2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

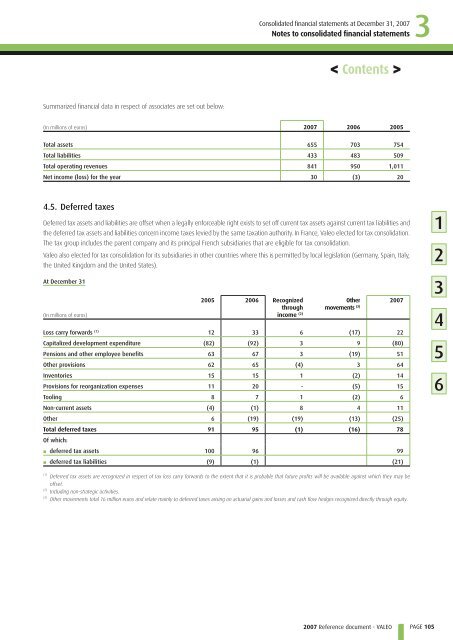

Summarized financial data in respect of associates are set out below:<br />

Consolidated fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

(In millions of euros) <strong>2007</strong> 2006 2005<br />

Total assets 655 703 754<br />

Total liabilities 433 483 509<br />

Total operating revenues 841 950 1,011<br />

Net income (loss) for the year 30 (3) 20<br />

4.5. Deferred taxes<br />

Deferred tax assets and liabilities are offset when a legally enforceable right exists to set off current tax assets against current tax liabilities and<br />

the deferred tax assets and liabilities concern income taxes levied by the same taxation authority. In France, <strong>Valeo</strong> elected for tax consolidation.<br />

The tax group includes the parent company and its principal French subsidiaries that are eligible for tax consolidation.<br />

<strong>Valeo</strong> also elected for tax consolidation for its subsidiaries in other countries where this is permitted by local legislation (Germany, Spain, Italy,<br />

the United Kingdom and the United States).<br />

At December 31<br />

(In millions of euros)<br />

2005 2006 Recognized<br />

through<br />

income (2)<br />

< Contents ><br />

Other<br />

movements (3)<br />

Loss carry forwards (1) 12 33 6 (17) 22<br />

Capitalized development expenditure (82) (92) 3 9 (80)<br />

Pensions and other employee benefits 63 67 3 (19) 51<br />

Other provisions 62 65 (4) 3 64<br />

Inventories 15 15 1 (2) 14<br />

Provisions for reorganization expenses 11 20 - (5) 15<br />

Tooling 8 7 1 (2) 6<br />

Non-current assets (4) (1) 8 4 11<br />

Other 6 (19) (19) (13 ) (25)<br />

Total deferred taxes<br />

Of which:<br />

91 95 (1) (16) 78<br />

▪ d eferred tax assets<br />

100 96 99<br />

▪ d eferred tax liabilities<br />

(9) (1) (21)<br />

(1)<br />

Deferred tax assets are recognized in respect of tax loss carry forwards to the extent that it is probable that future profits will be available against which they may be<br />

offset.<br />

(2)<br />

Including non-strategic activities.<br />

(3)<br />

Other movements total 16 million euros and relate mainly to deferred taxes arising on actuarial gains and losses and cash flow hedges recognized directly through equity.<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

<strong>2007</strong><br />

3<br />

PAGE 105<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6