2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

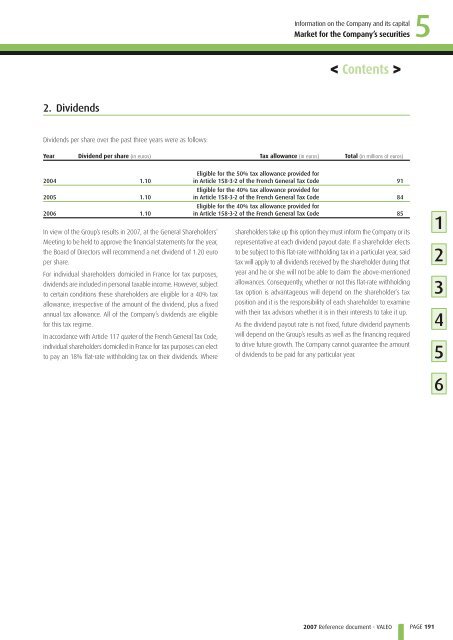

2. Dividends<br />

Dividends per share over the past three years were as follows:<br />

Information on the Company and its capital<br />

Market for the Company’s securities<br />

Year Dividend per share (in euros) Tax allowance (in euros) Total (in millions of euros)<br />

2004 1.10<br />

2005 1.10<br />

2006 1.10<br />

In view of the Group’s results in <strong>2007</strong>, at the General Shareholders’<br />

Meeting to be held to approve the financial statements for the year,<br />

the Board of Directors will recommend a net dividend of 1.20 euro<br />

per share.<br />

For individual shareholders domiciled in France for tax purposes,<br />

dividends are included in personal taxable income. However, subject<br />

to certain conditions these shareholders are eligible for a 40% tax<br />

allowance, irrespective of the amount of the dividend, plus a fixed<br />

annual tax allowance. All of the Company’s dividends are eligible<br />

for this tax regime.<br />

In accordance with Article 117 quater of the French General Tax Code,<br />

individual shareholders domiciled in France for tax purposes can elect<br />

to pay an 18% flat-rate withholding tax on their dividends. Where<br />

< Contents ><br />

Eligible for the 50% tax allowance provided for<br />

in Article 158-3-2 of the French General Tax Code 91<br />

Eligible for the 40% tax allowance provided for<br />

in Article 158-3-2 of the French General Tax Code 84<br />

Eligible for the 40% tax allowance provided for<br />

in Article 158-3-2 of the French General Tax Code 85<br />

shareholders take up this option they must inform the Company or its<br />

representative at each dividend payout date. If a shareholder elects<br />

to be subject to this flat-rate withholding tax in a particular year, said<br />

tax will apply to all dividends received by the shareholder during that<br />

year and he or she will not be able to claim the above-mentioned<br />

allowances. Consequently, whether or not this flat-rate withholding<br />

tax option is advantageous will depend on the shareholder’s tax<br />

position and it is the responsibility of each shareholder to examine<br />

with their tax advisors whether it is in their interests to take it up.<br />

As the dividend payout rate is not fixed, future dividend payments<br />

will depend on the Group’s results as well as the financing required<br />

to drive future growth. The Company cannot guarantee the amount<br />

of dividends to be paid for any particular year.<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

5<br />

PAGE 191<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6