Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

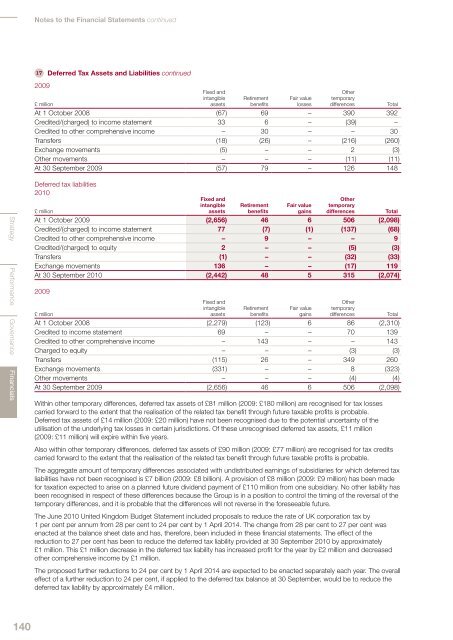

Notes to the Financial Statements continued17 Deferred Tax Assets and Liabilities continued2009Fixed andintangibleassetsRetirementbenefitsFair valuelossesOthertemporarydifferences£ millionTotalAt 1 October 2008 (67) 69 – 390 392Credited/(charged) to income statement 33 6 – (39) –Credited to other comprehensive income – 30 – – 30Transfers (18) (26) – (216) (260)Exchange movements (5) – – 2 (3)Other movements – – – (11) (11)At 30 September 2009 (57) 79 – 126 148Strategy Performance Governance FinancialsDeferred tax liabilities<strong>2010</strong>Fixed andintangibleassetsRetirementbenefitsFair valuegainsOthertemporarydifferences£ millionTotalAt 1 October 2009 (2,656) 46 6 506 (2,098)Credited/(charged) to income statement 77 (7) (1) (137) (68)Credited to other comprehensive income – 9 – – 9Credited/(charged) to equity 2 – – (5) (3)Transfers (1) – – (32) (33)Exchange movements 136 – – (17) 119At 30 September <strong>2010</strong> (2,442) 48 5 315 (2,074)2009Fixed andintangibleassetsRetirementbenefitsFair valuegainsOthertemporarydifferences£ millionTotalAt 1 October 2008 (2,279) (123) 6 86 (2,310)Credited to income statement 69 – – 70 139Credited to other comprehensive income – 143 – – 143Charged to equity – – – (3) (3)Transfers (115) 26 – 349 260Exchange movements (331) – – 8 (323)Other movements – – – (4) (4)At 30 September 2009 (2,656) 46 6 506 (2,098)Within other temporary differences, deferred tax assets of £81 million (2009: £180 million) are recognised for tax lossescarried forward to the extent that the realisation of the related tax benefit through future taxable profits is probable.Deferred tax assets of £14 million (2009: £20 million) have not been recognised due to the potential uncertainty of theutilisation of the underlying tax losses in certain jurisdictions. Of these unrecognised deferred tax assets, £11 million(2009: £11 million) will expire within five years.Also within other temporary differences, deferred tax assets of £90 million (2009: £77 million) are recognised for tax creditscarried forward to the extent that the realisation of the related tax benefit through future taxable profits is probable.The aggregate amount of temporary differences associated with undistributed earnings of subsidiaries for which deferred taxliabilities have not been recognised is £7 billion (2009: £8 billion). A provision of £8 million (2009: £9 million) has been madefor taxation expected to arise on a planned future dividend payment of £110 million from one subsidiary. No other liability hasbeen recognised in respect of these differences because the <strong>Group</strong> is in a position to control the timing of the reversal of thetemporary differences, and it is probable that the differences will not reverse in the foreseeable future.The June <strong>2010</strong> United Kingdom Budget Statement included proposals to reduce the rate of UK corporation tax by1 per cent per annum from 28 per cent to 24 per cent by 1 April 2014. The change from 28 per cent to 27 per cent wasenacted at the balance sheet date and has, therefore, been included in these financial statements. The effect of thereduction to 27 per cent has been to reduce the deferred tax liability provided at 30 September <strong>2010</strong> by approximately£1 million. This £1 million decrease in the deferred tax liability has increased profit for the year by £2 million and decreasedother comprehensive income by £1 million.The proposed further reductions to 24 per cent by 1 April 2014 are expected to be enacted separately each year. The overalleffect of a further reduction to 24 per cent, if applied to the deferred tax balance at 30 September, would be to reduce thedeferred tax liability by approximately £4 million.140