Accounting Policies continuedStrategy Performance Governance FinancialsShare CapitalOrdinary shares are classified as equity.Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction, net of tax,from the proceeds.Where the Company purchases its own equity share capital (treasury shares), the consideration paid, including any directlyattributable incremental costs (net of income taxes), is deducted on consolidation from equity attributable to owners of theparent until the shares are cancelled, reissued or disposed of. Where such shares are subsequently sold or reissued, anyconsideration received, net of any directly attributable incremental transaction costs and the related income tax effects,is included in equity attributable to owners of the parent.Use of Adjusted MeasuresManagement believes that <strong>report</strong>ing non-GAAP or adjusted measures provides a useful comparison of businessperformance and reflects the way in which the business is controlled. Accordingly, adjusted measures of operating profit, netfinance costs, profit before tax, taxation, attributable earnings and earnings per share exclude, where applicable, acquisitionaccounting adjustments, amortisation of acquired intangibles, restructuring costs, post-employment benefits net financingcost, fair value gains and losses on derivative financial instruments in respect of commercially effective hedges and relatedtaxation effects. Reconciliations between adjusted and <strong>report</strong>ed operating profit are included within note 1 to the financialstatements, adjusted and <strong>report</strong>ed net finance costs in note 5, adjusted and <strong>report</strong>ed taxation in note 6, and adjusted and<strong>report</strong>ed earnings per share in note 8. The adjusted measures in this <strong>report</strong> are not defined terms under IFRS and may notbe comparable with similarly titled measures <strong>report</strong>ed by other companies.The items excluded from adjusted results are those which are one-off in nature or which arose due to acquisitions and arenot influenced by the day to day operations of the <strong>Group</strong>, and the movements in the fair value of financial instruments whichare marked to market and not naturally offset. Adjusted net finance costs also exclude all interest on items not includedwithin adjusted net debt. This allows comparison of the <strong>Group</strong>’s cost of debt with adjusted net debt. The adjusted measuresare used by management to assess the <strong>Group</strong>’s financial performance and aid comparability of results year on year.The principal adjustments made to <strong>report</strong>ed profits are as follows:Acquisition Accounting AdjustmentsAcquisition accounting adjustments eliminate costs charged to the income statement as a consequence of investigationsinto alleged foreign trading violations in the period prior to our acquisition of Reemtsma which are recoverable fromthe sellers. IFRS 3 requires that adjustments to the cost of an acquisition are taken to goodwill, whereas changes inmeasurement of assets and liabilities after the provisional fair value period are taken to the income statement. These itemsare excluded from our adjusted earnings measures since the costs do not relate to the current trading performance of the<strong>Group</strong> and the amounts are recoverable from the sellers.Amortisation of Acquired IntangiblesAcquired intangibles are amortised over their estimated useful economic lives where these are considered to be finite.Acquired intangibles considered to have an indefinite life are not amortised. We exclude from our adjusted measures theamortisation of acquired intangibles, other than software, and the deferred tax associated with amortisation of acquiredintangibles and tax deductible goodwill. The deferred tax liability is excluded on the basis that it will only crystallise upondisposal of the intangibles and goodwill. The related current cash tax benefit is retained in the adjusted measure to reflectthe ongoing tax benefit to the <strong>Group</strong>. Impairment of goodwill is also excluded from our adjusted measures.Fair Value Gains and Losses on Derivative Financial InstrumentsIAS 39 requires that all derivative financial instruments are recognised in the balance sheet at fair value, with changes in thefair value being recognised in the income statement unless the instrument satisfies the hedge accounting rules under IFRSand the <strong>Group</strong> chooses to designate the derivative financial instrument as a hedge.The <strong>Group</strong> hedges underlying exposures in an efficient, commercial and structured manner. However, the strict hedgingrequirements of IAS 39 may lead to some commercially effective hedge positions not qualifying for hedge accounting. As aresult, and as permitted under IAS 39, the <strong>Group</strong> has decided not to apply cash flow or fair value hedge accounting for itsderivative financial instruments. However, the <strong>Group</strong> does apply net investment hedging, designating certain borrowings andderivatives as hedges of the net investment in the <strong>Group</strong>’s foreign operations, as permitted by IAS 39, in order to minimiseincome statement volatility.We exclude fair value gains and losses on derivative financial instruments providing commercial hedges from adjusted netfinance costs. Fair value gains and losses on the interest element of derivative financial instruments are excluded as they willreverse over time or are matched in future periods by interest charges. Fair value gains and losses on the currency elementof derivative financial instruments are excluded as the relevant foreign exchange gains and losses on the commerciallyhedged item are accumulated as a separate component of other comprehensive income in accordance with the <strong>Group</strong>’spolicy on foreign currency.108

