- Page 21 and 22:

We are a responsive business with s

- Page 23 and 24:

Operating responsibly, combined wit

- Page 25 and 26:

Our growth drivers of sales growth,

- Page 27 and 28:

Principal Risks and UncertaintiesA

- Page 29 and 30:

Competition LawOverviewWe take comp

- Page 31 and 32:

Reconciliation of Adjusted Performa

- Page 33 and 34:

Key Performance Indicators (KPIs) 1

- Page 35 and 36:

Lambert & Butler and Richmond remai

- Page 37 and 38:

Within this the travel retail marke

- Page 39 and 40:

OutlookThe strength of our portfoli

- Page 41 and 42:

Blondes. In the Middle East, we aga

- Page 43 and 44:

Corporate ResponsibilityOur Corpora

- Page 45 and 46:

Corporate Responsibility and our St

- Page 47 and 48:

We have revised our IMS and employe

- Page 49 and 50:

Environmental Performance 1Absolute

- Page 51 and 52:

across the business. More informati

- Page 53 and 54:

Supplier RelationshipsOur main supp

- Page 55 and 56:

Non-financial performance indicator

- Page 57 and 58:

“High standards of corporategover

- Page 59 and 60:

5. Pierre Jungels, CBE (HON), PHD,

- Page 61 and 62:

Management and Corporate StructureB

- Page 63 and 64:

Meetings of the Board, Board Commit

- Page 65 and 66:

and supplemented by our Non-Executi

- Page 67 and 68:

6 Performance evaluation: How do we

- Page 69 and 70:

The Board recognises that we operat

- Page 71 and 72:

Assurance process for financial rep

- Page 73 and 74:

- receiving reports from, and quest

- Page 75 and 76:

Directors’ Report: Other Informat

- Page 77 and 78:

- state whether IFRSs as adopted by

- Page 79 and 80:

We understand that a purported coll

- Page 81 and 82: This Report covers the following:1

- Page 83 and 84: 2 Directors’ Emoluments for the Y

- Page 85 and 86: Directors’ Interests in Ordinary

- Page 87 and 88: Executive Directors’ Service Agre

- Page 89 and 90: When setting base salary the Remune

- Page 91 and 92: First ElementFifty per cent of the

- Page 93 and 94: In respect of the October 2007 - Oc

- Page 95 and 96: Any annual bonus earned up to 100 p

- Page 97 and 98: Benefit Trusts have also been provi

- Page 99 and 100: Independent Auditors’ Reportto th

- Page 101 and 102: Consolidated Statement ofComprehens

- Page 103 and 104: Consolidated Statement of Changes i

- Page 105 and 106: Accounting PoliciesBasis of Prepara

- Page 107 and 108: Duty and Similar ItemsDuty and simi

- Page 109 and 110: InventoriesInventories are stated a

- Page 111 and 112: Restructuring CostsSignificant one-

- Page 113 and 114: Property, Plant and Equipment and I

- Page 115 and 116: Tobacco net revenue£ million 2010

- Page 117 and 118: 3 Restructuring Costs£ million 201

- Page 119 and 120: Factors affecting the tax charge fo

- Page 121 and 122: 9 Intangible Assets2010£ million G

- Page 123 and 124: 10 Property, Plant and Equipment201

- Page 125 and 126: 13 Trade and Other Receivables2010

- Page 127 and 128: Sensitivity analysisIFRS 7 requires

- Page 129 and 130: At 30 September 2009Balance sheetam

- Page 131: (iii) Currency analysis and effecti

- Page 135 and 136: Matures in financial year ending in

- Page 137 and 138: The following tables are provided i

- Page 139 and 140: Matures in financial year ending in

- Page 141 and 142: (vi) Hedge of net investments in fo

- Page 143 and 144: 18 Retirement Benefit SchemesThe Gr

- Page 145 and 146: Assumptions regarding future mortal

- Page 147 and 148: 21 Share SchemesThe Group recognise

- Page 149 and 150: Year from 1 October 2008 to 30 Sept

- Page 151 and 152: 23 CommitmentsCapital commitments£

- Page 153 and 154: 27 Reconciliation of Cash Flow to M

- Page 155 and 156: Imperial Tobacco Group PLC Balance

- Page 157 and 158: (iii) Debtors: Amounts Falling Due

- Page 159 and 160: Principal SubsidiariesThe principal

- Page 161 and 162: Shareholder InformationRegistered O

- Page 163 and 164: IndexAAccounting Policies 103Acquis