Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

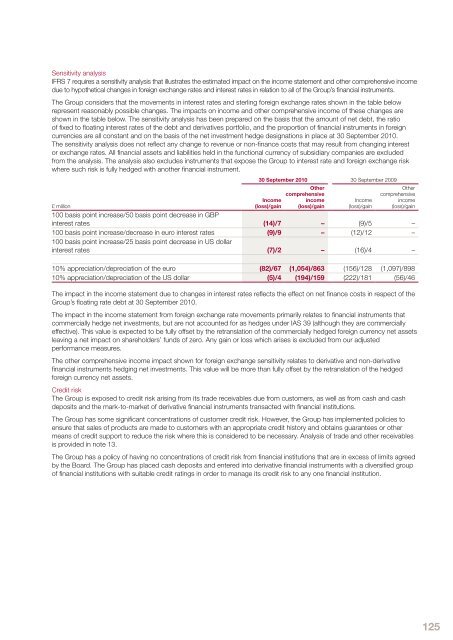

Sensitivity analysisIFRS 7 requires a sensitivity analysis that illustrates the estimated impact on the income statement and other comprehensive incomedue to hypothetical changes in foreign exchange rates and interest rates in relation to all of the <strong>Group</strong>’s financial instruments.The <strong>Group</strong> considers that the movements in interest rates and sterling foreign exchange rates shown in the table belowrepresent reasonably possible changes. The impacts on income and other comprehensive income of these changes areshown in the table below. The sensitivity analysis has been prepared on the basis that the amount of net debt, the ratioof fixed to floating interest rates of the debt and derivatives portfolio, and the proportion of financial instruments in foreigncurrencies are all constant and on the basis of the net investment hedge designations in place at 30 September <strong>2010</strong>.The sensitivity analysis does not reflect any change to revenue or non-finance costs that may result from changing interestor exchange rates. All financial assets and liabilities held in the functional currency of subsidiary companies are excludedfrom the analysis. The analysis also excludes instruments that expose the <strong>Group</strong> to interest rate and foreign exchange riskwhere such risk is fully hedged with another financial instrument.30 September <strong>2010</strong> 30 September 2009Income(loss)/gainOthercomprehensiveincome(loss)/gainIncome(loss)/gainOthercomprehensiveincome(loss)/gain£ million100 basis point increase/50 basis point decrease in GBPinterest rates (14)/7 – (9)/5 –100 basis point increase/decrease in euro interest rates (9)/9 – (12)/12 –100 basis point increase/25 basis point decrease in US dollarinterest rates (7)/2 – (16)/4 –10% appreciation/depreciation of the euro (82)/67 (1,054)/863 (156)/128 (1,097)/89810% appreciation/depreciation of the US dollar (5)/4 (194)/159 (222)/181 (56)/46The impact in the income statement due to changes in interest rates reflects the effect on net finance costs in respect of the<strong>Group</strong>’s floating rate debt at 30 September <strong>2010</strong>.The impact in the income statement from foreign exchange rate movements primarily relates to financial instruments thatcommercially hedge net investments, but are not accounted for as hedges under IAS 39 (although they are commerciallyeffective). This value is expected to be fully offset by the retranslation of the commercially hedged foreign currency net assetsleaving a net impact on shareholders’ funds of zero. Any gain or loss which arises is excluded from our adjustedperformance measures.The other comprehensive income impact shown for foreign exchange sensitivity relates to derivative and non-derivativefinancial instruments hedging net investments. This value will be more than fully offset by the retranslation of the hedgedforeign currency net assets.Credit riskThe <strong>Group</strong> is exposed to credit risk arising from its trade receivables due from customers, as well as from cash and cashdeposits and the mark-to-market of derivative financial instruments transacted with financial institutions.The <strong>Group</strong> has some significant concentrations of customer credit risk. However, the <strong>Group</strong> has implemented policies toensure that sales of products are made to customers with an appropriate credit history and obtains guarantees or othermeans of credit support to reduce the risk where this is considered to be necessary. Analysis of trade and other receivablesis provided in note 13.The <strong>Group</strong> has a policy of having no concentrations of credit risk from financial institutions that are in excess of limits agreedby the Board. The <strong>Group</strong> has placed cash deposits and entered into derivative financial instruments with a diversified groupof financial institutions with suitable credit ratings in order to manage its credit risk to any one financial institution.125