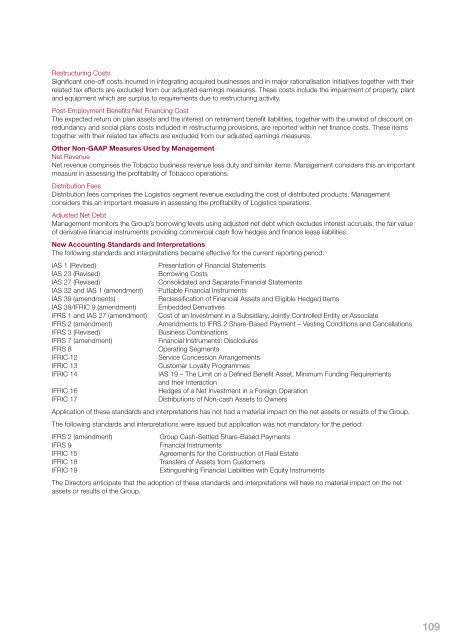

Restructuring CostsSignificant one-off costs incurred in integrating acquired businesses and in major rationalisation initiatives together with theirrelated tax effects are excluded from our adjusted earnings measures. These costs include the impairment of property, plantand equipment which are surplus to requirements due to restructuring activity.Post-Employment Benefits Net Financing CostThe expected return on plan assets and the interest on retirement benefit liabilities, together with the unwind of discount onredundancy and social plans costs included in restructuring provisions, are <strong>report</strong>ed within net finance costs. These itemstogether with their related tax effects are excluded from our adjusted earnings measures.Other Non-GAAP Measures Used by ManagementNet RevenueNet revenue comprises the <strong>Tobacco</strong> business revenue less duty and similar items. Management considers this an importantmeasure in assessing the profitability of <strong>Tobacco</strong> operations.Distribution FeesDistribution fees comprises the Logistics segment revenue excluding the cost of distributed products. Managementconsiders this an important measure in assessing the profitability of Logistics operations.Adjusted Net DebtManagement monitors the <strong>Group</strong>’s borrowing levels using adjusted net debt which excludes interest accruals, the fair valueof derivative financial instruments providing commercial cash flow hedges and finance lease liabilities.New Accounting Standards and InterpretationsThe following standards and interpretations became effective for the current <strong>report</strong>ing period:IAS 1 (Revised)Presentation of Financial StatementsIAS 23 (Revised)Borrowing CostsIAS 27 (Revised)Consolidated and Separate Financial StatementsIAS 32 and IAS 1 (amendment) Puttable Financial InstrumentsIAS 39 (amendments)Reclassification of Financial Assets and Eligible Hedged ItemsIAS 39/IFRIC 9 (amendment) Embedded DerivativesIFRS 1 and IAS 27 (amendment) Cost of an Investment in a Subsidiary, Jointly Controlled Entity or AssociateIFRS 2 (amendment)Amendments to IFRS 2 Share-Based Payment – Vesting Conditions and CancellationsIFRS 3 (Revised)Business CombinationsIFRS 7 (amendment)Financial Instruments: DisclosuresIFRS 8Operating SegmentsIFRIC 12Service Concession ArrangementsIFRIC 13Customer Loyalty ProgrammesIFRIC 14IAS 19 – The Limit on a Defined Benefit Asset, Minimum Funding Requirementsand their InteractionIFRIC 16Hedges of a Net Investment in a Foreign OperationIFRIC 17Distributions of Non-cash Assets to OwnersApplication of these standards and interpretations has not had a material impact on the net assets or results of the <strong>Group</strong>.The following standards and interpretations were issued but application was not mandatory for the period:IFRS 2 (amendment)<strong>Group</strong> Cash-Settled Share-Based PaymentsIFRS 9Financial InstrumentsIFRIC 15Agreements for the Construction of Real EstateIFRIC 18Transfers of Assets from CustomersIFRIC 19Extinguishing Financial Liabilities with Equity InstrumentsThe Directors anticipate that the adoption of these standards and interpretations will have no material impact on the netassets or results of the <strong>Group</strong>.109

- Page 1 and 2:

Imperial Tobacco Group PLCAnnual Re

- Page 3 and 4:

…to deliver sustainableshareholde

- Page 5 and 6:

Operational HighlightsDelivering Su

- Page 7 and 8:

and product portfolio to evolving c

- Page 9 and 10:

In this section9 Strategic Review10

- Page 11 and 12:

Our StrategyWe are focused on deliv

- Page 13 and 14:

Total Tobacco5 % Our Powerful Brand

- Page 15 and 16:

Our global strategic cigarette bran

- Page 17 and 18:

Our global team is fully aligned be

- Page 19 and 20:

Satisfying consumers and aligning o

- Page 21 and 22:

We are a responsive business with s

- Page 23 and 24:

Operating responsibly, combined wit

- Page 25 and 26:

Our growth drivers of sales growth,

- Page 27 and 28:

Principal Risks and UncertaintiesA

- Page 29 and 30:

Competition LawOverviewWe take comp

- Page 31 and 32:

Reconciliation of Adjusted Performa

- Page 33 and 34:

Key Performance Indicators (KPIs) 1

- Page 35 and 36:

Lambert & Butler and Richmond remai

- Page 37 and 38:

Within this the travel retail marke

- Page 39 and 40:

OutlookThe strength of our portfoli

- Page 41 and 42:

Blondes. In the Middle East, we aga

- Page 43 and 44:

Corporate ResponsibilityOur Corpora

- Page 45 and 46:

Corporate Responsibility and our St

- Page 47 and 48:

We have revised our IMS and employe

- Page 49 and 50:

Environmental Performance 1Absolute

- Page 51 and 52:

across the business. More informati

- Page 53 and 54:

Supplier RelationshipsOur main supp

- Page 55 and 56:

Non-financial performance indicator

- Page 57 and 58:

“High standards of corporategover

- Page 59 and 60: 5. Pierre Jungels, CBE (HON), PHD,

- Page 61 and 62: Management and Corporate StructureB

- Page 63 and 64: Meetings of the Board, Board Commit

- Page 65 and 66: and supplemented by our Non-Executi

- Page 67 and 68: 6 Performance evaluation: How do we

- Page 69 and 70: The Board recognises that we operat

- Page 71 and 72: Assurance process for financial rep

- Page 73 and 74: - receiving reports from, and quest

- Page 75 and 76: Directors’ Report: Other Informat

- Page 77 and 78: - state whether IFRSs as adopted by

- Page 79 and 80: We understand that a purported coll

- Page 81 and 82: This Report covers the following:1

- Page 83 and 84: 2 Directors’ Emoluments for the Y

- Page 85 and 86: Directors’ Interests in Ordinary

- Page 87 and 88: Executive Directors’ Service Agre

- Page 89 and 90: When setting base salary the Remune

- Page 91 and 92: First ElementFifty per cent of the

- Page 93 and 94: In respect of the October 2007 - Oc

- Page 95 and 96: Any annual bonus earned up to 100 p

- Page 97 and 98: Benefit Trusts have also been provi

- Page 99 and 100: Independent Auditors’ Reportto th

- Page 101 and 102: Consolidated Statement ofComprehens

- Page 103 and 104: Consolidated Statement of Changes i

- Page 105 and 106: Accounting PoliciesBasis of Prepara

- Page 107 and 108: Duty and Similar ItemsDuty and simi

- Page 109: InventoriesInventories are stated a

- Page 113 and 114: Property, Plant and Equipment and I

- Page 115 and 116: Tobacco net revenue£ million 2010

- Page 117 and 118: 3 Restructuring Costs£ million 201

- Page 119 and 120: Factors affecting the tax charge fo

- Page 121 and 122: 9 Intangible Assets2010£ million G

- Page 123 and 124: 10 Property, Plant and Equipment201

- Page 125 and 126: 13 Trade and Other Receivables2010

- Page 127 and 128: Sensitivity analysisIFRS 7 requires

- Page 129 and 130: At 30 September 2009Balance sheetam

- Page 131 and 132: (iii) Currency analysis and effecti

- Page 133 and 134: (iv) Derivative financial instrumen

- Page 135 and 136: Matures in financial year ending in

- Page 137 and 138: The following tables are provided i

- Page 139 and 140: Matures in financial year ending in

- Page 141 and 142: (vi) Hedge of net investments in fo

- Page 143 and 144: 18 Retirement Benefit SchemesThe Gr

- Page 145 and 146: Assumptions regarding future mortal

- Page 147 and 148: 21 Share SchemesThe Group recognise

- Page 149 and 150: Year from 1 October 2008 to 30 Sept

- Page 151 and 152: 23 CommitmentsCapital commitments£

- Page 153 and 154: 27 Reconciliation of Cash Flow to M

- Page 155 and 156: Imperial Tobacco Group PLC Balance

- Page 157 and 158: (iii) Debtors: Amounts Falling Due

- Page 159 and 160: Principal SubsidiariesThe principal

- Page 161 and 162:

Shareholder InformationRegistered O

- Page 163 and 164:

IndexAAccounting Policies 103Acquis