Directors’ Remuneration Report continuedUnder the rules of the SMS, should <strong>Imperial</strong> <strong>Tobacco</strong> <strong>Group</strong> PLC be acquired the performance period would end on the dateof acquisition. Any outstanding awards would vest on a time pro rata basis subject to the achievement of the applicableperformance criterion.Strategy Performance Governance FinancialsExecutive Directors’ Contingent Rights to shares under the Share Matching Scheme (Audited)Balance at1/10/2009Contingentrights arisingPrevailingshare price atdate of grant£Vestedduring yearMarket priceat date ofvesting15/2/<strong>2010</strong>£Amountrealised onvesting£’000Balance at30/9/<strong>2010</strong> 1 Actual/expectedvesting dateMrs A J Cooper 8,804 – 19.40 2 (8,804) 20.57 181 – February <strong>2010</strong>11,366 – 21.18 3 – – – 11,366 February 201117,895 – 17.80 4 – – – 17,895 February 2012– 20,644 20.57 5 – – – 20,644 February 201338,065 20,644 – (8,804) – 181 49,905Mr R Dyrbus 14,800 – 19.40 2 (14,800) 20.57 304 – February <strong>2010</strong>24,030 – 21.18 3 – – – 24,030 February 201132,303 – 17.80 4 – – – 32,303 February 2012– 32,255 20.57 5 – – – 32,255 February 201371,133 32,255 – (14,800) – 304 88,588Mr G L Blashill 10,597 – 19.40 2 (10,597) 20.57 218 – February <strong>2010</strong>13,262 – 21.18 3 – – – 13,262 February 201117,684 – 17.80 4 – – – 17,684 February 2012– 18,735 20.57 5 – – – 18,735 February 201341,543 18,735 – (10,597) – 218 49,681Mr G Davis 6 23,323 – 19.40 2 (23,323) 20.57 480 – February <strong>2010</strong>37,859 – 21.18 3 – – – 37,859 February 201152,741 – 17.80 4 – – – 52,741 February 2012113,923 – – (23,323) – 480 90,6001 Or date of retirement if earlier.2 Award granted 15 February 2007. Share price on date of grant adjusted from £21.96 following June 2008 rights issue.3 Award granted 15 February 2008. Share price on date of grant adjusted from £23.97 following June 2008 rights issue.4 Award granted 15 February 2009.5 Award granted 15 February <strong>2010</strong>.6 Mr G Davis was not eligible to participate in the award granted 15 February <strong>2010</strong> due to his expected retirement.There have been no changes in any Executive Directors’ contingent rights since 30 September <strong>2010</strong>.During February <strong>2010</strong> annual bonuses earned in the financial year to 30 September 2006 and lodged under the SMS for athree year period matured. The performance criterion was met in full providing matched shares for participants on a one forone basis.In respect of annual bonuses earned in the financial year to 30 September 2009 and paid in December 2009, the ExecutiveDirectors elected, in February <strong>2010</strong>, to invest the equivalent of their entire bonus in the form of our shares under the SMS.These will be matched on a one for one basis provided they are left in the SMS for three years, the participant remains anemployee within the <strong>Group</strong> and the Company has achieved in excess of three per cent Real <strong>Annual</strong> EPS Growth over theretention period.This performance criterion and the award policy and vesting schedules were reviewed during the year by the RemunerationCommittee who were satisfied they remain appropriate notwithstanding current market conditions. However, the performancecriterion was amended for future awards, as discussed on page 92. These matched shares are shown within contingentrights arising above. In accordance with the Company’s normal practice, Mr G Davis was not eligible to participate in thisaward due to his expected retirement.It is anticipated that in February 2011 the Executive Directors will again invest the equivalent of their entire eligible annualbonus in the SMS.Long Term Incentive Plan<strong>Annual</strong> conditional awards are made under the LTIP to Executive Directors and other senior management. These awardsvest three years after grant and are subject to satisfying the appropriate performance criteria over the relevant three yearperformance period. All grants are at the discretion of the Remuneration Committee and no employee has a right to receivean award.Awards are equivalent to 200 per cent of base salary for the Chief Executive, 150 per cent for the Finance Directorand 100 per cent for the other Executive Director, with awards at a lower level for other senior management.Current StructureThe performance criterion for all awards is split into three elements. The Remuneration Committee reviewed the performancecriteria at its meeting in September <strong>2010</strong> and was satisfied that they remain appropriate notwithstanding current marketconditions. The three elements are as follows:88

