Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

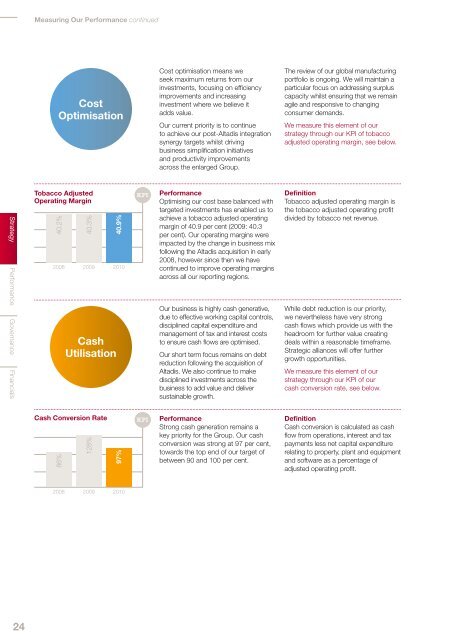

Measuring Our Performance continuedCostOptimisationCost optimisation means weseek maximum returns from ourinvestments, focusing on efficiencyimprovements and increasinginvestment where we believe itadds value.Our current priority is to continueto achieve our post-Altadis integrationsynergy targets whilst drivingbusiness simplification initiativesand productivity improvementsacross the enlarged <strong>Group</strong>.The review of our global manufacturingportfolio is ongoing. We will maintain aparticular focus on addressing surpluscapacity whilst ensuring that we remainagile and responsive to changingconsumer demands.We measure this element of ourstrategy through our KPI of tobaccoadjusted operating margin, see below.Strategy Performance Governance Financials<strong>Tobacco</strong> AdjustedOperating Margin40.2%200840.3%200940.9%CashUtilisation<strong>2010</strong>KPIPerformanceOptimising our cost base balanced withtargeted investments has enabled us toachieve a tobacco adjusted operatingmargin of 40.9 per cent (2009: 40.3per cent). Our operating margins wereimpacted by the change in business mixfollowing the Altadis acquisition in early2008, however since then we havecontinued to improve operating marginsacross all our <strong>report</strong>ing regions.Our business is highly cash generative,due to effective working capital controls,disciplined capital expenditure andmanagement of tax and interest coststo ensure cash flows are optimised.Our short term focus remains on debtreduction following the acquisition ofAltadis. We also continue to makedisciplined investments across thebusiness to add value and deliversustainable growth.Definition<strong>Tobacco</strong> adjusted operating margin isthe tobacco adjusted operating profitdivided by tobacco net revenue.While debt reduction is our priority,we nevertheless have very strongcash flows which provide us with theheadroom for further value creatingdeals within a reasonable timeframe.Strategic alliances will offer furthergrowth opportunities.We measure this element of ourstrategy through our KPI of ourcash conversion rate, see below.Cash Conversion Rate86%128%97%KPIPerformanceStrong cash generation remains akey priority for the <strong>Group</strong>. Our cashconversion was strong at 97 per cent,towards the top end of our target ofbetween 90 and 100 per cent.DefinitionCash conversion is calculated as cashflow from operations, interest and taxpayments less net capital expenditurerelating to property, plant and equipmentand software as a percentage ofadjusted operating profit.20082009<strong>2010</strong>24