2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

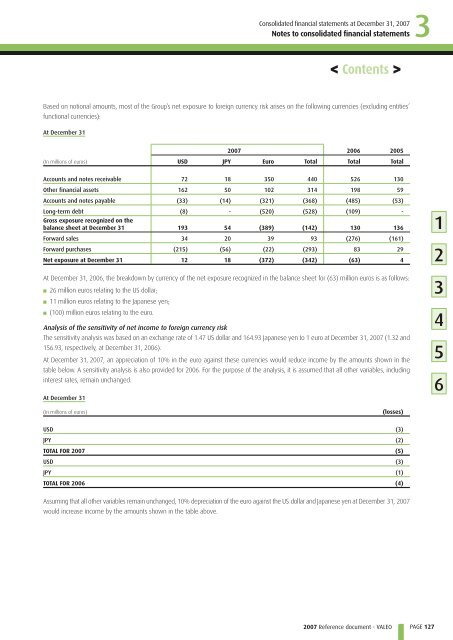

Based on notional amounts, most of the Group’s net exposure to foreign currency risk arises on the following currencies (excluding entities’<br />

functional currencies):<br />

At December 31<br />

(In millions of euros)<br />

<strong>2007</strong> 2006 2005<br />

USD JPY Euro Total Total Total<br />

Accounts and notes receivable 72 18 350 440 526 130<br />

Other financial assets 162 50 102 314 198 59<br />

Accounts and notes payable (33) (14) (321) (368) (485) (53)<br />

Long-term debt (8) - (520) (528) (109) -<br />

Gross exposure recognized on the<br />

balance sheet at December 31 193 54 (389) (142) 130 136<br />

Forward sales 34 20 39 93 (276) (161)<br />

Forward purchases (215) (56) (22) (293) 83 29<br />

Net exposure at December 31 12 18 (372) (342) (63) 4<br />

At December 31, 2006, the breakdown by currency of the net exposure recognized in the balance sheet for (63) million euros is as follows:<br />

■<br />

■<br />

■<br />

26 million euros relating to the US dollar;<br />

11 million euros relating to the Japanese yen;<br />

(100) million euros relating to the euro.<br />

Analysis of the sensitivity of net income to foreign currency risk<br />

The sensitivity analysis was based on an exchange rate of 1.47 US dollar and 164.93 Japanese yen to 1 euro at December 31, <strong>2007</strong> (1.32 and<br />

156.93, respectively, at December 31, 2006).<br />

At December 31, <strong>2007</strong>, an appreciation of 10% in the euro against these currencies would reduce income by the amounts shown in the<br />

table below. A sensitivity analysis is also provided for 2006. For the purpose of the analysis, it is assumed that all other variables, including<br />

interest rates, remain unchanged.<br />

At December 31<br />

(In millions of euros) (losses)<br />

USD (3)<br />

JPY (2)<br />

TOTAL FOR <strong>2007</strong> (5)<br />

USD (3)<br />

JPY (1)<br />

TOTAL FOR 2006 (4)<br />

Assuming that all other variables remain unchanged, 10% depreciation of the euro against the US dollar and Japanese yen at December 31, <strong>2007</strong><br />

would increase income by the amounts shown in the table above.<br />

< Contents ><br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

3<br />

PAGE 127<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6