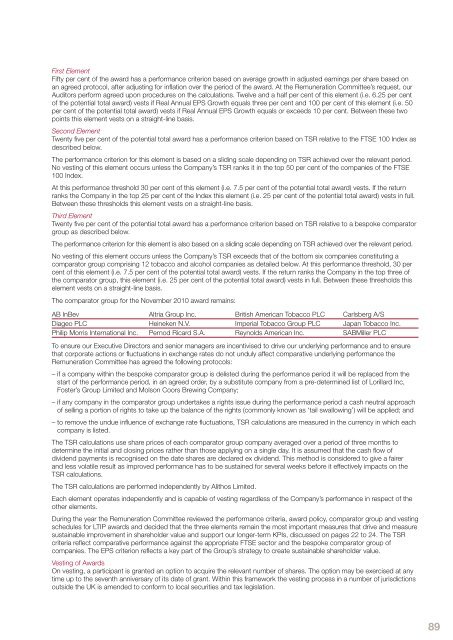

First ElementFifty per cent of the award has a performance criterion based on average growth in adjusted earnings per share based onan agreed protocol, after adjusting for inflation over the period of the award. At the Remuneration Committee’s request, ourAuditors perform agreed upon procedures on the calculations. Twelve and a half per cent of this element (i.e. 6.25 per centof the potential total award) vests if Real <strong>Annual</strong> EPS Growth equals three per cent and 100 per cent of this element (i.e. 50per cent of the potential total award) vests if Real <strong>Annual</strong> EPS Growth equals or exceeds 10 per cent. Between these twopoints this element vests on a straight-line basis.Second ElementTwenty five per cent of the potential total award has a performance criterion based on TSR relative to the FTSE 100 Index asdescribed below.The performance criterion for this element is based on a sliding scale depending on TSR achieved over the relevant period.No vesting of this element occurs unless the Company’s TSR ranks it in the top 50 per cent of the companies of the FTSE100 Index.At this performance threshold 30 per cent of this element (i.e. 7.5 per cent of the potential total award) vests. If the returnranks the Company in the top 25 per cent of the Index this element (i.e. 25 per cent of the potential total award) vests in full.Between these thresholds this element vests on a straight-line basis.Third ElementTwenty five per cent of the potential total award has a performance criterion based on TSR relative to a bespoke comparatorgroup as described below.The performance criterion for this element is also based on a sliding scale depending on TSR achieved over the relevant period.No vesting of this element occurs unless the Company’s TSR exceeds that of the bottom six companies constituting acomparator group comprising 12 tobacco and alcohol companies as detailed below. At this performance threshold, 30 percent of this element (i.e. 7.5 per cent of the potential total award) vests. If the return ranks the Company in the top three ofthe comparator group, this element (i.e. 25 per cent of the potential total award) vests in full. Between these thresholds thiselement vests on a straight-line basis.The comparator group for the November <strong>2010</strong> award remains:AB InBev Altria <strong>Group</strong> Inc. British American <strong>Tobacco</strong> PLC Carlsberg A/SDiageo PLC Heineken N.V. <strong>Imperial</strong> <strong>Tobacco</strong> <strong>Group</strong> PLC Japan <strong>Tobacco</strong> Inc.Philip Morris International Inc. Pernod Ricard S.A. Reynolds American Inc. SABMiller PLCTo ensure our Executive Directors and senior managers are incentivised to drive our underlying performance and to ensurethat corporate actions or fluctuations in exchange rates do not unduly affect comparative underlying performance theRemuneration Committee has agreed the following protocols:– if a company within the bespoke comparator group is delisted during the performance period it will be replaced from thestart of the performance period, in an agreed order, by a substitute company from a pre-determined list of Lorillard Inc,Foster’s <strong>Group</strong> Limited and Molson Coors Brewing Company;– if any company in the comparator group undertakes a rights issue during the performance period a cash neutral approachof selling a portion of rights to take up the balance of the rights (commonly known as ‘tail swallowing’) will be applied; and– to remove the undue influence of exchange rate fluctuations, TSR calculations are measured in the currency in which eachcompany is listed.The TSR calculations use share prices of each comparator group company averaged over a period of three months todetermine the initial and closing prices rather than those applying on a single day. It is assumed that the cash flow ofdividend payments is recognised on the date shares are declared ex dividend. This method is considered to give a fairerand less volatile result as improved performance has to be sustained for several weeks before it effectively impacts on theTSR calculations.The TSR calculations are performed independently by Alithos Limited.Each element operates independently and is capable of vesting regardless of the Company’s performance in respect of theother elements.During the year the Remuneration Committee reviewed the performance criteria, award policy, comparator group and vestingschedules for LTIP awards and decided that the three elements remain the most important measures that drive and measuresustainable improvement in shareholder value and support our longer-term KPIs, discussed on pages 22 to 24. The TSRcriteria reflect comparative performance against the appropriate FTSE sector and the bespoke comparator group ofcompanies. The EPS criterion reflects a key part of the <strong>Group</strong>’s strategy to create sustainable shareholder value.Vesting of AwardsOn vesting, a participant is granted an option to acquire the relevant number of shares. The option may be exercised at anytime up to the seventh anniversary of its date of grant. Within this framework the vesting process in a number of jurisdictionsoutside the UK is amended to conform to local securities and tax legislation.89

- Page 1 and 2:

Imperial Tobacco Group PLCAnnual Re

- Page 3 and 4:

