- Page 1 and 2:

Imperial Tobacco Group PLCAnnual Re

- Page 3 and 4:

…to deliver sustainableshareholde

- Page 5 and 6:

Operational HighlightsDelivering Su

- Page 7 and 8:

and product portfolio to evolving c

- Page 9 and 10:

In this section9 Strategic Review10

- Page 11 and 12:

Our StrategyWe are focused on deliv

- Page 13 and 14:

Total Tobacco5 % Our Powerful Brand

- Page 15 and 16:

Our global strategic cigarette bran

- Page 17 and 18:

Our global team is fully aligned be

- Page 19 and 20:

Satisfying consumers and aligning o

- Page 21 and 22:

We are a responsive business with s

- Page 23 and 24:

Operating responsibly, combined wit

- Page 25 and 26:

Our growth drivers of sales growth,

- Page 27 and 28:

Principal Risks and UncertaintiesA

- Page 29 and 30:

Competition LawOverviewWe take comp

- Page 31 and 32:

Reconciliation of Adjusted Performa

- Page 33 and 34:

Key Performance Indicators (KPIs) 1

- Page 35 and 36:

Lambert & Butler and Richmond remai

- Page 37 and 38:

Within this the travel retail marke

- Page 39 and 40:

OutlookThe strength of our portfoli

- Page 41 and 42:

Blondes. In the Middle East, we aga

- Page 43 and 44:

Corporate ResponsibilityOur Corpora

- Page 45 and 46:

Corporate Responsibility and our St

- Page 47 and 48:

We have revised our IMS and employe

- Page 49 and 50:

Environmental Performance 1Absolute

- Page 51 and 52:

across the business. More informati

- Page 53 and 54:

Supplier RelationshipsOur main supp

- Page 55 and 56:

Non-financial performance indicator

- Page 57 and 58:

“High standards of corporategover

- Page 59 and 60:

5. Pierre Jungels, CBE (HON), PHD,

- Page 61 and 62:

Management and Corporate StructureB

- Page 63 and 64:

Meetings of the Board, Board Commit

- Page 65 and 66:

and supplemented by our Non-Executi

- Page 67 and 68:

6 Performance evaluation: How do we

- Page 69 and 70:

The Board recognises that we operat

- Page 71 and 72:

Assurance process for financial rep

- Page 73 and 74:

- receiving reports from, and quest

- Page 75 and 76:

Directors’ Report: Other Informat

- Page 77 and 78:

- state whether IFRSs as adopted by

- Page 79 and 80:

We understand that a purported coll

- Page 81 and 82:

This Report covers the following:1

- Page 83 and 84:

2 Directors’ Emoluments for the Y

- Page 85 and 86:

Directors’ Interests in Ordinary

- Page 87 and 88: Executive Directors’ Service Agre

- Page 89 and 90: When setting base salary the Remune

- Page 91 and 92: First ElementFifty per cent of the

- Page 93 and 94: In respect of the October 2007 - Oc

- Page 95 and 96: Any annual bonus earned up to 100 p

- Page 97 and 98: Benefit Trusts have also been provi

- Page 99 and 100: Independent Auditors’ Reportto th

- Page 101 and 102: Consolidated Statement ofComprehens

- Page 103 and 104: Consolidated Statement of Changes i

- Page 105 and 106: Accounting PoliciesBasis of Prepara

- Page 107 and 108: Duty and Similar ItemsDuty and simi

- Page 109 and 110: InventoriesInventories are stated a

- Page 111 and 112: Restructuring CostsSignificant one-

- Page 113 and 114: Property, Plant and Equipment and I

- Page 115 and 116: Tobacco net revenue£ million 2010

- Page 117 and 118: 3 Restructuring Costs£ million 201

- Page 119 and 120: Factors affecting the tax charge fo

- Page 121 and 122: 9 Intangible Assets2010£ million G

- Page 123 and 124: 10 Property, Plant and Equipment201

- Page 125 and 126: 13 Trade and Other Receivables2010

- Page 127 and 128: Sensitivity analysisIFRS 7 requires

- Page 129 and 130: At 30 September 2009Balance sheetam

- Page 131 and 132: (iii) Currency analysis and effecti

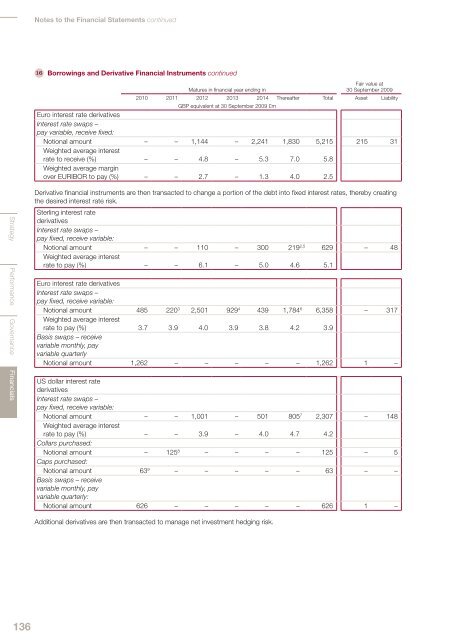

- Page 133 and 134: (iv) Derivative financial instrumen

- Page 135 and 136: Matures in financial year ending in

- Page 137: The following tables are provided i

- Page 141 and 142: (vi) Hedge of net investments in fo

- Page 143 and 144: 18 Retirement Benefit SchemesThe Gr

- Page 145 and 146: Assumptions regarding future mortal

- Page 147 and 148: 21 Share SchemesThe Group recognise

- Page 149 and 150: Year from 1 October 2008 to 30 Sept

- Page 151 and 152: 23 CommitmentsCapital commitments£

- Page 153 and 154: 27 Reconciliation of Cash Flow to M

- Page 155 and 156: Imperial Tobacco Group PLC Balance

- Page 157 and 158: (iii) Debtors: Amounts Falling Due

- Page 159 and 160: Principal SubsidiariesThe principal

- Page 161 and 162: Shareholder InformationRegistered O

- Page 163 and 164: IndexAAccounting Policies 103Acquis