Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

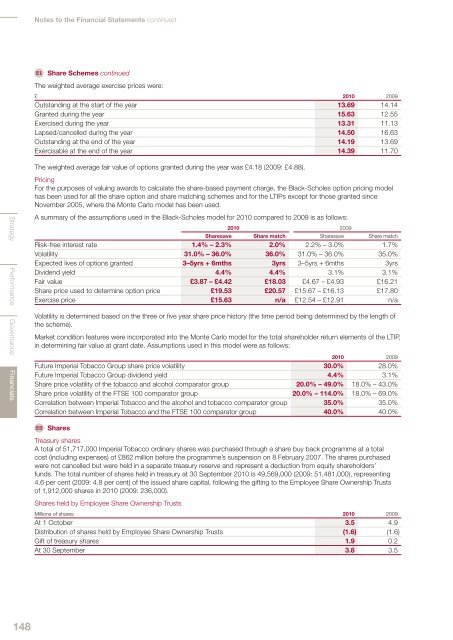

Notes to the Financial Statements continued21 Share Schemes continuedThe weighted average exercise prices were:£ <strong>2010</strong> 2009Outstanding at the start of the year 13.69 14.14Granted during the year 15.63 12.55Exercised during the year 13.31 11.13Lapsed/cancelled during the year 14.50 16.63Outstanding at the end of the year 14.19 13.69Exercisable at the end of the year 14.39 11.70The weighted average fair value of options granted during the year was £4.18 (2009: £4.88).PricingFor the purposes of valuing awards to calculate the share-based payment charge, the Black-Scholes option pricing modelhas been used for all the share option and share matching schemes and for the LTIPs except for those granted sinceNovember 2005, where the Monte Carlo model has been used.Strategy Performance Governance FinancialsA summary of the assumptions used in the Black-Scholes model for <strong>2010</strong> compared to 2009 is as follows:<strong>2010</strong> 2009Sharesave Share match Sharesave Share matchRisk-free interest rate 1.4% – 2.3% 2.0% 2.2% – 3.0% 1.7%Volatility 31.0% – 36.0% 36.0% 31.0% – 36.0% 35.0%Expected lives of options granted 3–5yrs + 6mths 3yrs 3–5yrs + 6mths 3yrsDividend yield 4.4% 4.4% 3.1% 3.1%Fair value £3.87 – £4.42 £18.03 £4.67 – £4.93 £16.21Share price used to determine option price £19.53 £20.57 £15.67 – £16.13 £17.80Exercise price £15.63 n/a £12.54 – £12.91 n/aVolatility is determined based on the three or five year share price history (the time period being determined by the length ofthe scheme).Market condition features were incorporated into the Monte Carlo model for the total shareholder return elements of the LTIP,in determining fair value at grant date. Assumptions used in this model were as follows:<strong>2010</strong> 2009Future <strong>Imperial</strong> <strong>Tobacco</strong> <strong>Group</strong> share price volatility 30.0% 28.0%Future <strong>Imperial</strong> <strong>Tobacco</strong> <strong>Group</strong> dividend yield 4.4% 3.1%Share price volatility of the tobacco and alcohol comparator group 20.0% – 49.0% 18.0% – 43.0%Share price volatility of the FTSE 100 comparator group 20.0% – 114.0% 18.0% – 69.0%Correlation between <strong>Imperial</strong> <strong>Tobacco</strong> and the alcohol and tobacco comparator group 35.0% 35.0%Correlation between <strong>Imperial</strong> <strong>Tobacco</strong> and the FTSE 100 comparator group 40.0% 40.0%22 SharesTreasury sharesA total of 51,717,000 <strong>Imperial</strong> <strong>Tobacco</strong> ordinary shares was purchased through a share buy back programme at a totalcost (including expenses) of £862 million before the programme’s suspension on 8 February 2007. The shares purchasedwere not cancelled but were held in a separate treasury reserve and represent a deduction from equity shareholders’funds. The total number of shares held in treasury at 30 September <strong>2010</strong> is 49,569,000 (2009: 51,481,000), representing4.6 per cent (2009: 4.8 per cent) of the issued share capital, following the gifting to the Employee Share Ownership Trustsof 1,912,000 shares in <strong>2010</strong> (2009: 236,000).Shares held by Employee Share Ownership TrustsMillions of shares <strong>2010</strong> 2009At 1 October 3.5 4.9Distribution of shares held by Employee Share Ownership Trusts (1.6) (1.6)Gift of treasury shares 1.9 0.2At 30 September 3.8 3.5148