Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

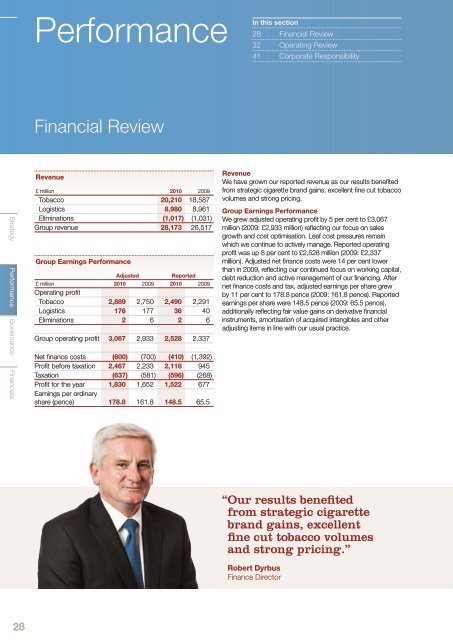

PerformanceIn this section28 Financial Review32 Operating Review41 Corporate ResponsibilityFinancial ReviewStrategy Performance Governance FinancialsRevenue£ million <strong>2010</strong> 2009<strong>Tobacco</strong> 20,210 18,587Logistics 8,980 8,961Eliminations (1,017) (1,031)<strong>Group</strong> revenue 28,173 26,517<strong>Group</strong> Earnings PerformanceAdjustedReported£ million <strong>2010</strong> 2009 <strong>2010</strong> 2009Operating profit<strong>Tobacco</strong> 2,889 2,750 2,490 2,291Logistics 176 177 36 40Eliminations 2 6 2 6<strong>Group</strong> operating profit 3,067 2,933 2,528 2,337Net finance costs (600) (700) (410) (1,392)Profit before taxation 2,467 2,233 2,118 945Taxation (637) (581) (596) (268)Profit for the year 1,830 1,652 1,522 677Earnings per ordinaryshare (pence) 178.8 161.8 148.5 65.5RevenueWe have grown our <strong>report</strong>ed revenue as our results benefitedfrom strategic cigarette brand gains, excellent fine cut tobaccovolumes and strong pricing.<strong>Group</strong> Earnings PerformanceWe grew adjusted operating profit by 5 per cent to £3,067million (2009: £2,933 million) reflecting our focus on salesgrowth and cost optimisation. Leaf cost pressures remainwhich we continue to actively manage. Reported operatingprofit was up 8 per cent to £2,528 million (2009: £2,337million). Adjusted net finance costs were 14 per cent lowerthan in 2009, reflecting our continued focus on working capital,debt reduction and active management of our financing. Afternet finance costs and tax, adjusted earnings per share grewby 11 per cent to 178.8 pence (2009: 161.8 pence). Reportedearnings per share were 148.5 pence (2009: 65.5 pence),additionally reflecting fair value gains on derivative financialinstruments, amortisation of acquired intangibles and otheradjusting items in line with our usual practice.“Our results benefitedfrom strategic cigarettebrand gains, excellentfine cut tobacco volumesand strong pricing.”Robert DyrbusFinance Director28