SECTION 1 -

SECTION 1 -

SECTION 1 -

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- Length‐of‐service awards in Italy:<br />

New Services: Pro forma Financial Statements and Notes<br />

December, 31, 2009<br />

o These are lump‐sum payments made to employees when they retire, resign or are laid off. They are determined by<br />

reference to the employee's years of service and final salary.<br />

o The related obligation is covered by a provision.<br />

- Pensions: the main defined benefit pension plans are for employees in United Kingdom (42% of the obligation at<br />

December 31, 2009), in France and the Worldwide Structures (18% of the obligation at December 31, 2009), in Belgium<br />

(17% of the obligation at December 31, 2009) and in Italy (15% of the obligation at December 31, 2009). Pension<br />

benefit obligations are determined by reference to employees' years of service and final salary. They are funded by<br />

payments to external organizations that are legally separate from the New Services Group.<br />

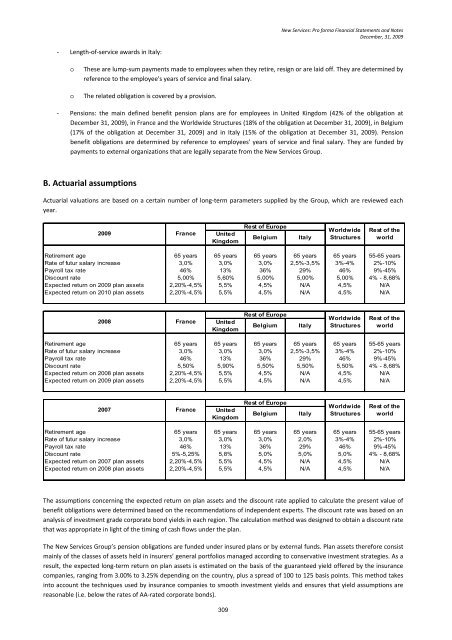

B. Actuarial assumptions<br />

Actuarial valuations are based on a certain number of long‐term parameters supplied by the Group, which are reviewed each<br />

year.<br />

2009 France<br />

United<br />

Kingdom<br />

Belgium Italy<br />

Retirement age 65 years 65 years 65 years 65 years 65 years 55-65 years<br />

Rate of futur salary increase 3,0% 3,0% 3,0% 2,5%-3,5% 3%-4% 2%-10%<br />

Payroll tax rate 46% 13% 36% 29% 46% 9%-45%<br />

Discount rate 5,00% 5,60% 5,00% 5,00% 5,00% 4% - 8,68%<br />

Expected return on 2009 plan assets 2,20%-4,5% 5,5% 4,5% N/A 4,5% N/A<br />

Expected return on 2010 plan assets 2,20%-4,5% 5,5% 4,5% N/A 4,5% N/A<br />

2008<br />

France<br />

United<br />

Kingdom<br />

Belgium Italy<br />

Retirement age 65 years 65 years 65 years 65 years 65 years 55-65 years<br />

Rate of futur salary increase 3,0% 3,0% 3,0% 2,5%-3,5% 3%-4% 2%-10%<br />

Payroll tax rate 46% 13% 36% 29% 46% 9%-45%<br />

Discount rate 5,50% 5,90% 5,50% 5,50% 5,50% 4% - 8,68%<br />

Expected return on 2008 plan assets 2,20%-4,5% 5,5% 4,5% N/A 4,5% N/A<br />

Expected return on 2009 plan assets 2,20%-4,5% 5,5% 4,5% N/A 4,5% N/A<br />

2007 France<br />

United<br />

Kingdom<br />

Rest of Europe<br />

Rest of Europe<br />

Rest of Europe<br />

Belgium Italy<br />

Worldwide<br />

Structures<br />

Worldwide<br />

Structures<br />

Worldwide<br />

Structures<br />

Rest of the<br />

world<br />

Rest of the<br />

world<br />

Rest of the<br />

world<br />

Retirement age 65 years 65 years 65 years 65 years 65 years 55-65 years<br />

Rate of futur salary increase 3,0% 3,0% 3,0% 2,0% 3%-4% 2%-10%<br />

Payroll tax rate 46% 13% 36% 29% 46% 9%-45%<br />

Discount rate 5%-5,25% 5,8% 5,0% 5,0% 5,0% 4% - 8,68%<br />

Expected return on 2007 plan assets 2,20%-4,5% 5,5% 4,5% N/A 4,5% N/A<br />

Expected return on 2008 plan assets 2,20%-4,5% 5,5% 4,5% N/A 4,5% N/A<br />

The assumptions concerning the expected return on plan assets and the discount rate applied to calculate the present value of<br />

benefit obligations were determined based on the recommendations of independent experts. The discount rate was based on an<br />

analysis of investment grade corporate bond yields in each region. The calculation method was designed to obtain a discount rate<br />

that was appropriate in light of the timing of cash flows under the plan.<br />

The New Services Group’s pension obligations are funded under insured plans or by external funds. Plan assets therefore consist<br />

mainly of the classes of assets held in insurers’ general portfolios managed according to conservative investment strategies. As a<br />

result, the expected long‐term return on plan assets is estimated on the basis of the guaranteed yield offered by the insurance<br />

companies, ranging from 3.00% to 3.25% depending on the country, plus a spread of 100 to 125 basis points. This method takes<br />

into account the techniques used by insurance companies to smooth investment yields and ensures that yield assumptions are<br />

reasonable (i.e. below the rates of AA‐rated corporate bonds).<br />

309