Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

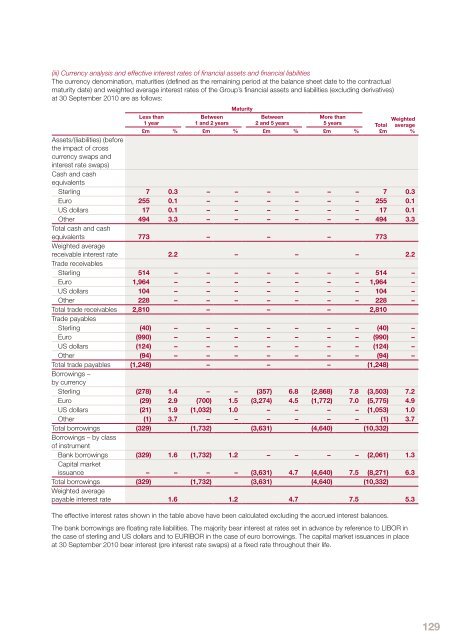

(iii) Currency analysis and effective interest rates of financial assets and financial liabilitiesThe currency denomination, maturities (defined as the remaining period at the balance sheet date to the contractualmaturity date) and weighted average interest rates of the <strong>Group</strong>’s financial assets and liabilities (excluding derivatives)at 30 September <strong>2010</strong> are as follows:Less than1 yearBetween1 and 2 yearsMaturityBetween2 and 5 yearsMore than5 yearsTotal£mWeightedaverage%£m % £m % £m % £m %Assets/(liabilities) (beforethe impact of crosscurrency swaps andinterest rate swaps)Cash and cashequivalentsSterling 7 0.3 – – – – – – 7 0.3Euro 255 0.1 – – – – – – 255 0.1US dollars 17 0.1 – – – – – – 17 0.1Other 494 3.3 – – – – – – 494 3.3Total cash and cashequivalents 773 – – – 773Weighted averagereceivable interest rate 2.2 – – – 2.2Trade receivablesSterling 514 – – – – – – – 514 –Euro 1,964 – – – – – – – 1,964 –US dollars 104 – – – – – – – 104 –Other 228 – – – – – – – 228 –Total trade receivables 2,810 – – – 2,810Trade payablesSterling (40) – – – – – – – (40) –Euro (990) – – – – – – – (990) –US dollars (124) – – – – – – – (124) –Other (94) – – – – – – – (94) –Total trade payables (1,248) – – – (1,248)Borrowings –by currencySterling (278) 1.4 – – (357) 6.8 (2,868) 7.8 (3,503) 7.2Euro (29) 2.9 (700) 1.5 (3,274) 4.5 (1,772) 7.0 (5,775) 4.9US dollars (21) 1.9 (1,032) 1.0 – – – – (1,053) 1.0Other (1) 3.7 – – – – – – (1) 3.7Total borrowings (329) (1,732) (3,631) (4,640) (10,332)Borrowings – by classof instrumentBank borrowings (329) 1.6 (1,732) 1.2 – – – – (2,061) 1.3Capital marketissuance – – – – (3,631) 4.7 (4,640) 7.5 (8,271) 6.3Total borrowings (329) (1,732) (3,631) (4,640) (10,332)Weighted averagepayable interest rate 1.6 1.2 4.7 7.5 5.3The effective interest rates shown in the table above have been calculated excluding the accrued interest balances.The bank borrowings are floating rate liabilities. The majority bear interest at rates set in advance by reference to LIBOR inthe case of sterling and US dollars and to EURIBOR in the case of euro borrowings. The capital market issuances in placeat 30 September <strong>2010</strong> bear interest (pre interest rate swaps) at a fixed rate throughout their life.129