Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

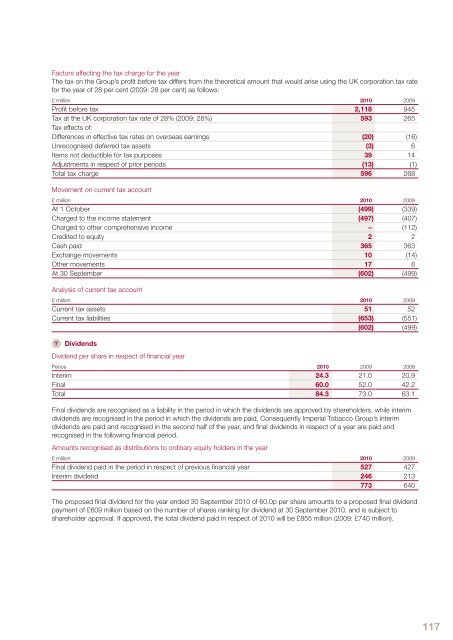

Factors affecting the tax charge for the yearThe tax on the <strong>Group</strong>’s profit before tax differs from the theoretical amount that would arise using the UK corporation tax ratefor the year of 28 per cent (2009: 28 per cent) as follows:£ million <strong>2010</strong> 2009Profit before tax 2,118 945Tax at the UK corporation tax rate of 28% (2009: 28%) 593 265Tax effects of:Differences in effective tax rates on overseas earnings (20) (16)Unrecognised deferred tax assets (3) 6Items not deductible for tax purposes 39 14Adjustments in respect of prior periods (13) (1)Total tax charge 596 268Movement on current tax account£ million <strong>2010</strong> 2009At 1 October (499) (339)Charged to the income statement (497) (407)Charged to other comprehensive income – (112)Credited to equity 2 2Cash paid 365 363Exchange movements 10 (14)Other movements 17 8At 30 September (602) (499)Analysis of current tax account£ million <strong>2010</strong> 2009Current tax assets 51 52Current tax liabilities (653) (551)(602) (499)7 DividendsDividend per share in respect of financial yearPence <strong>2010</strong> 2009 2008Interim 24.3 21.0 20.9Final 60.0 52.0 42.2Total 84.3 73.0 63.1Final dividends are recognised as a liability in the period in which the dividends are approved by shareholders, while interimdividends are recognised in the period in which the dividends are paid. Consequently <strong>Imperial</strong> <strong>Tobacco</strong> <strong>Group</strong>’s interimdividends are paid and recognised in the second half of the year, and final dividends in respect of a year are paid andrecognised in the following financial period.Amounts recognised as distributions to ordinary equity holders in the year£ million <strong>2010</strong> 2009Final dividend paid in the period in respect of previous financial year 527 427Interim dividend 246 213773 640The proposed final dividend for the year ended 30 September <strong>2010</strong> of 60.0p per share amounts to a proposed final dividendpayment of £609 million based on the number of shares ranking for dividend at 30 September <strong>2010</strong>, and is subject toshareholder approval. If approved, the total dividend paid in respect of <strong>2010</strong> will be £855 million (2009: £740 million).117