Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

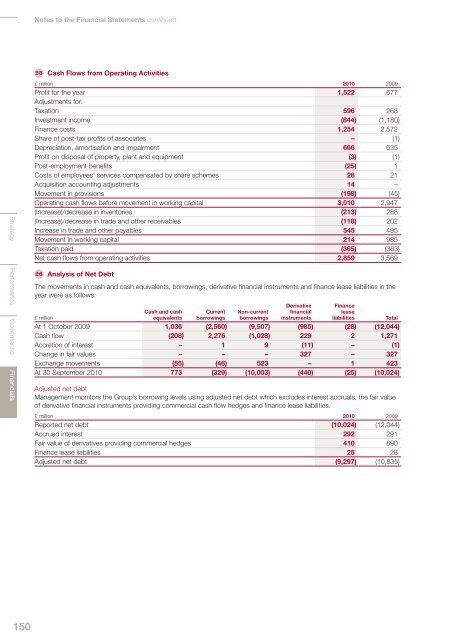

Notes to the Financial Statements continued25 Cash Flows from Operating ActivitiesStrategy Performance Governance Financials£ million <strong>2010</strong> 2009Profit for the year 1,522 677Adjustments for:Taxation 596 268Investment income (844) (1,180)Finance costs 1,254 2,572Share of post-tax profits of associates – (1)Depreciation, amortisation and impairment 666 635Profit on disposal of property, plant and equipment (3) (1)Post-employment benefits (25) 1Costs of employees’ services compensated by share schemes 28 21Acquisition accounting adjustments 14 –Movement in provisions (198) (45)Operating cash flows before movement in working capital 3,010 2,947(Increase)/decrease in inventories (213) 288(Increase)/decrease in trade and other receivables (118) 202Increase in trade and other payables 545 495Movement in working capital 214 985Taxation paid (365) (363)Net cash flows from operating activities 2,859 3,56926 Analysis of Net DebtThe movements in cash and cash equivalents, borrowings, derivative financial instruments and finance lease liabilities in theyear were as follows:Cash and cashequivalentsCurrentborrowingsNon-currentborrowingsDerivativefinancialinstrumentsFinanceleaseliabilities£ millionTotalAt 1 October 2009 1,036 (2,560) (9,507) (985) (28) (12,044)Cash flow (208) 2,276 (1,028) 229 2 1,271Accretion of interest – 1 9 (11) – (1)Change in fair values – – – 327 – 327Exchange movements (55) (46) 523 – 1 423At 30 September <strong>2010</strong> 773 (329) (10,003) (440) (25) (10,024)Adjusted net debtManagement monitors the <strong>Group</strong>’s borrowing levels using adjusted net debt which excludes interest accruals, the fair valueof derivative financial instruments providing commercial cash flow hedges and finance lease liabilities.£ million <strong>2010</strong> 2009Reported net debt (10,024) (12,044)Accrued interest 292 291Fair value of derivatives providing commercial hedges 410 890Finance lease liabilities 25 28Adjusted net debt (9,297) (10,835)150