2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

2007 Reference document (PDF) - Valeo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 Management<br />

PAGE 42<br />

Report<br />

Remuneration of corporate offi cers and directors<br />

Commitments<br />

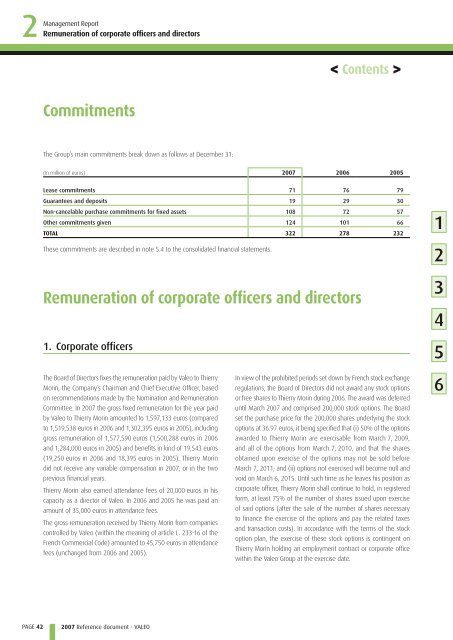

The Group’s main commitments break down as follows at December 31:<br />

(In million of euros) <strong>2007</strong> 2006 2005<br />

Lease commitments 71 76 79<br />

Guarantees and deposits 19 29 30<br />

Non-cancelable purchase commitments for fixed assets 108 72 57<br />

Other commitments given 124 101 66<br />

TOTAL 322 278 232<br />

These commitments are described in note 5.4 to the consolidated financial statements.<br />

Remuneration of corporate officers and directors<br />

1. Corporate officers<br />

The Board of Directors fixes the remuneration paid by <strong>Valeo</strong> to Thierry<br />

Morin, the Company’s Chairman and Chief Executive Officer, based<br />

on recommendations made by the Nomination and Remuneration<br />

Committee. In <strong>2007</strong> the gross fixed remuneration for the year paid<br />

by <strong>Valeo</strong> to Thierry Morin amounted to 1,597,133 euros (compared<br />

to 1,519,538 euros in 2006 and 1,302,395 euros in 2005), including<br />

gross remuneration of 1,577,590 euros (1,500,288 euros in 2006<br />

and 1,284,000 euros in 2005) and benefits in kind of 19,543 euros<br />

(19,250 euros in 2006 and 18,395 euros in 2005). Thierry Morin<br />

did not receive any variable compensation in <strong>2007</strong>, or in the two<br />

previous financial years.<br />

Thierry Morin also earned attendance fees of 20,000 euros in his<br />

capacity as a director of <strong>Valeo</strong>. In 2006 and 2005 he was paid an<br />

amount of 35,000 euros in attendance fees.<br />

The gross remuneration received by Thierry Morin from companies<br />

controlled by <strong>Valeo</strong> (within the meaning of article L. 233-16 of the<br />

French Commercial Code) amounted to 45,750 euros in attendance<br />

fees (unchanged from 2006 and 2005).<br />

<strong>2007</strong> <strong>Reference</strong> <strong>document</strong> - VALEO<br />

< Contents ><br />

In view of the prohibited periods set down by French stock exchange<br />

regulations, the Board of Directors did not award any stock options<br />

or free shares to Thierry Morin during 2006. The award was deferred<br />

until March <strong>2007</strong> and comprised 200,000 stock options. The Board<br />

set the purchase price for the 200,000 shares underlying the stock<br />

options at 36.97 euros, it being specified that (i) 50% of the options<br />

awarded to Thierry Morin are exercisable from March 7, 2009,<br />

and all of the options from March 7, 2010, and that the shares<br />

obtained upon exercise of the options may not be sold before<br />

March 7, 2011; and (ii) options not exercised will become null and<br />

void on March 6, 2015. Until such time as he leaves his position as<br />

corporate officer, Thierry Morin shall continue to hold, in registered<br />

form, at least 75% of the number of shares issued upon exercise<br />

of said options (after the sale of the number of shares necessary<br />

to finance the exercise of the options and pay the related taxes<br />

and transaction costs). In accordance with the terms of the stock<br />

option plan, the exercise of these stock options is contingent on<br />

Thierry Morin holding an employment contract or corporate office<br />

within the <strong>Valeo</strong> Group at the exercise date.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6