Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

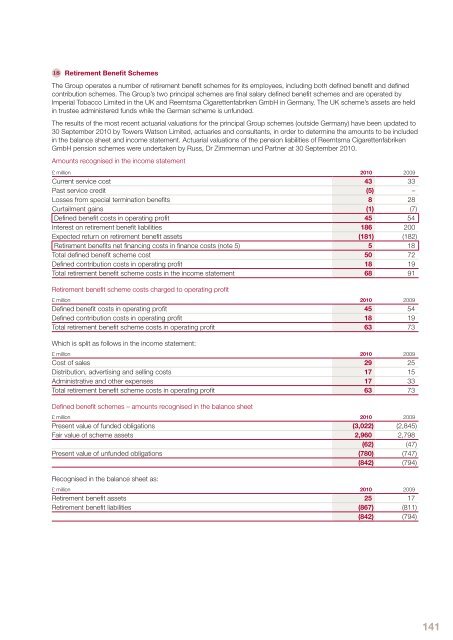

18 Retirement Benefit SchemesThe <strong>Group</strong> operates a number of retirement benefit schemes for its employees, including both defined benefit and definedcontribution schemes. The <strong>Group</strong>’s two principal schemes are final salary defined benefit schemes and are operated by<strong>Imperial</strong> <strong>Tobacco</strong> Limited in the UK and Reemtsma Cigarettenfabriken GmbH in Germany. The UK scheme’s assets are heldin trustee administered funds while the German scheme is unfunded.The results of the most recent actuarial valuations for the principal <strong>Group</strong> schemes (outside Germany) have been updated to30 September <strong>2010</strong> by Towers Watson Limited, actuaries and consultants, in order to determine the amounts to be includedin the balance sheet and income statement. Actuarial valuations of the pension liabilities of Reemtsma CigarettenfabrikenGmbH pension schemes were undertaken by Russ, Dr Zimmerman und Partner at 30 September <strong>2010</strong>.Amounts recognised in the income statement£ million <strong>2010</strong> 2009Current service cost 43 33Past service credit (5) –Losses from special termination benefits 8 28Curtailment gains (1) (7)Defined benefit costs in operating profit 45 54Interest on retirement benefit liabilities 186 200Expected return on retirement benefit assets (181) (182)Retirement benefits net financing costs in finance costs (note 5) 5 18Total defined benefit scheme cost 50 72Defined contribution costs in operating profit 18 19Total retirement benefit scheme costs in the income statement 68 91Retirement benefit scheme costs charged to operating profit£ million <strong>2010</strong> 2009Defined benefit costs in operating profit 45 54Defined contribution costs in operating profit 18 19Total retirement benefit scheme costs in operating profit 63 73Which is split as follows in the income statement:£ million <strong>2010</strong> 2009Cost of sales 29 25Distribution, advertising and selling costs 17 15Administrative and other expenses 17 33Total retirement benefit scheme costs in operating profit 63 73Defined benefit schemes – amounts recognised in the balance sheet£ million <strong>2010</strong> 2009Present value of funded obligations (3,022) (2,845)Fair value of scheme assets 2,960 2,798(62) (47)Present value of unfunded obligations (780) (747)(842) (794)Recognised in the balance sheet as:£ million <strong>2010</strong> 2009Retirement benefit assets 25 17Retirement benefit liabilities (867) (811)(842) (794)141