Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

Annual report 2010 - Imperial Tobacco Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

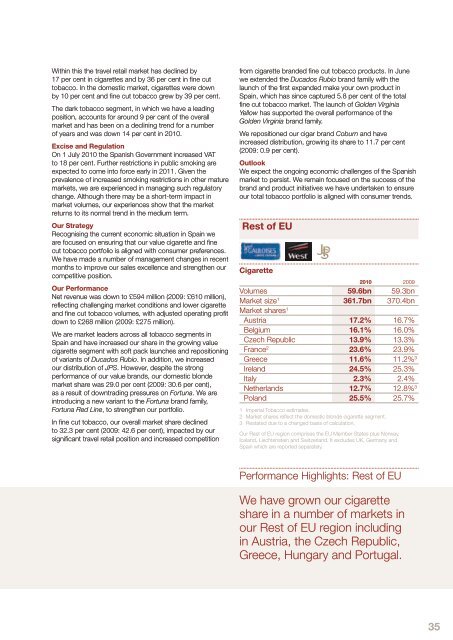

Within this the travel retail market has declined by17 per cent in cigarettes and by 36 per cent in fine cuttobacco. In the domestic market, cigarettes were downby 10 per cent and fine cut tobacco grew by 39 per cent.The dark tobacco segment, in which we have a leadingposition, accounts for around 9 per cent of the overallmarket and has been on a declining trend for a numberof years and was down 14 per cent in <strong>2010</strong>.Excise and RegulationOn 1 July <strong>2010</strong> the Spanish Government increased VATto 18 per cent. Further restrictions in public smoking areexpected to come into force early in 2011. Given theprevalence of increased smoking restrictions in other maturemarkets, we are experienced in managing such regulatorychange. Although there may be a short-term impact inmarket volumes, our experiences show that the marketreturns to its normal trend in the medium term.Our StrategyRecognising the current economic situation in Spain weare focused on ensuring that our value cigarette and finecut tobacco portfolio is aligned with consumer preferences.We have made a number of management changes in recentmonths to improve our sales excellence and strengthen ourcompetitive position.Our PerformanceNet revenue was down to £594 million (2009: £610 million),reflecting challenging market conditions and lower cigaretteand fine cut tobacco volumes, with adjusted operating profitdown to £268 million (2009: £275 million).We are market leaders across all tobacco segments inSpain and have increased our share in the growing valuecigarette segment with soft pack launches and repositioningof variants of Ducados Rubio. In addition, we increasedour distribution of JPS. However, despite the strongperformance of our value brands, our domestic blondemarket share was 29.0 per cent (2009: 30.6 per cent),as a result of downtrading pressures on Fortuna. We areintroducing a new variant to the Fortuna brand family,Fortuna Red Line, to strengthen our portfolio.In fine cut tobacco, our overall market share declinedto 32.3 per cent (2009: 42.6 per cent), impacted by oursignificant travel retail position and increased competitionfrom cigarette branded fine cut tobacco products. In Junewe extended the Ducados Rubio brand family with thelaunch of the first expanded make your own product inSpain, which has since captured 5.8 per cent of the totalfine cut tobacco market. The launch of Golden VirginiaYellow has supported the overall performance of theGolden Virginia brand family.We repositioned our cigar brand Coburn and haveincreased distribution, growing its share to 11.7 per cent(2009: 0.9 per cent).OutlookWe expect the ongoing economic challenges of the Spanishmarket to persist. We remain focused on the success of thebrand and product initiatives we have undertaken to ensureour total tobacco portfolio is aligned with consumer trends.Rest of EUCigarette<strong>2010</strong> 2009Volumes 59.6bn 59.3bnMarket size 1 361.7bn 370.4bnMarket shares 1Austria 17.2% 16.7%Belgium 16.1% 16.0%Czech Republic 13.9% 13.3%France 2 23.6% 23.9%Greece 11.6% 11.2% 3Ireland 24.5% 25.3%Italy 2.3% 2.4%Netherlands 12.7% 12.8% 3Poland 25.5% 25.7%1 <strong>Imperial</strong> <strong>Tobacco</strong> estimates.2 Market shares reflect the domestic blonde cigarette segment.3 Restated due to a changed basis of calculation.Our Rest of EU region comprises the EU Member States plus Norway,Iceland, Liechtenstein and Switzerland. It excludes UK, Germany andSpain which are <strong>report</strong>ed separately.Performance Highlights: Rest of EUWe have grown our cigaretteshare in a number of markets inour Rest of EU region includingin Austria, the Czech Republic,Greece, Hungary and Portugal.35