Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

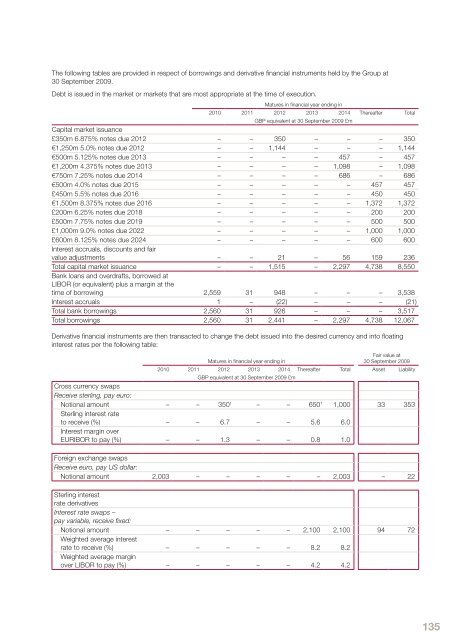

The following tables are provided in respect of borrowings and derivative financial instruments held by the <strong>Group</strong> at30 September 2009.Debt is issued in the market or markets that are most appropriate at the time of execution.Matures in financial year ending in<strong>2010</strong> 2011 2012 2013 2014 Thereafter TotalGBP equivalent at 30 September 2009 £mCapital market issuance£350m 6.875% notes due 2012 – – 350 – – – 350€1,250m 5.0% notes due 2012 – – 1,144 – – – 1,144€500m 5.125% notes due 2013 – – – – 457 – 457€1,200m 4.375% notes due 2013 – – – – 1,098 – 1,098€750m 7.25% notes due 2014 – – – – 686 – 686€500m 4.0% notes due 2015 – – – – – 457 457£450m 5.5% notes due 2016 – – – – – 450 450€1,500m 8.375% notes due 2016 – – – – – 1,372 1,372£200m 6.25% notes due 2018 – – – – – 200 200£500m 7.75% notes due 2019 – – – – – 500 500£1,000m 9.0% notes due 2022 – – – – – 1,000 1,000£600m 8.125% notes due 2024 – – – – – 600 600Interest accruals, discounts and fairvalue adjustments – – 21 – 56 159 236Total capital market issuance – – 1,515 – 2,297 4,738 8,550Bank loans and overdrafts, borrowed atLIBOR (or equivalent) plus a margin at thetime of borrowing 2,559 31 948 – – – 3,538Interest accruals 1 – (22) – – – (21)Total bank borrowings 2,560 31 926 – – – 3,517Total borrowings 2,560 31 2,441 – 2,297 4,738 12,067Derivative financial instruments are then transacted to change the debt issued into the desired currency and into floatinginterest rates per the following table:Fair value atMatures in financial year ending in30 September 2009<strong>2010</strong> 2011 2012 2013 2014 Thereafter Total Asset LiabilityGBP equivalent at 30 September 2009 £mCross currency swapsReceive sterling, pay euro:Notional amount – – 350 1 – – 650 1 1,000 33 353Sterling interest rateto receive (%) – – 6.7 – – 5.6 6.0Interest margin overEURIBOR to pay (%) – – 1.3 – – 0.8 1.0Foreign exchange swapsReceive euro, pay US dollar:Notional amount 2,003 – – – – – 2,003 – 22Sterling interestrate derivativesInterest rate swaps –pay variable, receive fixed:Notional amount – – – – – 2,100 2,100 94 72Weighted average interestrate to receive (%) – – – – – 8.2 8.2Weighted average marginover LIBOR to pay (%) – – – – – 4.2 4.2135