Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

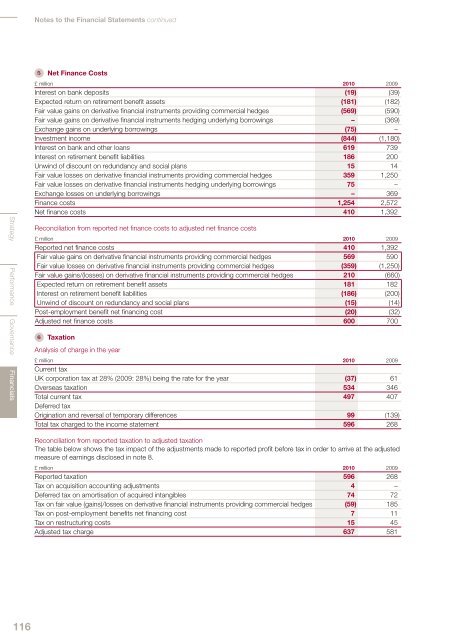

Notes to the Financial Statements continued5 Net Finance CostsStrategy Performance Governance Financials£ million <strong>2010</strong> 2009Interest on bank deposits (19) (39)Expected return on retirement benefit assets (181) (182)Fair value gains on derivative financial instruments providing commercial hedges (569) (590)Fair value gains on derivative financial instruments hedging underlying borrowings – (369)Exchange gains on underlying borrowings (75) –Investment income (844) (1,180)Interest on bank and other loans 619 739Interest on retirement benefit liabilities 186 200Unwind of discount on redundancy and social plans 15 14Fair value losses on derivative financial instruments providing commercial hedges 359 1,250Fair value losses on derivative financial instruments hedging underlying borrowings 75 –Exchange losses on underlying borrowings – 369Finance costs 1,254 2,572Net finance costs 410 1,392Reconciliation from <strong>report</strong>ed net finance costs to adjusted net finance costs£ million <strong>2010</strong> 2009Reported net finance costs 410 1,392Fair value gains on derivative financial instruments providing commercial hedges 569 590Fair value losses on derivative financial instruments providing commercial hedges (359) (1,250)Fair value gains/(losses) on derivative financial instruments providing commercial hedges 210 (660)Expected return on retirement benefit assets 181 182Interest on retirement benefit liabilities (186) (200)Unwind of discount on redundancy and social plans (15) (14)Post-employment benefit net financing cost (20) (32)Adjusted net finance costs 600 7006 TaxationAnalysis of charge in the year£ million <strong>2010</strong> 2009Current taxUK corporation tax at 28% (2009: 28%) being the rate for the year (37) 61Overseas taxation 534 346Total current tax 497 407Deferred taxOrigination and reversal of temporary differences 99 (139)Total tax charged to the income statement 596 268Reconciliation from <strong>report</strong>ed taxation to adjusted taxationThe table below shows the tax impact of the adjustments made to <strong>report</strong>ed profit before tax in order to arrive at the adjustedmeasure of earnings disclosed in note 8.£ million <strong>2010</strong> 2009Reported taxation 596 268Tax on acquisition accounting adjustments 4 –Deferred tax on amortisation of acquired intangibles 74 72Tax on fair value (gains)/losses on derivative financial instruments providing commercial hedges (59) 185Tax on post-employment benefits net financing cost 7 11Tax on restructuring costs 15 45Adjusted tax charge 637 581116