2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3 Consolidated<br />

PAGE 130<br />

fi nancial statements at December 31, <strong>2007</strong><br />

Notes to consolidated financial statements<br />

The Group also has a short-term commercial paper financing program<br />

of a maximum amount of 1.2 billion euros and a medium- and longterm<br />

Euro Medium Term Note financing program of a maximum<br />

amount of 2 billion euros.<br />

Covenants: existing credit lines have an early repayment clause<br />

related to the Group’s debt/equity ratio. This clause stipulates that<br />

the Group’s net debt should not exceed 120% of stockholders’<br />

equity. Non-compliance with this ratio would cause the credit<br />

lines to be suspended and would lead to early repayment of<br />

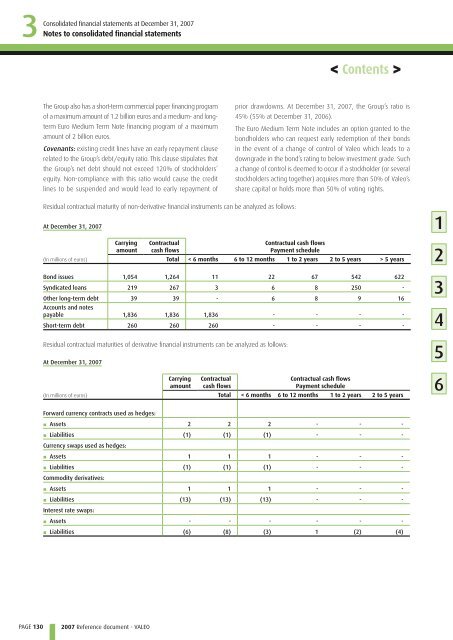

Residual contractual maturity of non-derivative financial instruments can be analyzed as follows:<br />

At December 31, <strong>2007</strong><br />

(In millions of euros)<br />

Carrying<br />

amount<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

Contractual<br />

cash flows<br />

prior drawdowns. At December 31, <strong>2007</strong>, the Group’s ratio is<br />

45% (55% at December 31, 2006).<br />

The Euro Medium Term Note includes an option granted to the<br />

bondholders who can request early redemption of their bonds<br />

in the event of a change of control of <strong>Valeo</strong> which leads to a<br />

downgrade in the bond’s rating to below investment grade. Such<br />

a change of control is deemed to occur if a stockholder (or several<br />

stockholders acting together) acquires more than 50% of <strong>Valeo</strong>’s<br />

share capital or holds more than 50% of voting rights.<br />

Contractual cash flows<br />

Payment schedule<br />

Total < 6 months 6 to 12 months 1 to 2 years 2 to 5 years > 5 years<br />

Bond issues 1,054 1,264 11 22 67 542 622<br />

Syndicated loans 219 267 3 6 8 250 -<br />

Other long-term debt<br />

Accounts and notes<br />

39 39 - 6 8 9 16<br />

payable 1,836 1,836 1,836 - - - -<br />

Short-term debt 260 260 260 - - - -<br />

Residual contractual maturities of derivative financial instruments can be analyzed as follows:<br />

At December 31, <strong>2007</strong><br />

(In millions of euros)<br />

Forward currency contracts used as hedges:<br />

Carrying<br />

amount<br />

Contractual<br />

cash flows<br />

Contractual cash flows<br />

Payment schedule<br />

Total < 6 months 6 to 12 months 1 to 2 years 2 to 5 years<br />

▪ Assets<br />

2 2 2 - - -<br />

▪ Liabilities<br />

(1) (1) (1) - - -<br />

Currency swaps used as hedges:<br />

▪ Assets<br />

1 1 1 - - -<br />

▪ Liabilities<br />

(1) (1) (1) - - -<br />

Commodity derivatives:<br />

▪ Assets<br />

1 1 1 - - -<br />

▪ Liabilities<br />

(13) (13) (13) - - -<br />

Interest rate swaps:<br />

< Contents ><br />

▪ Assets<br />

- - - - - -<br />

▪ Liabilities<br />

(6) (8) (3) 1 (2) (4)<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6