Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

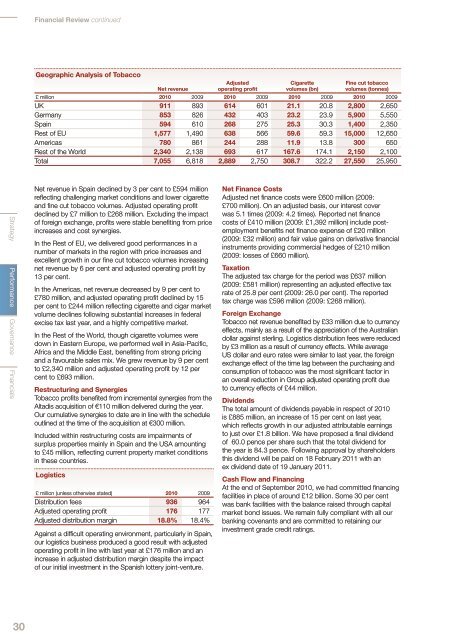

Financial Review continuedGeographic Analysis of <strong>Tobacco</strong>Net revenueAdjustedoperating profitCigarettevolumes (bn)Fine cut tobaccovolumes (tonnes)£ million <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009UK 911 893 614 601 21.1 20.8 2,800 2,650Germany 853 826 432 403 23.2 23.9 5,900 5,550Spain 594 610 268 275 25.3 30.3 1,400 2,350Rest of EU 1,577 1,490 638 566 59.6 59.3 15,000 12,650Americas 780 861 244 288 11.9 13.8 300 650Rest of the World 2,340 2,138 693 617 167.6 174.1 2,150 2,100Total 7,055 6,818 2,889 2,750 308.7 322.2 27,550 25,950Strategy Performance Governance FinancialsNet revenue in Spain declined by 3 per cent to £594 millionreflecting challenging market conditions and lower cigaretteand fine cut tobacco volumes. Adjusted operating profitdeclined by £7 million to £268 million. Excluding the impactof foreign exchange, profits were stable benefiting from priceincreases and cost synergies.In the Rest of EU, we delivered good performances in anumber of markets in the region with price increases andexcellent growth in our fine cut tobacco volumes increasingnet revenue by 6 per cent and adjusted operating profit by13 per cent.In the Americas, net revenue decreased by 9 per cent to£780 million, and adjusted operating profit declined by 15per cent to £244 million reflecting cigarette and cigar marketvolume declines following substantial increases in federalexcise tax last year, and a highly competitive market.In the Rest of the World, though cigarette volumes weredown in Eastern Europe, we performed well in Asia-Pacific,Africa and the Middle East, benefiting from strong pricingand a favourable sales mix. We grew revenue by 9 per centto £2,340 million and adjusted operating profit by 12 percent to £693 million.Restructuring and Synergies<strong>Tobacco</strong> profits benefited from incremental synergies from theAltadis acquisition of €110 million delivered during the year.Our cumulative synergies to date are in line with the scheduleoutlined at the time of the acquisition at €300 million.Included within restructuring costs are impairments ofsurplus properties mainly in Spain and the USA amountingto £45 million, reflecting current property market conditionsin these countries.Logistics£ million (unless otherwise stated) <strong>2010</strong> 2009Distribution fees 936 964Adjusted operating profit 176 177Adjusted distribution margin 18.8% 18.4%Against a difficult operating environment, particularly in Spain,our logistics business produced a good result with adjustedoperating profit in line with last year at £176 million and anincrease in adjusted distribution margin despite the impactof our initial investment in the Spanish lottery joint-venture.Net Finance CostsAdjusted net finance costs were £600 million (2009:£700 million). On an adjusted basis, our interest coverwas 5.1 times (2009: 4.2 times). Reported net financecosts of £410 million (2009: £1,392 million) include postemploymentbenefits net finance expense of £20 million(2009: £32 million) and fair value gains on derivative financialinstruments providing commercial hedges of £210 million(2009: losses of £660 million).TaxationThe adjusted tax charge for the period was £637 million(2009: £581 million) representing an adjusted effective taxrate of 25.8 per cent (2009: 26.0 per cent). The <strong>report</strong>edtax charge was £596 million (2009: £268 million).Foreign Exchange<strong>Tobacco</strong> net revenue benefited by £33 million due to currencyeffects, mainly as a result of the appreciation of the Australiandollar against sterling. Logistics distribution fees were reducedby £3 million as a result of currency effects. While averageUS dollar and euro rates were similar to last year, the foreignexchange effect of the time lag between the purchasing andconsumption of tobacco was the most significant factor inan overall reduction in <strong>Group</strong> adjusted operating profit dueto currency effects of £44 million.DividendsThe total amount of dividends payable in respect of <strong>2010</strong>is £885 million, an increase of 15 per cent on last year,which reflects growth in our adjusted attributable earningsto just over £1.8 billion. We have proposed a final dividendof 60.0 pence per share such that the total dividend forthe year is 84.3 pence. Following approval by shareholdersthis dividend will be paid on 18 February 2011 with anex dividend date of 19 January 2011.Cash Flow and FinancingAt the end of September <strong>2010</strong>, we had committed financingfacilities in place of around £12 billion. Some 30 per centwas bank facilities with the balance raised through capitalmarket bond issues. We remain fully compliant with all ourbanking covenants and are committed to retaining ourinvestment grade credit ratings.30