Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

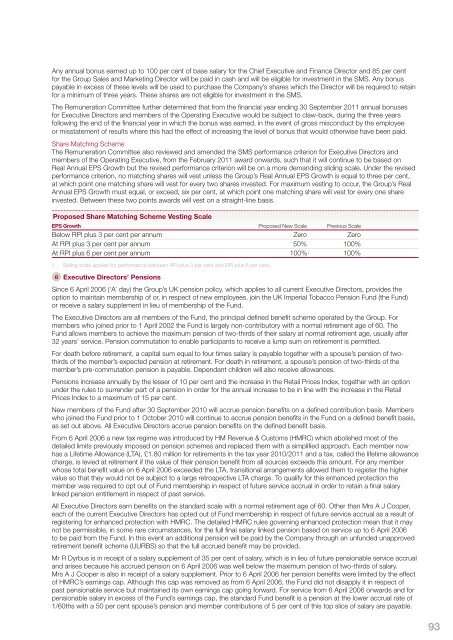

Any annual bonus earned up to 100 per cent of base salary for the Chief Executive and Finance Director and 85 per centfor the <strong>Group</strong> Sales and Marketing Director will be paid in cash and will be eligible for investment in the SMS. Any bonuspayable in excess of these levels will be used to purchase the Company’s shares which the Director will be required to retainfor a minimum of three years. These shares are not eligible for investment in the SMS.The Remuneration Committee further determined that from the financial year ending 30 September 2011 annual bonusesfor Executive Directors and members of the Operating Executive would be subject to claw-back, during the three yearsfollowing the end of the financial year in which the bonus was earned, in the event of gross misconduct by the employeeor misstatement of results where this had the effect of increasing the level of bonus that would otherwise have been paid.Share Matching SchemeThe Remuneration Committee also reviewed and amended the SMS performance criterion for Executive Directors andmembers of the Operating Executive, from the February 2011 award onwards, such that it will continue to be based onReal <strong>Annual</strong> EPS Growth but the revised performance criterion will be on a more demanding sliding scale. Under the revisedperformance criterion, no matching shares will vest unless the <strong>Group</strong>’s Real <strong>Annual</strong> EPS Growth is equal to three per cent,at which point one matching share will vest for every two shares invested. For maximum vesting to occur, the <strong>Group</strong>’s Real<strong>Annual</strong> EPS Growth must equal, or exceed, six per cent, at which point one matching share will vest for every one shareinvested. Between these two points awards will vest on a straight-line basis.Proposed Share Matching Scheme Vesting ScaleEPS Growth Proposed New Scale Previous ScaleBelow RPI plus 3 per cent per annum Zero ZeroAt RPI plus 3 per cent per annum 50% 100%At RPI plus 6 per cent per annum 100% 1 100%1 Sliding scale applies for performance between RPI plus 3 per cent and RPI plus 6 per cent.6 Executive Directors’ PensionsSince 6 April 2006 (‘A’ day) the <strong>Group</strong>’s UK pension policy, which applies to all current Executive Directors, provides theoption to maintain membership of or, in respect of new employees, join the UK <strong>Imperial</strong> <strong>Tobacco</strong> Pension Fund (the Fund)or receive a salary supplement in lieu of membership of the Fund.The Executive Directors are all members of the Fund, the principal defined benefit scheme operated by the <strong>Group</strong>. Formembers who joined prior to 1 April 2002 the Fund is largely non-contributory with a normal retirement age of 60. TheFund allows members to achieve the maximum pension of two-thirds of their salary at normal retirement age, usually after32 years’ service. Pension commutation to enable participants to receive a lump sum on retirement is permitted.For death before retirement, a capital sum equal to four times salary is payable together with a spouse’s pension of twothirdsof the member’s expected pension at retirement. For death in retirement, a spouse’s pension of two-thirds of themember’s pre-commutation pension is payable. Dependant children will also receive allowances.Pensions increase annually by the lesser of 10 per cent and the increase in the Retail Prices Index, together with an optionunder the rules to surrender part of a pension in order for the annual increase to be in line with the increase in the RetailPrices Index to a maximum of 15 per cent.New members of the Fund after 30 September <strong>2010</strong> will accrue pension benefits on a defined contribution basis. Memberswho joined the Fund prior to 1 October <strong>2010</strong> will continue to accrue pension benefits in the Fund on a defined benefit basis,as set out above. All Executive Directors accrue pension benefits on the defined benefit basis.From 6 April 2006 a new tax regime was introduced by HM Revenue & Customs (HMRC) which abolished most of thedetailed limits previously imposed on pension schemes and replaced them with a simplified approach. Each member nowhas a Lifetime Allowance (LTA), £1.80 million for retirements in the tax year <strong>2010</strong>/2011 and a tax, called the lifetime allowancecharge, is levied at retirement if the value of their pension benefit from all sources exceeds this amount. For any memberwhose total benefit value on 6 April 2006 exceeded the LTA, transitional arrangements allowed them to register the highervalue so that they would not be subject to a large retrospective LTA charge. To qualify for this enhanced protection themember was required to opt out of Fund membership in respect of future service accrual in order to retain a final salarylinked pension entitlement in respect of past service.All Executive Directors earn benefits on the standard scale with a normal retirement age of 60. Other than Mrs A J Cooper,each of the current Executive Directors has opted out of Fund membership in respect of future service accrual as a result ofregistering for enhanced protection with HMRC. The detailed HMRC rules governing enhanced protection mean that it maynot be permissible, in some rare circumstances, for the full final salary linked pension based on service up to 6 April 2006to be paid from the Fund. In this event an additional pension will be paid by the Company through an unfunded unapprovedretirement benefit scheme (UURBS) so that the full accrued benefit may be provided.Mr R Dyrbus is in receipt of a salary supplement of 35 per cent of salary, which is in lieu of future pensionable service accrualand arises because his accrued pension on 6 April 2006 was well below the maximum pension of two-thirds of salary.Mrs A J Cooper is also in receipt of a salary supplement. Prior to 6 April 2006 her pension benefits were limited by the effectof HMRC’s earnings cap. Although this cap was removed as from 6 April 2006, the Fund did not disapply it in respect ofpast pensionable service but maintained its own earnings cap going forward. For service from 6 April 2006 onwards and forpensionable salary in excess of the Fund’s earnings cap, the standard Fund benefit is a pension at the lower accrual rate of1/60ths with a 50 per cent spouse’s pension and member contributions of 5 per cent of this top slice of salary are payable.93