Annual Performance Plan 508

Annual Performance Plan 508

Annual Performance Plan 508

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

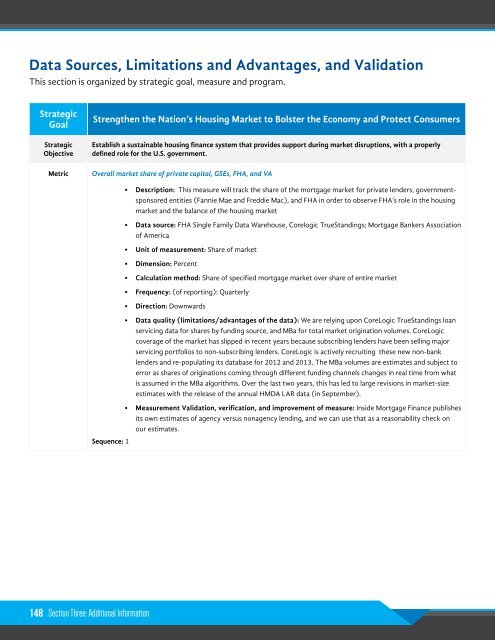

Data Sources, Limitations and Advantages, and Validation<br />

This section is organized by strategic goal, measure and program.<br />

Strategic<br />

Goal<br />

Strategic<br />

Objective<br />

Metric<br />

Strengthen the Nation’s Housing Market to Bolster the Economy and Protect Consumers<br />

Establish a sustainable housing finance system that provides support during market disruptions, with a properly<br />

defined role for the U.S. government.<br />

Overall market share of private capital, GSEs, FHA, and VA<br />

• Description: This measure will track the share of the mortgage market for private lenders, governmentsponsored<br />

entities (Fannie Mae and Freddie Mac), and FHA in order to observe FHA’s role in the housing<br />

market and the balance of the housing market<br />

• Data source: FHA Single Family Data Warehouse, Corelogic TrueStandings; Mortgage Bankers Association<br />

of America<br />

• Unit of measurement: Share of market<br />

• Dimension: Percent<br />

• Calculation method: Share of specified mortgage market over share of entire market<br />

• Frequency: (of reporting): Quarterly<br />

• Direction: Downwards<br />

• Data quality (limitations/advantages of the data): We are relying upon CoreLogic TrueStandings loan<br />

servicing data for shares by funding source, and MBa for total market origination volumes. CoreLogic<br />

coverage of the market has slipped in recent years because subscribing lenders have been selling major<br />

servicing portfolios to non-subscribing lenders. CoreLogic is actively recruiting these new non-bank<br />

lenders and re-populating its database for 2012 and 2013. The MBa volumes are estimates and subject to<br />

error as shares of originations coming through different funding channels changes in real time from what<br />

is assumed in the MBa algorithms. Over the last two years, this has led to large revisions in market-size<br />

estimates with the release of the annual HMDA LAR data (in September).<br />

• Measurement Validation, verification, and improvement of measure: Inside Mortgage Finance publishes<br />

its own estimates of agency versus nonagency lending, and we can use that as a reasonability check on<br />

our estimates.<br />

Sequence: 1<br />

148 Section Three: Additional Information