2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4.3. Credit risk<br />

<strong>Valeo</strong> is exposed to credit risk, particularly to risk of default by its<br />

automotive customers.<br />

<strong>Valeo</strong> works with all automakers in the sector. At December 31,<br />

<strong>2007</strong>, <strong>Valeo</strong>’s largest customer accounts for 18% of the Group’s<br />

accounts and notes receivable. Approximately 10% of accounts<br />

and notes receivable are with the American automakers, Chrysler,<br />

Ford and General Motors. The downturn in the automobile sector<br />

business environment in recent years has led the Group to<br />

Information likely to be impacted<br />

by a public tender offer<br />

Management Report<br />

Information likely to be impacted by a public tender offer<br />

strengthen control of customer risks and settlement periods which<br />

may, on a case-by-case basis, be subject to bilateral negotiations<br />

with customers. The average settlement period at December 31,<br />

<strong>2007</strong> is 69 days.<br />

<strong>Valeo</strong> also generates more than 8% of its net sales in the aftermarket.<br />

The Group’s large, dispersed customer base in this market is<br />

constantly monitored and the risk of default is covered by a credit<br />

insurance policy. These customers represent slightly more than 8%<br />

of Group accounts and notes receivable at December 31, <strong>2007</strong>.<br />

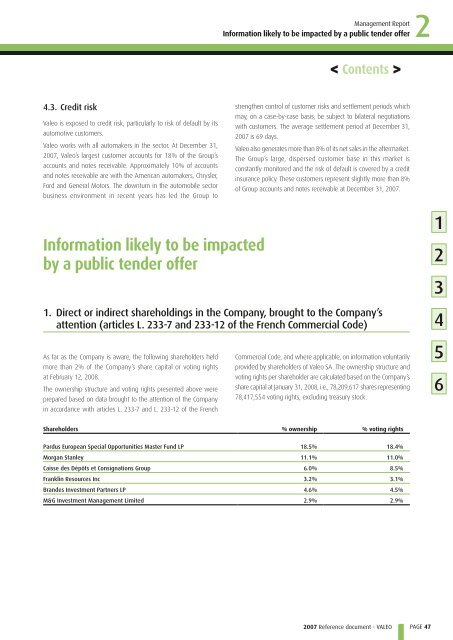

1. Direct or indirect shareholdings in the Company, brought to the Company’s<br />

attention (articles L. 233-7 and 233-12 of the French Commercial Code)<br />

As far as the Company is aware, the following shareholders held<br />

more than 2% of the Company’s share capital or voting rights<br />

at February 12, 2008.<br />

The ownership structure and voting rights presented above were<br />

prepared based on data brought to the attention of the Company<br />

in accordance with articles L. 233-7 and L. 233-12 of the French<br />

< Contents ><br />

Commercial Code, and where applicable, on information voluntarily<br />

provided by shareholders of <strong>Valeo</strong> SA. The ownership structure and<br />

voting rights per shareholder are calculated based on the Company’s<br />

share capital at January 31, 2008, i.e., 78,209,617 shares representing<br />

78,417,554 voting rights, excluding treasury stock.<br />

Shareholders % ownership % voting rights<br />

Pardus E uropean Special Opportunities Master Fund LP 18.5% 18.4%<br />

Morgan Stanley 11.1% 11.0%<br />

Caisse des Dépôts et Consignations Group 6.0% 8.5%<br />

Franklin Resources Inc 3.2% 3.1%<br />

Brandes Investment Partners LP 4.6% 4.5%<br />

M&G Investment Management Limited 2.9% 2.9%<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

2<br />

PAGE 47<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6