- Page 1 and 2: U.S. Department of Housing and Urba

- Page 3 and 4: Strategic Goal: Build Strong, Resil

- Page 5 and 6: About this Report About this Report

- Page 7 and 8: Some of the performance indicators

- Page 9 and 10: Section One: Agency and Mission Sec

- Page 11 and 12: Message from Secretary Castro I’m

- Page 13 and 14: Introduction This Fiscal Year (FY)

- Page 15 and 16: “ Those experiencing homelessness

- Page 17 and 18: Impact Veterans Family Housing Cent

- Page 19 and 20: Section Two: Strategic Goals, Strat

- Page 21 and 22: Management Objectives 1. Improve HU

- Page 23 and 24: Performance Indicators Performance

- Page 25 and 26: Strategic Goal: Use Housing as a Pl

- Page 27 and 28: Additional Community Development In

- Page 29 and 30: Strategic Goal: Strengthen the Nati

- Page 31 and 32: Strategic Objective: Housing Market

- Page 33 and 34: Overall market share of single-fami

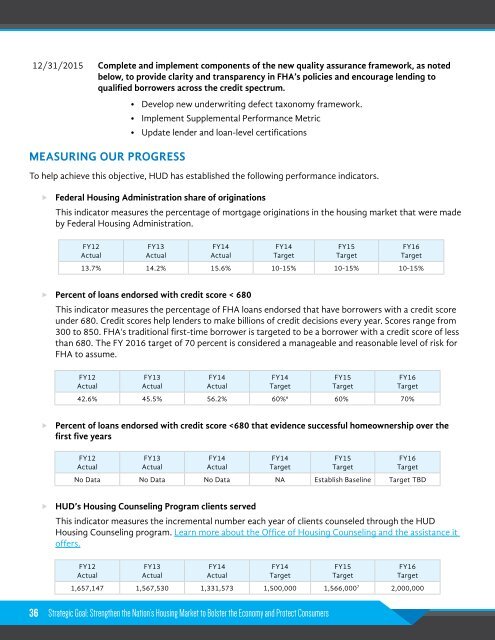

- Page 35: FY14 APR PROGRESS UPDATE HUD narrow

- Page 39 and 40: FY14 APR PROGRESS UPDATE HUD contin

- Page 41 and 42: In November 2012, FHA introduced it

- Page 43 and 44: Strategic Goal: Meet the Need for Q

- Page 45 and 46: Strategic Objective: Rental Investm

- Page 47 and 48: Proportion of very low-income rente

- Page 49 and 50: • Ensure that the households curr

- Page 51 and 52: Housing Choice Voucher budget utili

- Page 53 and 54: Strategic Goal: FY 2014-2015 Agency

- Page 55 and 56: Households in Occupied Rental Units

- Page 57 and 58: HOPWA, AIDS Ribbon on HUD Building

- Page 59 and 60: RETROSPECTIVE: FY 2014-2015 Agency

- Page 61 and 62: Groundbreaking for Alder Creek Apar

- Page 63 and 64: Strategic Goal: Use Housing as a Pl

- Page 65 and 66: Strategic Objective: Homelessness E

- Page 67 and 68: MAJOR MILESTONES 9/30/2014 Publish

- Page 69 and 70: Veterans placed in permanent housin

- Page 71 and 72: Admissions of new homeless families

- Page 73 and 74: RETROSPECTIVE: FY 2014-2015 Agency

- Page 75 and 76: Veterans placed in permanent housin

- Page 77 and 78: Impact Veterans Family Housing Cent

- Page 79 and 80: RETROSPECTIVE: FY 2014-2015 Agency

- Page 81 and 82: Strategic Objective: Economic Prosp

- Page 83 and 84: 9/30/2016 Develop technical assista

- Page 85 and 86: Strategic Objective: Health and Hou

- Page 87 and 88:

policy. Research by the Centers for

- Page 89 and 90:

MEASURING OUR PROGRES 85 To help ac

- Page 91 and 92:

Strategic Goal: Build Strong, Resil

- Page 93 and 94:

Strategic Objective: Fair Housing R

- Page 95 and 96:

MEASURING OUR PROGRESS To track our

- Page 97 and 98:

STRATEGIES Boost Energy Efficiency

- Page 99 and 100:

9/30/2015 Recruit 100 multifamily p

- Page 101 and 102:

National Housing Solar Trust Strate

- Page 103 and 104:

RETROSPECTIVE: FY 2014-2015 Agency

- Page 105 and 106:

Total number of HUD-assisted units

- Page 107 and 108:

FY14-15 APG PROGRESS UPDATE To asse

- Page 109 and 110:

Strategic Objective: Disaster Resil

- Page 111 and 112:

Strategic Objective: Community Deve

- Page 113 and 114:

and facilitate the exchange of idea

- Page 115 and 116:

6/30/2015 Begin comprehensive evalu

- Page 117 and 118:

• The Sustainable Communities Ini

- Page 119 and 120:

Achieving Operational Excellence Ma

- Page 121 and 122:

Management Objective: Acquisitions

- Page 123 and 124:

MEASURING OUR PROGRESS Standardized

- Page 125 and 126:

• Ensure transparency by utilizin

- Page 127 and 128:

LEADING THIS OBJECTIVE John Benison

- Page 129 and 130:

LEADING THIS OBJECTIVE Joseph Hunga

- Page 131 and 132:

FY14 APG PROGRESS UPDATE HUD has re

- Page 133 and 134:

LEADING THIS OBJECTIVE Towanda Broo

- Page 135 and 136:

Management Objective: Information M

- Page 137 and 138:

MEASURING OUR PROGRESS To track our

- Page 139 and 140:

FY14 APG PROGRESS UPDATE The Depart

- Page 141 and 142:

SECTION Three: Additional Informati

- Page 143 and 144:

through 2009. The data show substan

- Page 145 and 146:

awarded vouchers to former foster y

- Page 147 and 148:

Country are the same as the obstacl

- Page 149 and 150:

Strategic Goal Metric Strengthen th

- Page 151 and 152:

Strategic Goal Metric Strengthen th

- Page 153 and 154:

Strategic Goal Strategic Objective

- Page 155 and 156:

Strategic Goal Metric Strengthen th

- Page 157 and 158:

Strategic Goal Metric Meet the Need

- Page 159 and 160:

Strategic Goal Metric Public and In

- Page 161 and 162:

Strategic Goal Metric Office of Nat

- Page 163 and 164:

Strategic Goal Metric PIH Moderate

- Page 165 and 166:

Strategic Goal Metric Rental Assist

- Page 167 and 168:

Strategic Goal Meet the Need for Qu

- Page 169 and 170:

Strategic Goal Metric Community Pla

- Page 171 and 172:

Strategic Goal Meet the Need for Qu

- Page 173 and 174:

Strategic Goal Metric Meet the Need

- Page 175 and 176:

Strategic Goal Metric Meet the Need

- Page 177 and 178:

Strategic Goal Metric Veterans plac

- Page 179 and 180:

Strategic Goal Metric Use Housing a

- Page 181 and 182:

Strategic Goal Metric Use Housing a

- Page 183 and 184:

Strategic Goal Metric Use Housing a

- Page 185 and 186:

Strategic Goal Metric Use Housing a

- Page 187 and 188:

Strategic Goal Strategic Objective

- Page 189 and 190:

Strategic Goal Metric with Submetri

- Page 191 and 192:

Strategic Goal Metric with Submetri

- Page 193 and 194:

Strategic Goal Metric with Submetri

- Page 195 and 196:

Strategic Goal Metric with Submetri

- Page 197 and 198:

Strategic Goal Metric with Submetri

- Page 199 and 200:

Strategic Goal Metric with Submetri

- Page 201 and 202:

Strategic Goal Strategic Objective

- Page 203 and 204:

Strategic Goal Metric Build Strong,

- Page 205 and 206:

Section Three: Additional Informati