Consolidated Balance Sheetat 30 September <strong>2010</strong>Strategy Performance Governance Financials30 September<strong>2010</strong>30 September200930 September2008£ million NotesNon-current assetsIntangible assets 9 20,941 22,357 19,817Property, plant and equipment 10 1,971 2,010 1,820Investments in associates 11 18 22 16Retirement benefit assets 18 25 17 441Trade and other receivables 13 97 99 98Derivative financial instruments 16 327 134 120Deferred tax assets 17 150 148 39223,529 24,787 22,704Current assetsInventories 12 3,019 2,925 2,858Trade and other receivables 13 3,000 3,011 2,951Current tax assets 6 51 52 31Cash and cash equivalents 14 773 1,036 642Derivative financial instruments 16 243 198 997,086 7,222 6,581Total assets 30,615 32,009 29,285Current liabilitiesBorrowings 16 (329) (2,560) (2,678)Derivative financial instruments 16 (262) (284) (123)Trade and other payables 15 (7,710) (7,451) (6,183)Finance lease liabilities 26 (1) (2) (2)Current tax liabilities 6 (653) (551) (370)Provisions 19 (187) (292) (187)(9,142) (11,140) (9,543)Non-current liabilitiesBorrowings 16 (10,003) (9,507) (9,558)Derivative financial instruments 16 (748) (1,033) (163)Trade and other payables 15 (21) (23) (14)Finance lease liabilities 26 (24) (26) (24)Deferred tax liabilities 17 (2,074) (2,098) (2,310)Retirement benefit liabilities 18 (867) (811) (546)Provisions 19 (647) (776) (771)(14,384) (14,274) (13,386)Total liabilities (23,526) (25,414) (22,929)Net assets 7,089 6,595 6,356EquityShare capital 20 107 107 107Share premium 5,833 5,833 5,833Retained earnings 206 (469) (109)Exchange translation reserve 883 1,067 476Equity attributable to owners of the parent 7,029 6,538 6,307Non-controlling interests 60 57 49Total equity 7,089 6,595 6,356In accordance with IAS 1 (Revised) Presentation of Financial Statements and as explained in the Accounting Policies note,previously <strong>report</strong>ed figures for derivative financial instruments have been re-analysed between current and non-currentclassifications, and an additional balance sheet has been presented as at 30 September 2008.The financial statements on pages 98 to 151 were approved by the Board of Directors on 2 November <strong>2010</strong> and signed onits behalf by:Iain NapierChairmanRobert DyrbusDirector100

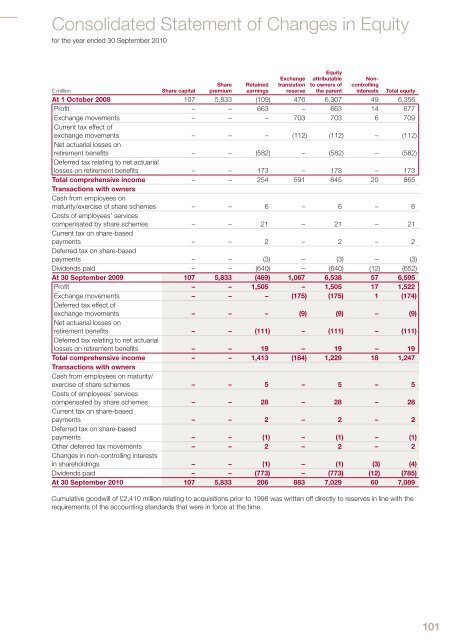

Consolidated Statement of Changes in Equityfor the year ended 30 September <strong>2010</strong>SharepremiumRetainedearningsExchangetranslationreserveEquityattributableto owners ofthe parentNoncontrollinginterests£ million Share capitalTotal equityAt 1 October 2008 107 5,833 (109) 476 6,307 49 6,356Profit – – 663 – 663 14 677Exchange movements – – – 703 703 6 709Current tax effect ofexchange movements – – – (112) (112) – (112)Net actuarial losses onretirement benefits – – (582) – (582) – (582)Deferred tax relating to net actuariallosses on retirement benefits – – 173 – 173 – 173Total comprehensive income – – 254 591 845 20 865Transactions with ownersCash from employees onmaturity/exercise of share schemes – – 6 – 6 – 6Costs of employees’ servicescompensated by share schemes – – 21 – 21 – 21Current tax on share-basedpayments – – 2 – 2 – 2Deferred tax on share-basedpayments – – (3) – (3) – (3)Dividends paid – – (640) – (640) (12) (652)At 30 September 2009 107 5,833 (469) 1,067 6,538 57 6,595Profit – – 1,505 – 1,505 17 1,522Exchange movements – – – (175) (175) 1 (174)Deferred tax effect ofexchange movements – – – (9) (9) – (9)Net actuarial losses onretirement benefits – – (111) – (111) – (111)Deferred tax relating to net actuariallosses on retirement benefits – – 19 – 19 – 19Total comprehensive income – – 1,413 (184) 1,229 18 1,247Transactions with ownersCash from employees on maturity/exercise of share schemes – – 5 – 5 – 5Costs of employees’ servicescompensated by share schemes – – 28 – 28 – 28Current tax on share-basedpayments – – 2 – 2 – 2Deferred tax on share-basedpayments – – (1) – (1) – (1)Other deferred tax movements – – 2 – 2 – 2Changes in non-controlling interestsin shareholdings – – (1) – (1) (3) (4)Dividends paid – – (773) – (773) (12) (785)At 30 September <strong>2010</strong> 107 5,833 206 883 7,029 60 7,089Cumulative goodwill of £2,410 million relating to acquisitions prior to 1998 was written off directly to reserves in line with therequirements of the accounting standards that were in force at the time.101