…to deliver sustainableshareholde

- Page 5 and 6:

Operational HighlightsDelivering Su

- Page 7 and 8:

and product portfolio to evolving c

- Page 9 and 10:

In this section9 Strategic Review10

- Page 11 and 12:

Our StrategyWe are focused on deliv

- Page 13 and 14:

Total Tobacco5 % Our Powerful Brand

- Page 15 and 16:

Our global strategic cigarette bran

- Page 17 and 18:

Our global team is fully aligned be

- Page 19 and 20:

Satisfying consumers and aligning o

- Page 21 and 22:

We are a responsive business with s

- Page 23 and 24:

Operating responsibly, combined wit

- Page 25 and 26:

Our growth drivers of sales growth,

- Page 27 and 28:

Principal Risks and UncertaintiesA

- Page 29 and 30:

Competition LawOverviewWe take comp

- Page 31 and 32:

Reconciliation of Adjusted Performa

- Page 33 and 34:

Key Performance Indicators (KPIs) 1

- Page 35 and 36:

Lambert & Butler and Richmond remai

- Page 37 and 38:

Within this the travel retail marke

- Page 39 and 40: OutlookThe strength of our portfoli

- Page 41 and 42: Blondes. In the Middle East, we aga

- Page 43 and 44: Corporate ResponsibilityOur Corpora

- Page 45 and 46: Corporate Responsibility and our St

- Page 47 and 48: We have revised our IMS and employe

- Page 49 and 50: Environmental Performance 1Absolute

- Page 51 and 52: across the business. More informati

- Page 53 and 54: Supplier RelationshipsOur main supp

- Page 55 and 56: Non-financial performance indicator

- Page 57 and 58: “High standards of corporategover

- Page 59 and 60: 5. Pierre Jungels, CBE (HON), PHD,

- Page 61 and 62: Management and Corporate StructureB

- Page 63 and 64: Meetings of the Board, Board Commit

- Page 65 and 66: and supplemented by our Non-Executi

- Page 67 and 68: 6 Performance evaluation: How do we

- Page 69 and 70: The Board recognises that we operat

- Page 71 and 72: Assurance process for financial rep

- Page 73 and 74: - receiving reports from, and quest

- Page 75 and 76: Directors’ Report: Other Informat

- Page 77 and 78: - state whether IFRSs as adopted by

- Page 79 and 80: We understand that a purported coll

- Page 81 and 82: This Report covers the following:1

- Page 83 and 84: 2 Directors’ Emoluments for the Y

- Page 85 and 86: Directors’ Interests in Ordinary

- Page 87 and 88: Executive Directors’ Service Agre

- Page 89: When setting base salary the Remune

- Page 93 and 94: In respect of the October 2007 - Oc

- Page 95 and 96: Any annual bonus earned up to 100 p

- Page 97 and 98: Benefit Trusts have also been provi

- Page 99 and 100: Independent Auditors’ Reportto th

- Page 101 and 102: Consolidated Statement ofComprehens

- Page 103 and 104: Consolidated Statement of Changes i

- Page 105 and 106: Accounting PoliciesBasis of Prepara

- Page 107 and 108: Duty and Similar ItemsDuty and simi

- Page 109 and 110: InventoriesInventories are stated a

- Page 111 and 112: Restructuring CostsSignificant one-

- Page 113 and 114: Property, Plant and Equipment and I

- Page 115 and 116: Tobacco net revenue£ million 2010

- Page 117 and 118: 3 Restructuring Costs£ million 201

- Page 119 and 120: Factors affecting the tax charge fo

- Page 121 and 122: 9 Intangible Assets2010£ million G

- Page 123 and 124: 10 Property, Plant and Equipment201

- Page 125 and 126: 13 Trade and Other Receivables2010

- Page 127 and 128: Sensitivity analysisIFRS 7 requires

- Page 129 and 130: At 30 September 2009Balance sheetam

- Page 131 and 132: (iii) Currency analysis and effecti

- Page 133 and 134: (iv) Derivative financial instrumen

- Page 135 and 136: Matures in financial year ending in

- Page 137 and 138: The following tables are provided i

- Page 139 and 140: Matures in financial year ending in

- Page 141 and 142:

(vi) Hedge of net investments in fo

- Page 143 and 144:

18 Retirement Benefit SchemesThe Gr

- Page 145 and 146:

Assumptions regarding future mortal

- Page 147 and 148:

21 Share SchemesThe Group recognise

- Page 149 and 150:

Year from 1 October 2008 to 30 Sept

- Page 151 and 152:

23 CommitmentsCapital commitments£

- Page 153 and 154:

27 Reconciliation of Cash Flow to M

- Page 155 and 156:

Imperial Tobacco Group PLC Balance

- Page 157 and 158:

(iii) Debtors: Amounts Falling Due

- Page 159 and 160:

Principal SubsidiariesThe principal

- Page 161 and 162:

Shareholder InformationRegistered O

- Page 163 and 164:

IndexAAccounting Policies 103Acquis