Annual Performance Plan 508

Annual Performance Plan 508

Annual Performance Plan 508

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

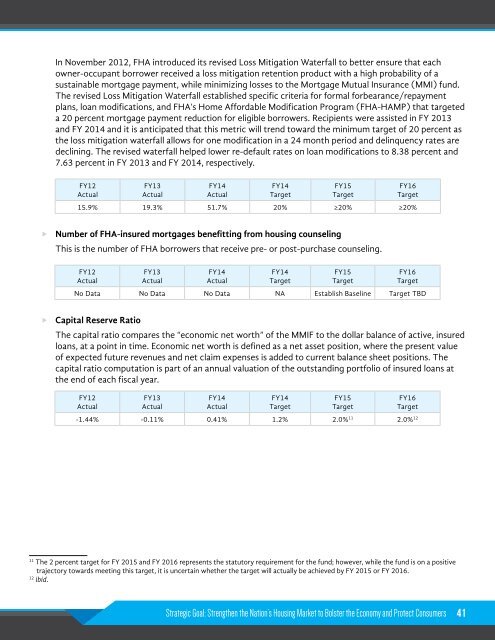

In November 2012, FHA introduced its revised Loss Mitigation Waterfall to better ensure that each<br />

owner-occupant borrower received a loss mitigation retention product with a high probability of a<br />

sustainable mortgage payment, while minimizing losses to the Mortgage Mutual Insurance (MMI) fund.<br />

The revised Loss Mitigation Waterfall established specific criteria for formal forbearance/repayment<br />

plans, loan modifications, and FHA’s Home Affordable Modification Program (FHA-HAMP) that targeted<br />

a 20 percent mortgage payment reduction for eligible borrowers. Recipients were assisted in FY 2013<br />

and FY 2014 and it is anticipated that this metric will trend toward the minimum target of 20 percent as<br />

the loss mitigation waterfall allows for one modification in a 24 month period and delinquency rates are<br />

declining. The revised waterfall helped lower re-default rates on loan modifications to 8.38 percent and<br />

7.63 percent in FY 2013 and FY 2014, respectively.<br />

FY12<br />

Actual<br />

FY13<br />

Actual<br />

FY14<br />

Actual<br />

FY14<br />

Target<br />

FY15<br />

Target<br />

FY16<br />

Target<br />

15.9% 19.3% 51.7% 20% ≥20% ≥20%<br />

Number of FHA-insured mortgages benefitting from housing counseling<br />

This is the number of FHA borrowers that receive pre- or post-purchase counseling.<br />

FY12<br />

Actual<br />

FY13<br />

Actual<br />

FY14<br />

Actual<br />

FY14<br />

Target<br />

FY15<br />

Target<br />

FY16<br />

Target<br />

No Data No Data No Data NA Establish Baseline Target TBD<br />

Capital Reserve Ratio<br />

The capital ratio compares the “economic net worth” of the MMIF to the dollar balance of active, insured<br />

loans, at a point in time. Economic net worth is defined as a net asset position, where the present value<br />

of expected future revenues and net claim expenses is added to current balance sheet positions. The<br />

capital ratio computation is part of an annual valuation of the outstanding portfolio of insured loans at<br />

the end of each fiscal year.<br />

FY12<br />

Actual<br />

FY13<br />

Actual<br />

FY14<br />

Actual<br />

FY14<br />

Target<br />

FY15<br />

Target<br />

FY16<br />

Target<br />

-1.44% -0.11% 0.41% 1.2% 2.0% 11 2.0% 12<br />

11<br />

The 2 percent target for FY 2015 and FY 2016 represents the statutory requirement for the fund; however, while the fund is on a positive<br />

trajectory towards meeting this target, it is uncertain whether the target will actually be achieved by FY 2015 or FY 2016.<br />

12<br />

ibid.<br />

Strategic Goal: Strengthen the Nation’s Housing Market to Bolster the Economy and Protect Consumers<br />

41