- Page 1 and 2:

Imperial Tobacco Group PLCAnnual Re

- Page 3 and 4:

…to deliver sustainableshareholde

- Page 5 and 6:

Operational HighlightsDelivering Su

- Page 7 and 8:

and product portfolio to evolving c

- Page 9 and 10:

In this section9 Strategic Review10

- Page 11 and 12:

Our StrategyWe are focused on deliv

- Page 13 and 14:

Total Tobacco5 % Our Powerful Brand

- Page 15 and 16:

Our global strategic cigarette bran

- Page 17 and 18:

Our global team is fully aligned be

- Page 19 and 20:

Satisfying consumers and aligning o

- Page 21 and 22:

We are a responsive business with s

- Page 23 and 24:

Operating responsibly, combined wit

- Page 25 and 26:

Our growth drivers of sales growth,

- Page 27 and 28:

Principal Risks and UncertaintiesA

- Page 29 and 30:

Competition LawOverviewWe take comp

- Page 31 and 32:

Reconciliation of Adjusted Performa

- Page 33 and 34:

Key Performance Indicators (KPIs) 1

- Page 35 and 36:

Lambert & Butler and Richmond remai

- Page 37 and 38:

Within this the travel retail marke

- Page 39 and 40:

OutlookThe strength of our portfoli

- Page 41 and 42:

Blondes. In the Middle East, we aga

- Page 43 and 44:

Corporate ResponsibilityOur Corpora

- Page 45 and 46:

Corporate Responsibility and our St

- Page 47 and 48:

We have revised our IMS and employe

- Page 49 and 50:

Environmental Performance 1Absolute

- Page 51 and 52: across the business. More informati

- Page 53 and 54: Supplier RelationshipsOur main supp

- Page 55 and 56: Non-financial performance indicator

- Page 57 and 58: “High standards of corporategover

- Page 59 and 60: 5. Pierre Jungels, CBE (HON), PHD,

- Page 61 and 62: Management and Corporate StructureB

- Page 63 and 64: Meetings of the Board, Board Commit

- Page 65 and 66: and supplemented by our Non-Executi

- Page 67 and 68: 6 Performance evaluation: How do we

- Page 69 and 70: The Board recognises that we operat

- Page 71 and 72: Assurance process for financial rep

- Page 73 and 74: - receiving reports from, and quest

- Page 75 and 76: Directors’ Report: Other Informat

- Page 77 and 78: - state whether IFRSs as adopted by

- Page 79 and 80: We understand that a purported coll

- Page 81 and 82: This Report covers the following:1

- Page 83 and 84: 2 Directors’ Emoluments for the Y

- Page 85 and 86: Directors’ Interests in Ordinary

- Page 87 and 88: Executive Directors’ Service Agre

- Page 89 and 90: When setting base salary the Remune

- Page 91 and 92: First ElementFifty per cent of the

- Page 93 and 94: In respect of the October 2007 - Oc

- Page 95 and 96: Any annual bonus earned up to 100 p

- Page 97 and 98: Benefit Trusts have also been provi

- Page 99 and 100: Independent Auditors’ Reportto th

- Page 101: Consolidated Statement ofComprehens

- Page 105 and 106: Accounting PoliciesBasis of Prepara

- Page 107 and 108: Duty and Similar ItemsDuty and simi

- Page 109 and 110: InventoriesInventories are stated a

- Page 111 and 112: Restructuring CostsSignificant one-

- Page 113 and 114: Property, Plant and Equipment and I

- Page 115 and 116: Tobacco net revenue£ million 2010

- Page 117 and 118: 3 Restructuring Costs£ million 201

- Page 119 and 120: Factors affecting the tax charge fo

- Page 121 and 122: 9 Intangible Assets2010£ million G

- Page 123 and 124: 10 Property, Plant and Equipment201

- Page 125 and 126: 13 Trade and Other Receivables2010

- Page 127 and 128: Sensitivity analysisIFRS 7 requires

- Page 129 and 130: At 30 September 2009Balance sheetam

- Page 131 and 132: (iii) Currency analysis and effecti

- Page 133 and 134: (iv) Derivative financial instrumen

- Page 135 and 136: Matures in financial year ending in

- Page 137 and 138: The following tables are provided i

- Page 139 and 140: Matures in financial year ending in

- Page 141 and 142: (vi) Hedge of net investments in fo

- Page 143 and 144: 18 Retirement Benefit SchemesThe Gr

- Page 145 and 146: Assumptions regarding future mortal

- Page 147 and 148: 21 Share SchemesThe Group recognise

- Page 149 and 150: Year from 1 October 2008 to 30 Sept

- Page 151 and 152: 23 CommitmentsCapital commitments£

- Page 153 and 154:

27 Reconciliation of Cash Flow to M

- Page 155 and 156:

Imperial Tobacco Group PLC Balance

- Page 157 and 158:

(iii) Debtors: Amounts Falling Due

- Page 159 and 160:

Principal SubsidiariesThe principal

- Page 161 and 162:

Shareholder InformationRegistered O

- Page 163 and 164:

IndexAAccounting Policies 103Acquis