Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

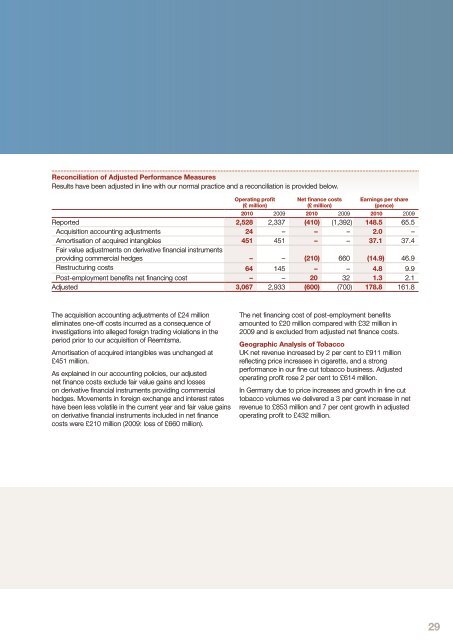

Reconciliation of Adjusted Performance MeasuresResults have been adjusted in line with our normal practice and a reconciliation is provided below.Operating profit(£ million)Net finance costs(£ million)Earnings per share(pence)<strong>2010</strong> 2009 <strong>2010</strong> 2009 <strong>2010</strong> 2009Reported 2,528 2,337 (410) (1,392) 148.5 65.5Acquisition accounting adjustments 24 – – – 2.0 –Amortisation of acquired intangibles 451 451 – – 37.1 37.4Fair value adjustments on derivative financial instrumentsproviding commercial hedges – – (210) 660 (14.9) 46.9Restructuring costs 64 145 – – 4.8 9.9Post-employment benefits net financing cost – – 20 32 1.3 2.1Adjusted 3,067 2,933 (600) (700) 178.8 161.8The acquisition accounting adjustments of £24 millioneliminates one-off costs incurred as a consequence ofinvestigations into alleged foreign trading violations in theperiod prior to our acquisition of Reemtsma.Amortisation of acquired intangibles was unchanged at£451 million.As explained in our accounting policies, our adjustednet finance costs exclude fair value gains and losseson derivative financial instruments providing commercialhedges. Movements in foreign exchange and interest rateshave been less volatile in the current year and fair value gainson derivative financial instruments included in net financecosts were £210 million (2009: loss of £660 million).The net financing cost of post-employment benefitsamounted to £20 million compared with £32 million in2009 and is excluded from adjusted net finance costs.Geographic Analysis of <strong>Tobacco</strong>UK net revenue increased by 2 per cent to £911 millionreflecting price increases in cigarette, and a strongperformance in our fine cut tobacco business. Adjustedoperating profit rose 2 per cent to £614 million.In Germany due to price increases and growth in fine cuttobacco volumes we delivered a 3 per cent increase in netrevenue to £853 million and 7 per cent growth in adjustedoperating profit to £432 million.29