Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

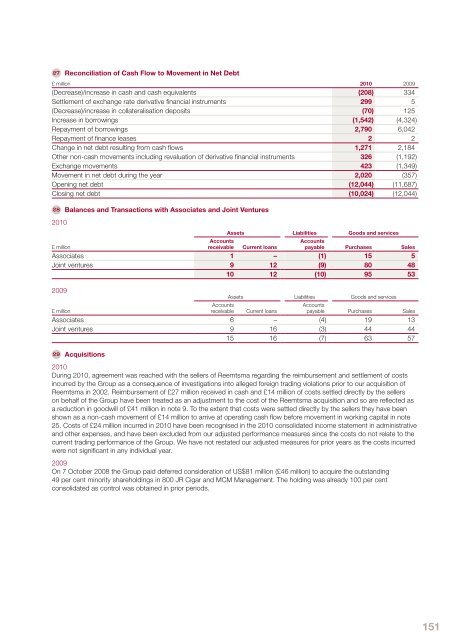

27 Reconciliation of Cash Flow to Movement in Net Debt£ million <strong>2010</strong> 2009(Decrease)/increase in cash and cash equivalents (208) 334Settlement of exchange rate derivative financial instruments 299 5(Decrease)/increase in collateralisation deposits (70) 125Increase in borrowings (1,542) (4,324)Repayment of borrowings 2,790 6,042Repayment of finance leases 2 2Change in net debt resulting from cash flows 1,271 2,184Other non-cash movements including revaluation of derivative financial instruments 326 (1,192)Exchange movements 423 (1,349)Movement in net debt during the year 2,020 (357)Opening net debt (12,044) (11,687)Closing net debt (10,024) (12,044)28 Balances and Transactions with Associates and Joint Ventures<strong>2010</strong>AccountsreceivableAssets Liabilities Goods and servicesAccountspayable Purchases Sales£ millionCurrent loansAssociates 1 – (1) 15 5Joint ventures 9 12 (9) 80 4810 12 (10) 95 532009AccountsreceivableAssets Liabilities Goods and servicesAccountspayable Purchases Sales£ millionCurrent loansAssociates 6 – (4) 19 13Joint ventures 9 16 (3) 44 4415 16 (7) 63 5729 Acquisitions<strong>2010</strong>During <strong>2010</strong>, agreement was reached with the sellers of Reemtsma regarding the reimbursement and settlement of costsincurred by the <strong>Group</strong> as a consequence of investigations into alleged foreign trading violations prior to our acquisition ofReemtsma in 2002. Reimbursement of £27 million received in cash and £14 million of costs settled directly by the sellerson behalf of the <strong>Group</strong> have been treated as an adjustment to the cost of the Reemtsma acquisition and so are reflected asa reduction in goodwill of £41 million in note 9. To the extent that costs were settled directly by the sellers they have beenshown as a non-cash movement of £14 million to arrive at operating cash flow before movement in working capital in note25. Costs of £24 million incurred in <strong>2010</strong> have been recognised in the <strong>2010</strong> consolidated income statement in administrativeand other expenses, and have been excluded from our adjusted performance measures since the costs do not relate to thecurrent trading performance of the <strong>Group</strong>. We have not restated our adjusted measures for prior years as the costs incurredwere not significant in any individual year.2009On 7 October 2008 the <strong>Group</strong> paid deferred consideration of US$81 million (£46 million) to acquire the outstanding49 per cent minority shareholdings in 800 JR Cigar and MCM Management. The holding was already 100 per centconsolidated as control was obtained in prior periods.151